Analysts look for effect of Tableau, ClickSoftware and Salesforce.org deals

Salesforce.com Inc. has been spending a lot of money on acquisitions, and executives are expected to explain why when the customer-relationship management software company reports earnings this week.

Salesforce CRM, +0.23% is scheduled to report second-quarter earnings after the close of markets on Thursday. Back in June, Tableau Software Inc. agreed to be acquired by Salesforce for $15.7 billion. Less than a week after the Tableau deal closed on Aug. 1, Salesforce said it was acquiring ClickSoftware for $1.35 billion.

In addition to the company’s acquisition of Salesforce.org, analysts are concerned how all these deals are going to affect profits. Expect Salesforce execs to speak in-depth about the Tableau acquisition on Thursday, since it is closed, but information may be scant on the other two.

Macquarie analyst Sarah Hindlian said she’ll be looking for how Tableau and ClickSoftware will affect the company’s outlook. Hindlian is interested in “updates on early integration efforts and go-to market strategies for Tableau” and how Salesforce “sees future margin growth trajectory given Tableau, ClickSoftware and Salesforce.org.”

What to expect

Earnings: Of the 39 analysts surveyed by FactSet, Salesforce on average is expected to post adjusted earnings of 47 cents a share, down from the 65 cents a share expected at the beginning of the quarter. Salesforce forecast 46 cents to 47 cents a share. Estimize, a software platform that uses crowdsourcing from hedge-fund executives, brokerages, buy-side analysts and others, calls for earnings of 52 cents a share.

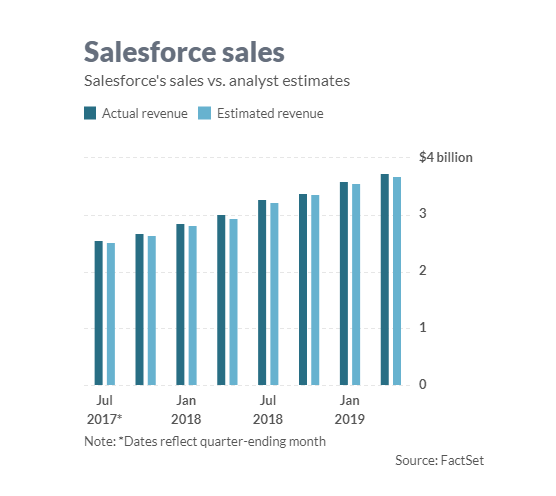

Revenue: Wall Street expects revenue of $3.96 billion from Salesforce, according to 35 analysts polled by FactSet. That’s up from the $3.94 billion forecast at the beginning of the quarter. Salesforce predicted revenue of $3.94 billion to $3.95 billion. Estimize expects revenue of $3.97 billion.

Stock movement: Salesforce shares have declined 4.4% since the company’s last earnings report. In comparison, the S&P 500 index SPX, +1.21% has increased 4.4% over that period, the Nasdaq Composite COMP, +1.35% has gained 6.4%, and the iShares Expanded Tech-Software Sector ETF IGV, +0.52% has advanced 3.7%.

Of the 43 analysts who cover Salesforce, 40 have buy or overweight ratings, and three have hold ratings, with an average price target of $183.03.

What analysts are saying

Jefferies analyst John DiFucci, who has a buy rating and a $165 price target, said he expects a weaker-than-usual quarter from Salesforce.

“In summary, we do not expect as difficult a Q as we had feared (due to the effects the major May outage might have had on new business), though we did detect Enterprise softness from field checks,” DiFucci wrote in a note.

“We don’t expect a ‘bad’ F2Q for CRM, but it doesn’t seem like it will be a very good one either,” DiFucci wrote. “However, the stock has lagged materially this year and the valuation seems compelling on recurring revenue multiple.”

Cowen analyst J. Derrick Wood, who has an outperform rating and a $185 price target, said there will be “a lot of moving parts in the numbers” given the early closing of the Tableau deal and Salesforce.org.

“We think expectations for 2Q are low given the stock’s underperformance since the Tableau acquisition and the emerging macro choppiness some other software co.’s have recently experienced,” Wood said.

“We are encouraged to see a good level of stability in execution from our survey results, though there was an uptick in partners highlighting macro factors weighing on buying behavior,” Wood said. “We suspect shares may stay rangebound in the near term given all the moving parts in the numbers and macro uncertainties. We would view 3Q execution (includes Tableau) and Dreamforce (mid-Nov.) to be more impactful catalysts for the stock.”