Ride hailing, mandatory training for truckers among last year’s success, according to minister

SGI has released its numbers for the previous fiscal year and the Crown Corporation is celebrating financial stability.

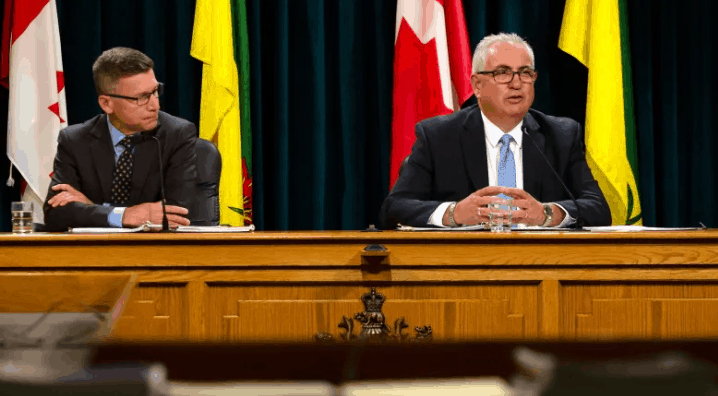

Joe Hargrave, minister of SGI, touted new impaired driving legislation, mandatory commercial truck driver training, permanent photo speed enforcement, and ride hailing as the Crown’s accomplishments through 2018 at a news conference on Tuesday.

Hargrave said ride hailing provides drivers with another safe option to get home and he expects it to roll out in smaller cities and towns through 2019.

“I know there’s several communities that are talking with other ride share companies coming to their community,” Hargrave said. “I’m optimistic that over the next number of months that we’ll see ride share … not only in larger communities, but it will continue to expand.”

The SGI Auto Fund, which provides insurance on vehicles in Saskatchewan, reported roughly $895 million in claims through 2018. Some $956 million in gross premium was recorded through the year while roughly $150 million in discounts were handed out through various programs.

There was about $26 million in storm claims through the year and the Crown reported roughly $136 million in investment earnings.

Hargrave said after Manitoba increased its rates, people using SGI for auto insurance are on average paying the lowest rates across Canada for auto insurance.

SGI Canada, which is the Crown’s competitive insurance company offered here in Saskatchewan as well as other provinces, reported a $48-million-dollar profit through 2018.

The company paid a $12.5-million dividend back to the province through that profit, according to Hargrave.

Hargrave said in 2018, SGI Canada reached a target the company was striving to hit for years — writing $371 million, or 40 per cent of their premiums written outside of Canada. Hargrave said the company obtained that goal one year ahead of schedule.

SGI Canada also reported a drop in storm claims through the year, according to Hargrave. Over the last five years, it wasn’t uncommon to see claims exceeding $50 million, but through 2018 there were $39.8 million in storm claims from SGI Canada.

Hargrave said SGI Canada launched new commercial property insurance in Ontario and started offering a new line of cyber security protection to protect business owners against cyber attacks and data breaches in late 2018.

Report shows value of Crown: opposition

While there are currently no plans in place or discussions underway to sell the Crown Corporation, NDP Deputy Leader Trent Wotherspoon said Tuesday’s report shows how valuable SGI is to the province and that such discussions shouldn’t happen.

“When I see that report, and I see the incredible return of so many levels of this Crown Corporation to Saskatchewan people, it just reminds me of how important it is for us to lock down our Crown Corporations like SGI,” Wotherspoon said.

Wotherspoon said specifically he saw the value SGI brings to the province through the low rates the auto fund provides to residents and through the $300 million dividend that the Crown Corporation has brought back to the province in the last 10 years.