Biomanufacuturing outfit Zymergen has raised hundreds of millions with the promise of enlisting genetically engineered microbes to do the tricky work of assembling groundbreaking new materials from the molecule up for use in electronics, agriculture and healthcare. But the microbes may have other plans.

Just months after going public through a $500 million IPO, the company disclosed yesterday severe setbacks in its commercial pipeline, erasing its chances of making money this year and projecting “product revenue to be immaterial in 2022.”

That grim outlook has driven Zymergen to a leadership change: Co-founder Josh Hoffman will step down as CEO and leave the board, effective immediately. In his stead, former Illumina CEO Jay Flatley will serve as acting chief. The company also said it is developing a plan to cut expenses in light of the forecast revenue drought.

The news sent the company’s fledgling stock tumbling down—by as much as 75% in after-hours trading, from $34.83 to as low as $8.50—and cut deep into its valuation, which previously reached $4.8 billion at its April peak.

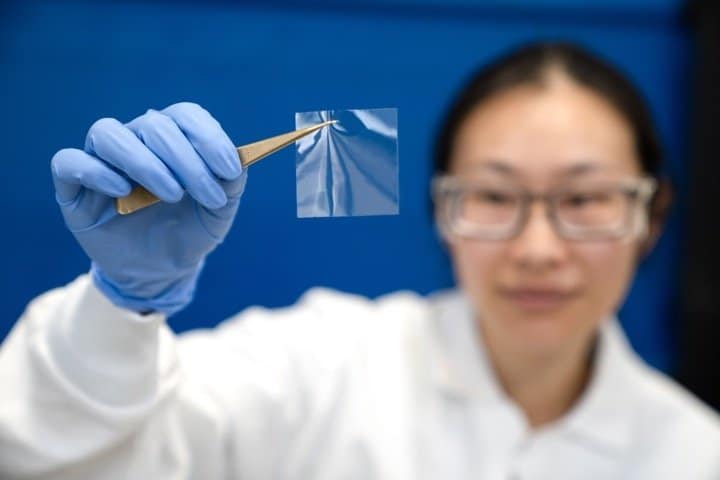

The issues stem from the company’s Hyaline film—a thin, pliable and transparent material that Zymergen hopes will excel as its lead product in electronic touchscreens. That includes foldable smartphones, a market the company said isn’t growing as fast as it once hoped.

Over the previous quarter, however, “several key target customers encountered technical issues in implementing Hyaline into their manufacturing processes, typical of new product and process development learnings” Zymergen said, adding that it “believes there are no intrinsic technical issues with Hyaline.”

Zymergen said it has made progress in addressing these challenges, but the delays will put off its planned commercial ramp-up.

“We are disappointed by these developments, and the board and management team are focused on resolving the underlying issues to ensure Zymergen moves forward as a stronger company with a compelling operating plan,” said Flatley, who also serves as the company’s chairman of the board.

“The board has formed dedicated committees including a strategic oversight committee and is working with outside experts to conduct an in-depth review of the company’s operational, financial, product and commercialization efforts to facilitate the development of an updated strategic plan for Zymergen,” he said in a statement. “The underlying promise of our business and technology is sound, and I am proud of the work our teams are doing across the organization.”

In preliminary results for the company’s second quarter, it estimated operating expenses of about $100 million to $105 million versus total revenues of $5 million to $6 million related to R&D services and collaborations. Zymergen said it had cash and cash equivalents totaling about $588 million.

Prior to its half-billion-dollar April IPO, the company raised over $850 million in venture capital since 2015—most recently with a $300 million series D round last September, backed by Baillie Gifford, Baron Capital Group and an unnamed sovereign wealth fund.

Before that, Zymergen attracted investments from SoftBank, Goldman Sachs and others, with a $400 million round in 2018 to help it take aim at a $3 trillion chemical and material manufacturing industry.