With the first generation of CAR-T therapies having shaken up the cancer space, all eyes are on what comes next. So it shouldn’t be a surprise that biotechs have already been in touch with Novartis to see whether they can jump onto the Swiss pharma’s T-Charge platform.

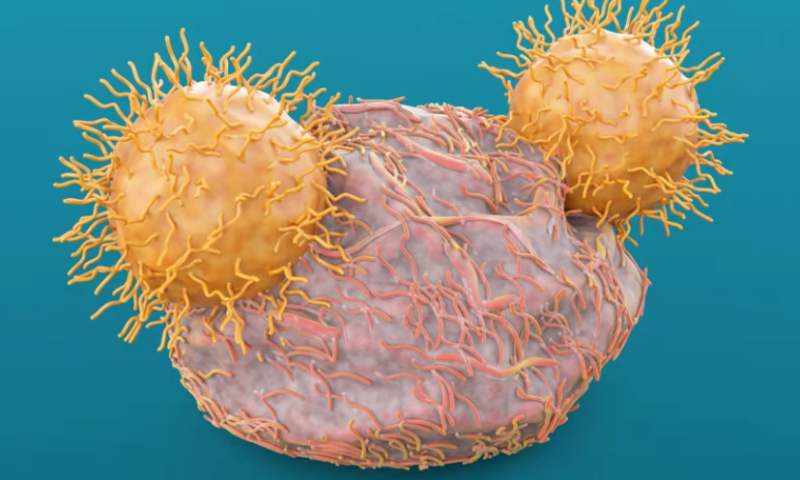

While approved CAR-Ts from the likes of Bristol Myers Squibb, Gilead’s Kite Pharma and Novartis with its own Kymriah have scored successes in terms of efficacy, manufacturing them is a long, complex process that has stifled their wider accessibility. This is because of the work done to T cells once they are taken from the patient’s blood, where they are changed in the lab to add a gene for a chimeric antigen receptor, or CAR, before being administered back to the patient.

In contrast, Novartis’ T-Charge process sees most of the CAR T-cell expansion occurring within the patient’s body. Reducing the time the cells spend ex vivo helps preserve the naive and stem cell memory T cells, leading to—so the theory goes—better responses, improved long-term outcomes and a reduced risk of severe adverse events. Novartis’ ultimate goal: to make the best T-cell product possible.

“We can retain all those younger T cell attributes and by doing that we shorten the timeframe and so we improve the accessibility,” Jennifer Brogdon, Ph.D., head of cell therapy research in the Department of Exploratory Immuno-oncology of the Novartis Institutes for BioMedical Research, told Fierce Biotech in an interview.

Novartis is trialing two CAR-T therapies produced from the platform. Phase 1 data released Sunday showed that one of these assets, dubbed YTB323, produced a 63% complete response rate after three months among the 26 patients with relapsed/refractory diffuse large B-cell lymphoma who were treated with the dose that will be taken into phase 2 studies.

Eight patients continued to show a response rate eight to 16 months after their infusion, and the median duration of response has not been reached, Novartis said.

Meanwhile, a follow-up analysis of a phase 1 study of the other asset, PHE885, showed a 96% overall response rate among the 23 patients with relapsed/refractory multiple myeloma who were evaluable for efficacy. Clinical responses occurred rapidly and deepened over time, according to Novartis, with 15 patients showing ongoing responses at the time of data cutoff.

The data look “really promising,” Brogdon said, noting that many of the patients on the PHE885 trial had a very high risk profile. Her team is now starting to enroll patients whose cancer is at a less severe stage, which could give them data more easily comparable to studies of similar therapies.

Expressions of interest

Even before the latest readouts, the platform has been generating enough excitement that CAR-T-focused biotechs have contacted Novartis to explore the possibility of giving their own candidates the T-Charge treatment.

“We’re open to considering how to partner and leverage other assets on our T-Charge platform,” Brogdon said. “Innovation comes from a lot of different areas, and we at Novartis continue to look for those opportunities to collaborate where others might have additional opportunities.”

While the Big Pharma was keen to stress that no agreements have yet been signed with prospective biotech partners—and remained tight-lipped on their identities—the interest is testament to the untapped potential of CAR-Ts. “We really envision this as a platform that will be game changing for the future of CAR-T,” Brogdon said.

All approved CAR-Ts to date are what are called autologous treatments, meaning they are based on donations of a patient’s own cells. An up-and-coming class of CAR-Ts in various stages of clinical testing is known as allogeneic, or “off-the-shelf,” therapies, because they use engineered cells collected from a third party.

Brogdon said she hopes the potential for the T-Charge platform to make CAR-Ts easier to manufacture and therefore reach patients means it can compete with these off-the-shelf options. Novartis’ current focus is on using the T-Charge process to generate autologous therapies, and Brogdon said there are no plans to attempt to adapt it for allogeneic therapies, which require more edits to the T cells.

Charging forward

Beyond YTB323 and PHE885, Novartis has a number of preclinical assets that have the potential to leverage the platform for additional indications. The T-Charge platform offers the opportunity to expand its CAR-T portfolio beyond the protein CD19—the most widely used target in approved CAR-T therapies—to explore new ones in hematologic malignancies as well as combinations of a CAR-T and other immunotherapies and traditional anticancer therapies, the company said.

“We’re certainly committed in the hematology space, where we feel like there’s proven benefit. And we continue to look towards what are the relapse and resistance mechanisms that are arising in these different patient populations and across the B-cell malignancies? Can we add additional flavors that might help where there is still a need?” Brogdon said.

“And, of course, we’re quite keen to move into solid tumors as well … but the bar there is much higher,” she added. “So I think we’re all realistic about the challenges in the solid tumor space.”

With Novartis’ mission statement of making the “next leap forward in the development of CAR-T therapies and reimagining cancer survival,” it sounds like the interest from prospective biotech partners won’t be letting up anytime soon.