As of the end of August, the US represented 40% of the world’s equity while China and Hong Kong represent 7.5% and 6.5%, respectively. Being the largest and most liquid equity market in the world, the US offers a variety of investment opportunities in many different sectors. In addition to having the opportunity to invest in famous American companies like Google, Apple or Amazon, Hong Kong investors can now also easily invest in famous Chinese companies like Alibaba, Baidu, and Weibo. Hundreds of Chinese companies are listed in the U.S. markets and many more are expected to continue seeking a US public listing in the future. Particularly, Chinese life sciences, e-commerce, and education companies looking to expand globally see the US equity market as an opportunity to leverage their brands.

To maximize investment return or diversify risk, many local investors start to shift their focus on US equity market due to the variety of products and trading strategies available. Now, investors using the “thinkorswim” platform can assess these products and implement the trading strategies easily.

TD Ameritrade has launched its operations in Hong Kong earlier this year, bringing investors a new award-winning “thinkorswim” trading platform with access to the US equity market. The company’s expansion into the Asian markets will provide investors a new way to make more-informed trading decisions using its “thinkorswim” desktop platform and “thinkorswim” mobile app. With its recent entrance to Hong Kong, TD Ameritrade now extends to local investors the same high-quality trading services and low commissions US investors have been enjoying to independently manage their portfolio for the past 40 years. By utilizing the innovative tools offered by the “thinkorswim” platform – trade scanners, advanced interactive charting, third party research reports, market heatmap, probability analysis and in-app chat support, retail investors can keep up with market developments and respond instantly just like the professionals. Additionally, TD Ameritrade offers online educational resources that include timely articles and videos, an immersive investment curriculum, as well as webcasts and engaging in-person events in both English and Chinese.

“thinkorswim” is an easy way for Hong Kong investors to diversify their portfolio by including U.S. equities plus trading major worldwide market indices, sector indices, ADRs, options, and futures. Moreover, with the platform’s professional level features, investors can perform analyses, test strategies and monitor potential risk/reward. For investors new to the US equity market and want a little practice before investing real money, TD Ameritrade offers virtual trading through its paperMoney® paper trading platform. paperMoney® provides retail traders a simulated trading account with $100,000 of “play money” to develop their trading skills before risking their own capital.

TD Ameritrade’s “thinkorswim” platform is designed for all levels of investors and provides straightforward pricing. It also offers 24 hours trading for select securities, which allows investors the flexibility to trade on their schedule. Unlike the Hong Kong market, where investors are required to trade in broad lots, investors can trade as few as one share in the U.S. Furthermore, whether the investment is USD$10,000 or USD$1 million, the commission charged remains only USD$6.95 for each online equity order.

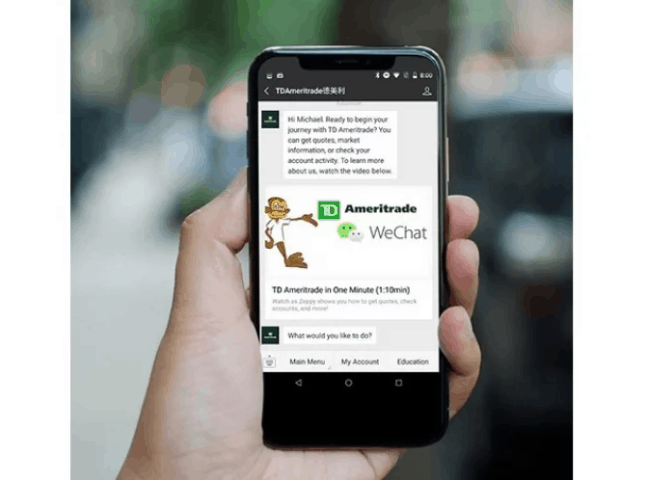

With support of AI and live customer service, TD Ameritrade is one of the few online brokers offering WeChat-based chatbot in Hong Kong. Individual investors in Hong Kong can monitor market developments and receive support using one of the most popular social and information platforms across Asia. In addition to accessing price quotes and industry information in the form of charts and figures as well as tracking a company’s events and trends, the WeChat chatbot provides the latest information on US markets, options, and forex. TD Ameritrade is also committed to providing investors with exceptional investment education resources, by offering Hong Kong retail investors access to its extensive archive tutorials and answers to their questions through education videos. Consumers can further explore and watch related education contents with the help of WeChat’s unique Shake function. One of the most valuable feature is that investors can easily see their account balance and position via WeChat, while accessing real-time communication with automatic or a live customer service representative. TD Ameritrade’s WeChat experience is the first of its kind with two versions, English and Simplified Chinese.