Once hailed as the future of immuno-oncology, it looks like TIGITs could now be in trouble. Roche admitted last week to a second phase 3 trial failure for tiragolumab, which was unable to demonstrate the progression-free survival achieved by Tecentriq alone in patients with non-small cell lung cancer.

In light of the news, iTeos is now reevaluating how to proceed with its own TIGIT drug, a collaboration with GlaxoSmithKline called EOS-448. While the range of ongoing trials for the therapy suggests the companies are a long way from abandoning TIGITs, it hints at the nervousness caused by Roche’s findings.

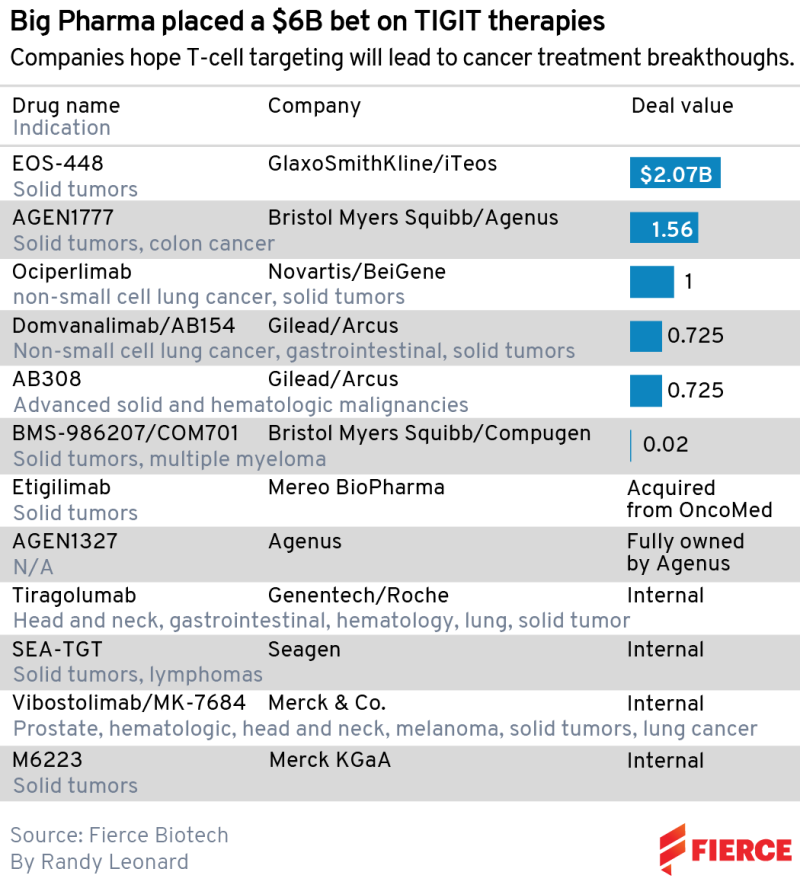

They aren’t the only major pharma players who bet big on TIGIT immune receptors following early evidence that these drugs can enhance the effects of PD-1/L1 checkpoint inhibitors. The likes of Merck & Co., Gilead Sciences, Novartis and Bristol Myers Squibb have all either invested internally or stumped up the cash to license a potential therapy.

The biggest spender to date is GSK, which paid $625 million upfront to iTeos in June 2021. Novartis handed over $300 million to BeiGene for the TIGIT ociperlimab in December of that year, seven months after BMS gave $200 million to Agenus for its own TIGIT candidate AGEN1777. Including potential biobucks, TIGIT deals by Big Pharma add up to over $6 billion.

Keep calm and carry on

With serious money on the line, do the Roche findings mean it’s time to start worrying? Based on the information the Swiss pharma has offered so far, SVB Securities senior research analyst Daina Graybosch, Ph.D., suggests Big Pharma shouldn’t give up hope yet.

“Two things give me optimism,” Graybosch tells Fierce Biotech in an interview. “One is the press release that said they did see a numerical difference in both endpoints. And they are continuing the study—that tells me this is not a flat-out failure.”

Graybosch’s other reason to remain upbeat is Roche’s randomized phase 2 CITYSCAPE study, which demonstrated in 2019 that a Tecentriq-tiragolumab combo beat placebo at shrinking tumors: in 31.3% of patients versus 16.2%. “So I’d say those things together—that Roche is … not changing their strategy yet, and the randomized phase 2—tells me this isn’t a total flop. And I know how hard it is to have a successful study in this setting.”

Roche said further analyses of the results are ongoing, and data will be presented at an upcoming medical meeting. “While these results are not what we hoped for in our first analysis, we look forward to seeing mature overall survival for this study to determine next steps,” said Levi Garraway, M.D., Ph.D., Roche’s chief medical officer and head of global product development, at the time.

But that doesn’t mean everyone should be breathing easy. “It’s definitely cause for concern,” Graybosch says. “I guess I could say it’s not a total failure. I think everybody is just waiting for Roche to present the actual data.”

Companies looking at TIGITs have broadly fallen into two camps so far. Roche’s tiragolumab—along with Merck’s vibostolimab, GSK and iTeos’ EOS-448, and Novartis and BeiGene’s ociperlimab—have an FC receptor function. FC receptors are found on the cell surface and contribute to the protective functions of the immune system by binding to antibodies that are attached to infected cells or invading pathogens.

Other TIGITs—like Arcus Biosciences and Gilead’s domvanalimab—have mutated out the receptor function. While the drug developers who have taken a different approach than Roche may have cause to feel insulated from the Swiss pharma’s troubles, the proof will be in the readout.

“Maybe those companies who’ve made different decisions have some reason for optimism,” says Graybosch. “But their evidence is preclinical and hypothetical. We don’t have really good clinical evidence for any of these hypotheses yet.”

The ‘way of the IDO’?

Beyond the publication of Roche’s full findings, all eyes will be on data from Gilead and Arcus’ phase 2 ARC-7 trial of their anti-TIGIT domvanalimab, which is due to read out in the second half of the year. Another company with high hopes for the drug class is Merck, which sees TIGITs as a way to extend the life of its blockbuster Keytruda franchise beyond the drug’s patent expiry in 2028.

So there’s plenty of reasons for Big Pharma to stay the course with TIGITs. But the Roche results do raise the specter of a repeat of IDO1 inhibitors, when a phase 3 flop for Incyte’s epacadostat in 2018 triggered a retreat from this once-hot target. If a full evaluation of tiragolumab doesn’t produce any bright spots, things could go downhill fast.

“The worst case is the numerical improvement is so minimal that it’s not clinically relevant [and] not even worth increasing your trial size to capture it,” Graybosch says. “This is where we have the best signal. So if it’s not going to work here, it’s maybe not going to work anywhere else and TIGIT goes the way of IDO—meaning all the biotechs have to stop their program.”

Even in this nightmare scenario, Big Pharma would likely continue to tinker away with TIGITs behind the scenes, but biotechs would have to abandon their programs. “Market investors will just be unwilling to invest biotechs to work here,” Graybosch says.

The smaller TIGIT-focused biotechs got a taste of this last week, when iTeos and Arcus both saw their shares plunge by around 27% in the wake of the Roche news. Neither company has yet fully recovered.

Luckily, TIGITs still have a long clinical journey ahead of them, but, for many biotechs and investors, some concrete data on their efficacy can’t come soon enough.