Treasury yields fell on Monday as investors searching for clues on the outlook for interest-rate cuts looked ahead to June’s consumer prices data and Federal Reserve Chairman Jerome Powell’s testimony on the economic outlook before lawmakers later this week.

What are Treasurys doing?

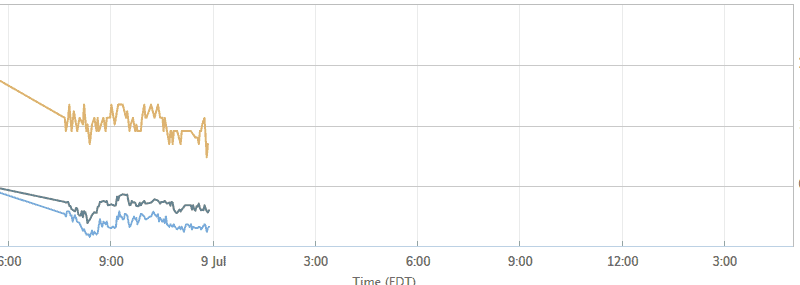

The 10-year Treasury note yield TMUBMUSD10Y, -0.64% fell 1.4 basis points to 2.030%, after staging its biggest daily climb in around seven months, while the 30-year bond yield TMUBMUSD30Y, -0.42% slipped by 2.9 basis points to 2.520%. The 2-year note rate TMUBMUSD02Y, -1.26% was up 0.5 basis point to 1.875%, its highest level in around a month. Debt prices move in the opposite direction of yields.

What’s driving Treasurys?

Investors will get a handle on key inflation data later on Thursday, with analysts viewing the June consumer price report as one of the last key economic indicators the Fed will monitor before it heads into its meeting on July 31. The U.S. central bank is still expected to carry out a quarter-percentage- point rate cut this month.

Beginning Wednesday, Fed Chairman Jerome Powell will also deliver his semiannual monetary policy report to Congress and the Senate. His remarks could offer further guidance on the future course of interest rates.

Global equity markets were on the backfoot in the wake of a stronger-than-expected jobs report, which showed the U.S. economy had created 224,000 new jobs. The surprising show of resilience from the labor market led traders to wind down bets on two quarter-percentage-point rate cuts at July’s Fed meeting.

Asian equity indexes ended sharply lower, stoking demand for haven assets like U.S. government paper. The Shanghai Composite SHCOMP, -0.57% fell 2.6%, while Tokyo’s Nikkei NIK, -0.09% shed 0.9%. The Dow DJIA, -0.43% and the S&P SPX, -0.48% were on track to record losses, but both equity benchmarks still remained within 1% from their all-time closing highs.

What’s driving Treasurys?

“The markets are likely to further walk back rate cut expectations after the upcoming semiannual monetary policy report scheduled to be delivered by Chairman Powell this week. Although the Monetary Policy Report already delivered to Congress clearly states that the Fed will do what is necessary to ensure a sustained expansion, the Chairman can assure Congress that the economy currently looks healthy,” said Steven Ricchiuto, chief U.S. economist for Mizuho.

“A lot of what we expect from CPI is already priced in. The [inflation report] is not going to change the Fed’s decision especially when the market is pricing in low inflation expectations on TIPs break-even rates,” said Leslie Falconio, senior strategist with UBS Global Wealth Management’s Chief Investment Office, referring to inflation expectations as indicated by Treasury inflation-protected securities.