- Euro weakens, loonie slumps; EM equities, currencies decline

- Argentina raises key interest rate to 60% to protect peso

U.S. equities were mixed following losses in Europe and Asia as traders weighed geopolitical concerns with data showing a strong U.S. economy. The dollar rallied as consumer-spending and inflation figures signaled policy makers can keep raising interest rates.

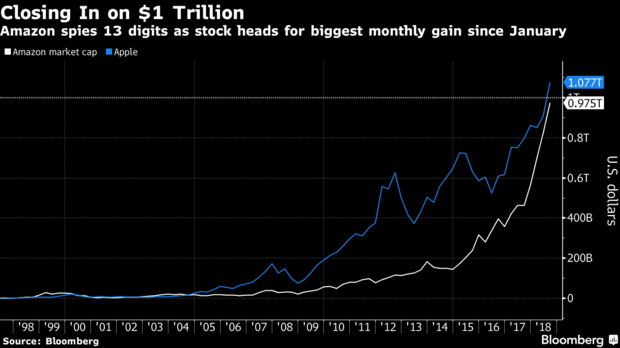

The S&P 500 Index fluctuated a day after the gauge closed above 2,900 for the first time. Electronic Arts Inc. slumped after cutting its forecast for net bookings, while Amazon.com Inc. climbed toward a $1 trillion market valuation. Almost every sector fell on the Stoxx Europe 600 Index. Argentina’s central bank jacked up its benchmark interest rate, already the highest in the world, to an unprecedented 60 percent in a bid to reverse a rout in the peso.

Treasuries edged higher with core European bonds. The euro fell after the EU’s chief negotiator warned the bloc must be prepared for a disorderly Brexit. Canada’s dollar weakened after second-quarter growth missed estimates.

Equities took a breather as August draws to a close after rallying for most of the month, with a gauge of world stocks heading for a second weekly gain and U.S. shares posting fresh all-time highs. Investors are cautious amid a slew of risks to the global outlook, not least U.S. trade and foreign policy. President Donald Trump on Wednesday accused China of undermining efforts to pressure North Korea into giving up its nuclear weapons — a potential indication that his trade war with Beijing is exacerbating geopolitical tensions.

In Asia, Japanese equities pared earlier gains to finish slightly higher and stocks fell in Hong Kong and China. The Australian dollar declined after second-quarter business investment was worse than expected, while New Zealand’s currency slumped as business confidence hit a 10-year low.

Elsewhere, oil futures added to gains following a bigger-than-expected decline in U.S. crude stockpiles. Emerging-market stocks and currencies declined, with the lira tumbling on a Turkish holiday amid reports the central bank’s deputy governor is set to resign.

Terminal users can read more in our Bloomberg Markets Live blog here.

Here are some key events scheduled for the remainder of this week:

- China’s official factory PMI are due Friday.

- The Bank of Korea sets policy on Friday. Weak jobs growth has cooled speculation of an interest-rate increase.

These are the main moves in markets:

Stocks

- The S&P 500 Index fell 0.1 percent as of 10:44 a.m. in New York. The Nasdaq Composite was little changed, while the Dow Jones Industrial Average slipped 0.3 percent.

- The Stoxx Europe 600 Index sank 0.3 percent, the biggest dip in more than two weeks.

- The U.K.’s FTSE 100 Index dipped 0.7 percent to the lowest in more than two weeks.

- The MSCI Emerging Market Index sank 1 percent, the biggest dip in more than two weeks.

Currencies

- The Bloomberg Dollar Spot Index climbed 0.2 percent.

- The euro dipped 0.3 percent to $1.1668, the first retreat in a week.

- Canada’s dollar fell 0.5 percent to C$1.2972 per U.S. dollar

- The Japanese yen increased 0.3 percent to 111.39 per dollar, the biggest climb in more than a week

Bonds

- The yield on 10-year Treasuries dipped two basis points to 2.87 percent.

- Germany’s 10-year yield decreased four basis points to 0.36 percent, the first retreat in a week.

- Britain’s 10-year yield declined two basis points to 1.46 percent.

Commodities

- West Texas Intermediate crude climbed 0.5 percent to $69.83 a barrel, a one-month high.

- Gold fell 0.5 percent to $1,200.38 an ounce.