Stock Markets

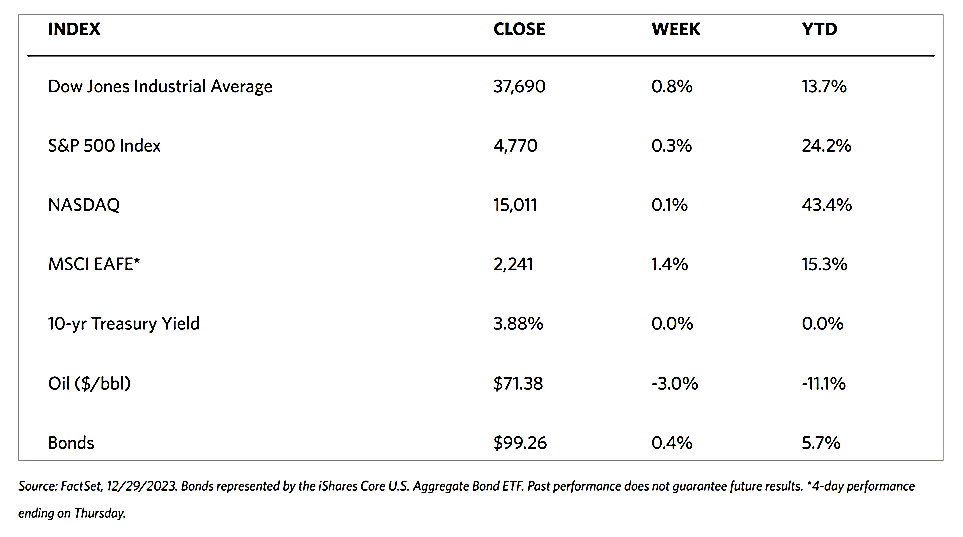

During the holiday-shortened weekend, the major benchmarks were mixed. The Dow Jones Industrial Average (DJIA) gained 0.81% and the DJ Total Stock Market advanced by 0.26%. The broad S&P 500 Index added 0.32% while the technology-heavy Nasdaq Stock Market Composite Index rose by 0.12%. The NYSE Composite Index climbed by 0.49%. The CBOE Volatility Index (VIX), an indicator of investor risk perception, declined by 4.45%. This was the S&P 500 Index’s ninth straight weekly gain, its longest rally since 2004, bringing it to within 0.53% of its record intraday high. The Nasdaq Composite recorded its sixth-biggest annual gain since the index was launched in 1971. Since trading was closed on Monday and many investors were out of the office, this being the week between Christmas and the New Year, trading volumes were muted and market movements were light.

U.S. Economy

The week’s economic calendar was mostly light, but there was arguably a negative overall tone. On Wednesday, an index of Mid-Atlantic manufacturing activity was reported to have fallen sharply in December, indicating the fastest pace of contraction since February. Further bad news emerged on Friday when a barometer of overall business activity in the Chicago region surprised significantly on the downside and descended once more into contraction territory. Pending home sales for November were flat in defiance of expectations for a modest increase, supposedly in response to a recent drop in mortgage interest rates. Lastly, there was an unexpected rise in weekly jobless claims, reaching 218,000, their highest level since the start of the month. Volumes were light in bonds trading for most of the week, although spreads modestly tightened as investors favored risk assets.

Metals and Mining

The spot market for precious metals was mixed for this holiday-shortened trading week. Gold gained marginally by 0.48% from last week’s closing price of $2,053.08 to end at $2,062.98 per troy ounce. Silver lost 1.61% of its value, moving down from last week’s closing price of $24.19 to end at $23.80 per troy ounce. Platinum moved up by 1.57% from its close last week at $976.60 to close this week at $991.90 per troy ounce. Palladium declined by 8.76% from its previous week’s closing price of $1,205.81 to end this week at $1,100.24 per troy ounce. The three-month LME prices of base metals were also mixed. Copper lost 0.42% from its previous week’s close at $8,595.50 to end the week at $8,559.00 per metric ton. Zinc gained by 4.36% from last week’s closing price of $2,547.00 to this week’s closing price of $2,658.00 per metric ton. Aluminum climbed by 6.24% from last week’s close at $2,244.00 to this week’s close at $2,384.00 per metric ton. Tin ticked up by 1.04% from its ending price last week of $25,153.00 to this week’s ending price of $25,415.00 per metric ton.

Energy and Oil

On Tuesday, oil prices rose almost by 3% due to worries of global trade and crude supply disruption caused by militant attacks on shipping in the Red Sea. However, bearish sentiment took over by the end of the week due to concerns that the market is oversupplied from record production outside the OPEC. U.S. crude closed the year at more than 10% lower than when the year began. The U.S. is producing crude at a record pace, pumping an estimated 13.3 million barrels per day during the week. Brazil and Guyana are also producing record outputs. This historic production outside the OPEC group coincides with an economic slowdown in China and other major economies. The Brent contract for March lost $0.11, or 14%, to settle at $77.04 per barrel on Friday, while the West Texas Intermediate (WTI) contract for February lost $0.12, or 17%, to settle at $71.65 per barrel. Despite ongoing geopolitical risk in the Middle East resulting from the war in Gaza, U.S. crude and the global benchmark recorded their first annual decline since 2020. WTI has descended by 10.73% while Brent has shed 10.32% for the year.

Natural Gas

For this report week beginning Wednesday, December 13, and ending Wednesday, December 20, 2023, the Henry Hub spot price rose by $0.16 from $2.33 per million British thermal units (MMBtu) to $2.49/MMBtu. Regarding Henry Hub futures prices, the price of the January 2024 NYMEX contract increased by $0.112, from $2.335/MMBtu at the start of the report week to $2.447/MMBtu at the end of the week. The price of the 12-month strip averaging January 2024 through December 2024 futures contracts increased modestly to $2.564/MMBtu. Natural gas spot prices rose at most locations this report week in the different regions of the country.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $2.47 to a weekly average of $13.30/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.84 to a weekly average of $10.89/MMBtu. In the week last year corresponding to this report week (the week from December 14 to December 21, 2022), the prices were $34.42/MMBtu in East Asia and $34.99/MMBtu at the TTF.

World Markets

As traders returned from an extended Christmas break and only a few days left in the year, trading volume was light but equities were higher for the last trading week of the year. The pan-European STOXX 600 Index gained 0.41% on heightened optimism that interest rates may be reduced next year. The region’s major stock indexes were mixed. Germany’s DAX gained a modest 0.22% while France’s CAC 40 and Italy’s FTSE MIB hardly changed. The UK’s FTSE 100 ascended by 0.66%. Spain, the first major eurozone economy to report December inflation, released a preliminary estimate of consumer price growth and it showed headline prices slowing in December to 3.1% year-over-year. This is a happy surprise in place of the acceleration to 3.3% initially expected by economists. FactSet, the national statistics agency, attributed the price slowdown to a fall in motor fuel prices. A European Central Bank (ECB) official, Madis Muller, announced that the ECB is not likely to raise interest rates again in light of the slowing inflation.

In Japan, stocks ended higher for the last trading week of 2023. The Nikkei 225 Index rose by 0,.89% while the broader TOPIX Index climbed by 1.28% in quiet trading ahead of the New Year’s holiday. The optimism was due to expectations that the Bank of Japan (BoJ) could continue with its ultralow interest rate policy. The Nikkei climbed 28% while the TOPIX gained 25% for 2023, their biggest annual gains since 2013. The Nikkei was the best-performing index in Asia. Economic data for the week was mixed and had little correlation with the stock market. Unemployment remained unchanged at 2.5% in November. Industrial output fell for the first time in three months but by much less than expected. Retail sales, however, grew robustly year-over-year on the back of recovering consumption from the pandemic slump. The yen strengthened to JPY 141 per U.S. dollar. The yield on the 10-year Japanese government bond (JGB) eased slightly to 0.6%.

Chinese equities ascended in the last trading week of the year, in response to the government’s announcement of new online game approvals. This calmed fears of a possible clampdown on the gaming sector. The Shanghai Composite Index gained 2.06% for the week, while the blue-chip CSI 300 Index climbed by 2.81%. The Hong Kong benchmark Hang Seng Index rallied by 4.33%. A bout of fresh approvals for new online games was announced by Chinese regulators to support the industry. This followed a draft of new rules designed to curb spending that caused stocks to plunge the week earlier. Shares of one of China’s largest online gaming companies, Tencent, plummeted by more than 12% amid concerns that the government may resume controls on big technology companies after its two-year crackdown that began in 2021. Stocks recovered some of their losses, however, as Beijing’s softer stance appears to have coaxed back some of the lost investor confidence. As Beijing’s latest stimulus measures supported growth, profits at industrial firms shot up by 29,5% in November year-on-year and rose from October’s 2.7% gain. Economists forecast China’s gross domestic product (GDP) growth to slow to 4.6% in 2024 from 5.2% in 2023 as the country continues to be dogged by persistent property woes and growing deflationary pressures.

The Week Ahead

Among the important economic data that are expected to be released this week are the month’s auto sales, ISM manufacturing, and several labor market readings that include nonfarm payrolls, JOLTS job openings, and the unemployment rate for December.

Key Topics to Watch

- S&P final U.S. manufacturing PMI for December

- Construction spending for November

- Richmond Fed President Tom Barkin speaks

- U.S. job openings for November

- ISM manufacturing for December

- Minutes of Fed’s December meeting

- Auto sales for December

- ADP employment for December

- Initial jobless claims for December 30

- S&P final U.S. services PMI for December

- U.S. unemployment report for December

- U.S. unemployment rate for December

- U.S. hourly wages for December

- Hourly wages (year-over-year)

- ISM services for December

- Factory orders for November

- Richmond Fed President Tom Barkin speaks

- Dallas Fed President Lorie Logan speaks

Markets Index Wrap-Up