Stock Markets

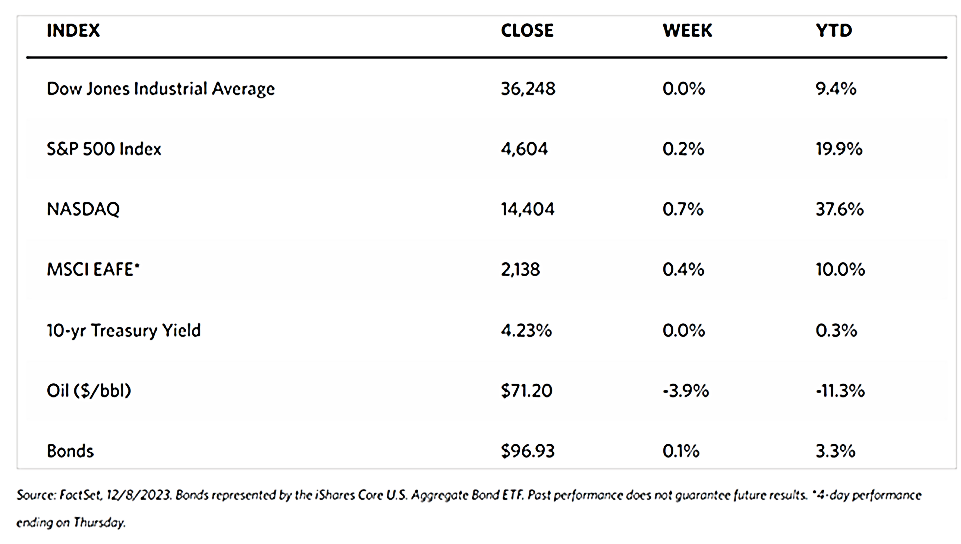

The major U.S. stock market indexes were mixed this week. According to the Wall Street Journal Markets report, the Dow Jones Industrial Average moved sideways for the week, adding a slight 0.01% and while the transportation and utility sectors came down, the total stock market index advanced by 0.26%. The broad S&P 500 Index gained by 0.21% although it was outperformed by the technology-heavy Nasdaq Stock Market Composite which climbed 0.69%. The NYSE Composite declined by 0.34%. The CBOE Volatility Index (VIX), an indicator of investor risk perception, ended lower by 2.22%. While the market is already set on expecting a rate cut instead of a rate hike from the next Fed move, the timing of this event may be a cause for some volatility.

The week began with a sell-off but a late rally helped the major indexes close flat to modestly higher. For the third time in the past four weeks, the small-cap Russell 2000 Index outperformed the S&P 500 Index which resulted in narrowing its significant year-to-date underperformance. Growth stocks have built slightly over their value counterparts, and energy stocks lagged within the S&P 500 due to oil prices falling below the $70-per-barrel level for the first time since June. One factor that seemed to boost the growth indexes and the technology-heavy Nasdaq Composite is the continuing enthusiasm of the market over the potential of generative artificial intelligence (AI). On Thursday, Alphabet, Google’s mother company, rose by more than 5% after the company divulged its new AI model, Gemini. This product can process text, code, audio, images, and video, and can be incorporated into mobile applications. Simultaneously, Advanced Micro Devices climbed by almost 10% upon announcing its launch of a new generation of AI chips, Earlier in the week, Apple moved back to near its summer all-time highs when it eclipsed $3 trillion in market capitalization.

U.S. Economy

The economic news released during the week drove market sentiment northward. Surprising on the upside was the nonfarm payrolls report released on Friday, revealing that employers added 199,000 jobs in November which was higher than consensus estimates of around 180,000. The unemployment rate also perked interest by falling back to 3.7% from a two-year high of 3.9% in October. Average hourly earnings rose above expectation at 0.4%, however, the year-over-year increase was maintained at the expected 4.0%. The biggest market reaction, though, was the University of Michigan’s preliminary gauge of consumer sentiment in December. The metric surged to its highest level since August due to calming inflation fears. The survey respondents expected prices to increase by a much lower 3.1% in the coming year from the 4.5% registered in November. December’s reading is also the lowest rate recorded since March 2021. Also rising considerably are gauges of consumer expectations and their assessment of current economic conditions.

Other economic data that emerged during the week drew mixed reactions. There was a modest pickup in services sector activity in November, as indicated by data from both the S&P Global and the Institute for Supply Management released on Tuesday. However, the Labor Department’s count of October job openings dropped by more than expected to 8.73 million, the lowest level since March 2021. On Monday, reported data on October factor orders also fell more than expected.

Metals and Mining

The gold market went through a rollercoaster week as the price of gold rallied to an all-time of high only to plunge and close at 3% lower than last week. On Monday, bullish momentum triggered a buy signal in an illiquid market in the Asian session, driving the precious yellow metal to hit $2,152.30 per ounce, a new high. The subsequent parabolic move, however, showed the rally to be unsustainable and cratered into a selling momentum triggered by occasional buy stops. It is not surprising, though, that gold was sold down after it breached past the $2,100 per ounce level because of the profit-taking potential provided to investors after prices hit a major projection level. This does not signify, however, that there is no long-term bullish sentiment in gold; this remains intact. Many analysts were warning investors that gold was in overbought territory, thus the near-term selloff was only to be expected.

The spot prices for precious metals ended the week down. Gold, which ended last week at $2,072.22, closed this week at $2,004.67 per troy ounce for a loss of 3.26%. Silver came down by 9.77% from its previous week’s close at $25.49 to end this week at $23.00 per troy ounce. Platinum, which ended last week at $937.15, went further south by 1.76% to close this week at $920.65 per troy ounce. Palladium came down by 5.90% from its close last week at $1,006.13 to end this week at $946.74 per troy ounce. The three-month LME prices of industrial metals were generally lower at the week’s close. Copper lost 1.45% this week from its previous close at $8,464.50, ending this week at $8,342.00 per metric ton. Zinc also dipped, ending the week lower by 2,79% from its previous week’s close at $2,475.50, for a closing price of $2,406.50 per metric ton. Aluminum descended by 2.76% to close this week at $2,132.50 per metric ton from last week’s closing price of $2,193.00. Tin bucked the trend and ended this week at $24,675.00 per metric ton, higher by 6.15% from last week’s close of $23,246.00.

Energy and Oil

The research unit of China’s national oil company, CNPC, announced that China’s oil demand is expected to peak by the year 2030 at approximately 15.6 to 16 million barrels per day. However, even sooner, Chinese oil demand has been slowing down into the fourth quarter of this year. Last week’s announcement of OPEC+ production cuts has failed to create a significant reaction in the market, with non-OPEC supply continuing to grow (Guyana is starting its third FPSO this month). These developments contribute to a less-than-rosy outlook for an increase in oil prices. Both the WTI and Brent dropped to their lowest readings since June, falling below $69 and $74 per barrel respectively, before bouncing back to regain some of those losses on Friday morning. To break the bearish sentiment in the oil market that has materialized over the past week would necessitate some very optimistic macroeconomic news or major supply disruption. In the U.S., gasoline prices continue to decline as the national average dropped to $3.185 per gallon on Friday. This is the lowest price since January and may continue to drop below the $3 per gallon threshold by Christmas for the first time since 2021.

Natural Gas

For the report week from Wednesday, November 29, to Wednesday, December 6, 2023, the Henry Hub spot price rose by $0.03 from $2.70 per million British thermal units (MMBtu) to $2.73/MMBtu. Regarding the Henry Hub futures market, the price of the January 2024 NYMEX contract decreased by $0.235, from $2.804/MMBtu at the start of the report week to $2.569/MMBtu at the end of the report week. The price of the 12-month strip averaging January 2024 to December 2024 futures contracts declined by $0.238 to $2.746/MMBtu.

International natural gas futures prices decreased for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.47 to a weekly average of $16.10/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $1.06 to a weekly average of $12.91/MMBtu. In the week last year corresponding to this report week (week from November 30 to December 7, 2022), the prices for international gas futures prices were $32.98/MMBtu in East Asia and $42.95/MMBtu at the TTF.

World Markets

Shares in Europe advanced for the fourth straight week on expectations that banks may cut interest rates in the coming year. The pan-European STOXX Europe 600 Index ascended by 1.30% as stocks received a lift from optimism among investors that inflation would be slowing and European economies have been cooling. Major stock indexes in the region have tracked the European index. France’s CAC 40 Index rose by 2.46%, Germany’s DAX climbed by 2.21%, and Italy’s FTSE MIB gained 1.59% for the week. The UK’s FTSE 100 Index added 0.33%. Meanwhile, European government bond yields ended generally lower as pronouncements by some European Central Bank (ECB) officials spurred hopes that interest rate reductions may be seen during the first half of the new year. The yield on the benchmark 10-year German bond descended towards its lowest levels during the year-to-date period, while the Italian government bond yields likewise slid. The 10-year UK government bond yield dropped to below 4% for the first time since the middle of May on speculation that the Bank of England may begin reducing borrowing costs by mid-2024. In the meantime, however, Germany’s economy struggled as its jobless rate rose, and the UK housing market continued to weaken.

In Japan, the stock market descended over the week, with the Nikkei 225 Index plummeting by 3.4% and the broader TOPIX Index sliding by 2.4%. Speculation went rife on the back of comments by officials of the Bank of Japan (BoJ) that the bank may abandon its policy of negative interest rates sooner than expected, weighing on riskier assets. Data showing that Japan’s economy contracted by more than initially estimated in the third quarter of 2023 brought greater pressure on equities. The yield on the 10-year Japanese government bond (JGB) rose to 0.77% from 0.71% at the end of the previous week amid the perceived BoJ hawkishness. Another factor that pushed yields higher was a notably weaker-than-expected 30-year JGB auction. Meanwhile, the yen strengthened to the new low-144 level against the U.S. dollar from 146.8 at the end of the week before, due to growing speculation about BoJ policy normalization. This is the currency’s highest level in nearly four months, which is also partially due to anticipation of reduced interest rate differentials with the U.S. The market consensus appears to be converging around the view that the Federal Reserve has completed its cycle of raising interest rates for now.

Chinese stock indexes fell as a result of a credit downgrade on China’s sovereign debt by Moody’s credit rating agency, further underscoring the country’s uncertain economic outlook. The Shanghai Composite Index lost by 2.05% on this week’s trading, while the blue-chip CSI 300 plunged by 2.4% after it fell midweek to its lowest level in almost five years. The Hong Kong benchmark Hang Seng Index plunged 2.95%. On Tuesday, Moody’s downgraded its outlook for China’s government bonds from “stable” to “negative,” citing the country’s debt-heavy local governments and state firms as posing significant economic downside risks. China has been grappling with a yearslong property market downturn and negative consumer and business confidence. The flurry of pro-growth stimulus measures adopted by Beijing earlier this year has been deemed by analysts to be insufficient to revive the economy.

The Week Ahead

For this week, the important economic data scheduled for release include the November CPI and PPI inflation data, the FOMC meeting, and import price index data for November.

Key Topics to Watch

- Consumer price index for November

- Core CPI for November

- CPI year over year

- Core CPI year over year

- Monthly U.S federal budget for November

- Producer price index for November

- Core PPI for November

- PPI year over year

- Core PPI year over year

- FOMC interior rate decision

- Fed Chairman Jerome Powell press conference

- Initial jobless claims for Dec. 9

- Import price index for November

- Import price index minus fuel for November

- U.S. retail sales for November

- Retail sales minus autos for November

- Business inventories for November

- Empire State manufacturing survey for December

- Industrial production for November

- Capacity utilization for November

Markets Index Wrap-Up