Stock Markets

In the week just ended, markets closed lower on concerns about the escalating tensions between Russia and the Ukraine. Volatility intensified and investors pulled back from equities in favor of safe-haven assets with perceived greater stability. The geopolitical tensions were only an addition to a market already contending with inflation levels not seen in four decades and expectations of rising Federal Reserve rates. In due time, attention may once more be channeled to economic fundamentals, although market volatility may continue to be a major challenge that investors will have to deal with for the rest of the year.

The large-cap indexes succumbed to its second straight week of losses, weighed down by the dramatic plunge of the Meta Platforms (Facebook’s parent) price, taking with it the rest of the communications sector. The consumer staples sector, which comprises the normally defensive industries, outperformed in the S&P 500 Index, particularly due to gains in Procter & Gamble and Walmart. In the face of market volatility and the upcoming long holiday (markets will remain closed on Monday, February 21, in observance of President’s Day), traded volumes were light as investors refrained from taking a position.

U.S. Economy

Conflicting signals associated with Federal Reserve indicators also fostered added caution among investors. Last, Monday, James Bullard, St. Louis Fed President, announced in an interview on CNBC that policymakers were dealing with the inflation increase, and questions may arise on the credibility of the central bank. Bullard indicated that it was his opinion and the consensus among fellow policymakers that a full percentage point increase in the federal funds rate may be expected by July. This ran contrary to traders’ expectation of a mere quarter-point increase in March, reflecting a more accommodative stance.

Other mixed economic data may also have suggested the unlikelihood of a more aggressive rate hike in the next Fed meeting. For the first time in a month, weekly jobless claims increased coupled with two lower-than-expected regional manufacturing indexes. On the other hand, retail sales grew 3.8% in January, which is above expectations, and the most it has recovered since spring. There is a caveat, however, that the sales data has not been adjusted for inflation, thus much of the increase may have been accounted for by the rise in prices. The Labor Department also reported on Tuesday that January’s producer prices increased by 1.0%, which is the highest in eight months and higher than forecasted. Housing numbers demonstrated no strong trends either way since housing starts rose less than expected but housing permits grew more than the consensus estimate.

Treasury yields fluctuated throughout the week due to the confusing signals from the Fed, Russia, and economic reports. The volatility in interest rates, together with outflows from municipal bond funds, weighed on the tax-exempt bond market. Light levels of supply, however, provided technical support to the market.

Metals and Mining

The same uncertainty in the geopolitical situation has also affected the precious metals sector but with increased optimism. Gold is riding the wave of fear and momentum that drives a flight to safe-haven assets. The price of the yellow metal touched $1,900 per ounce, an eight-month high. Although the gold rally surged by 3%, it is still uncertain whether the momentum will be sustained if and when the tensions between Russia and the U.S. will abate. While in normal times the price of gold may recede to prior levels, there is still the matter of inflation to contend with. The current inflation rate, which is the highest in four decades, may trigger monetary policy tightening that may move the global economy closer to a worldwide recession. The Bank of America chief investment strategist, Michael Hartnett, commented on Friday that the risk of a recession may be increasing. If this were to take place, it is an opportunity for gold to shine, providing a stable alternative to an increasingly uncertain monetary future.

Over the past week, gold increased by 2.13% from $1,858.76 to $1,898.43 per troy ounce. Silver rose from $23.59 in the preceding week to $23.92 per troy ounce in the week just concluded, gaining 1.40%. Platinum gained 4.03%, from $1,030.80 to $1,072.33 per troy ounce. Palladium climbed from $2,308.50 to end the week at $2,350.75 per troy ounce, a rise of 1.83%. Among base metals. copper moved up slightly by 0.97%, from $9,860.50 to $9,956.00 per metric tonne. Zinc fell from $3,626.50 to $3,575.50 per metric tonne for a loss of 1.41%. Aluminum rose by 4.02% from the previous week’s level at $3,136.50 to the past week’s close at $3,262.50 per metric tonne. Tin gained 1.36% week-on-week, from $43,549.00 to $44,140.00.

Energy and Oil

Oil prices have come down from their previous weeks’ highs. Oil price hikes that have taken place due to news about the Ukraine-Russian tensions have been offset by apparent progress in negotiations regarding the Iran nuclear talks. Improvement in the Iran situation is likely to assure a more stable supply of oil that would put to rest speculations of an oil supply shortage that a Russian embargo may trigger. The easing of sanctions on Iran is supposedly dependent on a sequence of steps, a matter which reportedly has been settled. The first step is for Iran to stop all enrichment of radioactive materials beyond 5% purity, simultaneous with the release of political prisoners. The Joint Comprehensive Plan of Action (JCPOA) members are then going to unfreeze Iranian assets frozen during the imposition of sanctions. If Iran shall agree to the deal, there is expected to be a more liberal flow of crude from this country beginning the third quarter of 2022. This should allay market fears about any supply tightness moving forward, bringing oil prices down. Should the Vienna talks successfully conclude, OPEC+ members have signaled their willingness to integrate Iran, which after all is a founding member of the OPEC, into their production curtailment deal.

Natural Gas

The spot prices of natural gas rose at most locations during the report week from February 9 to February 16. The Henry Hub spot price ascended to $4.39 per million British thermal units (MMBtu) from the previous week’s $4.06/MMBtu. International spot prices were mixed in the absence of more market-moving news. Regarding futures, the price of the March 2022 NYMEX contract rose $0.708, to end at $4.717/MMBtu for the week from the earlier week’s $4.009/MMBtu. The price of the 12-month strip averaging March 2022 through February 2023 futures contracts increased by $0.552 to $4.726/MMBtu.

In the U.S., prices along the Gulf Coast rose ahead of a cold front forecast for the central lower 48 states. Prices in the Mideast rose moderately, in line with the Henry Hub price. Prices also rose slightly in the West as a result of the cold weather front moving into the region. In the Northeast, prices are demonstrating some volatility as a result of the fluctuating weather patterns. The total natural gas supply in the U.S. is expected to rise in the coming week in tandem with increasing production. The total U.S. natural gas consumption is expected to substantially decrease across most sectors this week. This week, U.S. LNG exports are down by four vessels from last week.

World Markets

European equities slumped due to continued uncertainty in monetary policies and the tensions at the Ukraine-Russian border. The pan-European STOXX Europe 600 Index closed the week lower by 1.86%. France’s CAC 40 Index dipped 1.17%, Italy’s FTSE MIB Index descended 1.70%, and Germany’s DAX index lost 2.48% of its value. The UK’s FTSE 100 Index corrected by 1.92%. The core eurozone bond yields experienced some volatility but ended lower in the end due to intensified fears of a possible Russian invasion of Ukraine. Peripheral eurozone and UK government bond yields followed the direction taken by core markets. Christine Lagarde, the president of the European Central Bank, together with Governing Council members Pablo Hernandez de Cos and Francois Villeroy de Galhau, sought to reassure the markets that any adjustments to monetary policy would be gradual and guided by key economic data.

In Japan, the stock markets sustained week-on-week losses as sentiment continued to be affected by geopolitical developments in Ukraine and a possible shift to more aggressive monetary policy tightening by the U.S. Federal Reserve. The Nikkei 225 Index slid 2.07% and the broader TOPIX Index receded 1.95%. The fixed-rate Japanese government bond purchase operation of the Bank of Japan (BoJ) did not see any offers as market yields remain lower, successfully capped long-term interest rates, and kept the yield on the 10-year JGB unchanged at 0.22%. The yen moved higher against the U.S. dollar at JPY 115.18 compared to JPY 115.45 the previous week. The strength of the currency is dependent mainly on safe-haven demand in light of the worries over geopolitical issues.

Chinese equities climbed in response to positive signals from the government and lower-than-expected inflation figures that greatly buoyed investor sentiment. The Shanghai Composite Index gained 0.8% for the week, and the CSI 300 Index climbed 1.1%, in a week when most other international bourses were descending. The yield on the 10-year sovereign bond settled unchanged at 2.814%, while the yuan exchange rate against the U.S. dollar rose to 6.33 from 6.36 one week ago. An announcement by China’s Premier Li Keqiang stated that Beijing promised to rapidly implement measures that will strengthen economic support, particularly after the negative effects of COVID-19. Furthermore, corporate tax rates will be cut down, fiscal spending will be strengthened, and fiscal discipline instituted. Furthermore, the head of the People’s Bank of China (PBOC) indicated that supportive monetary policies will be maintained by the central bank for the rest of the year.

The Week Ahead

Among the important economic data scheduled for release in the coming week are consumer spending, consumer income, and consumer confidence.

Key Topics to Watch

- S&P Case-Shiller home price index (year-over-year change)

- FHFA home price index (year-over-year change)

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- Consumer confidence index

- Initial jobless claims

- Continuing jobless claims

- Gross domestic product revision (SAAR)

- Gross domestic income (SAAR)

- New home sales

- Nominal personal income

- Nominal consumer spending

- PCE inflation (monthly)

- Core inflation (monthly)

- PCE inflation (year-over-year)

- Real disposable income

- Real consumer spending

- UMich consumer sentiment (final)

- 5-year inflation expectations (final)

- Pending home sales

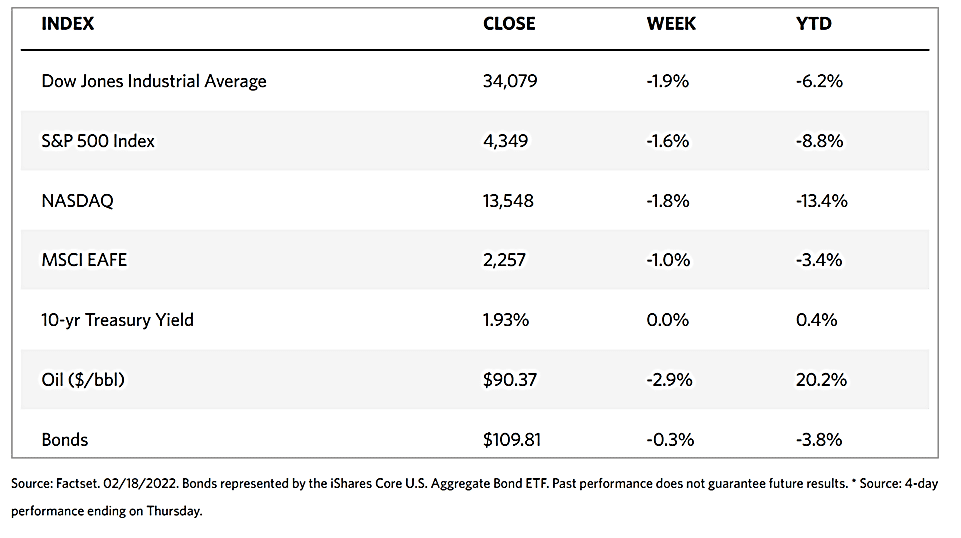

Markets Index Wrap Up