Stock Markets

Over the week, stocks set new highs on the back of the Congressional hearings looking into the GameStop trading spree and the better-than-foreseen economic data. Indices dipped slightly week-on-week, however, when optimism was tempered by concerns about the inflationary trend and rising bond yields. The ongoing negotiations of the details of the fiscal-aid package and growing anticipation of the accelerating vaccine roll-out continue to provide buying incentive for investors. The cyclical sectors outperformed the market, led by financials, industrials and energy and technology trailing behind. The benchmark 10-year Treasury yield advanced to 1.35%, its peak so far since November. The quick rise in yields may create some volatility in stocks, but in the longer term it might be a confirmation of the continued bull market rather than a threat.

U.S. Economy

Retail sales jumped 5.3% over the past month with gains registering across all major retail sectors. The main reason for the surge appears to be the stimulus checks and the gradual loosening of restrictions in several states, thus boosting consumer spending. Overall, the fundamental outlook remains positive despite the rising interest rates which would normally dampen interest in stocks.

- Higher inflation expectations signal the likely rebound in economic activity. The present inflation growth takes into account the sudden drop in prices one year ago at the beginning of the pandemic when demand dropped due to the lockdown. The rising inflation can be viewed in light of the 5.8% spending increase in January detailed in the retail-sales report released last week. The trend will likely continue in February due release of pent-up demand and savings resulting in higher-than-average future GDP growth.

- Ten-year interest rates advanced almost 0.2% week-on-week, in effect doubling since September levels. Viewed in perspective, this brings the ten-year benchmark back to its level in February. Historically, the yield in 10-year Treasuries is still at its lowest level. For this reason, a pragmatic assessment indicates that interest rates are far from being at the point that would begin to stifle economic growth.

- While the longer-term rates have increased, the Federal policy rate remains unchanged, and neither is the Fed expected to raise short-term rates in the foreseeable future. This pattern is indicative of a yield-curve steepening that is typically associated with the early and middle stages of economic expansion. The impact of the vaccine-deployment and pent-up demand may result in the subsequent phase of labor-market improvement, further fueling the economic expansion. Occasional volatility may be expected as the market consolidates its gains before resuming its bullish trend.

Metals and Mining

Gold surged to a four-week high before giving way to pressure brought about by the rising currency. The late-week rebound by the dollar arrested the continued rise in precious metal prices. Gold opened at $1,829 and peaked at its five-day trading session at $1,851 before settling at $1,825.03 per ounce. Silver also tested its four-week high when trading reached $27.66 per ounce on Tuesday. It subsequently corrected but remain above the $27 support level for the rest of the week, ending at $27.31. Platinum registered a six-year high at $1,262 per ounce on Thursday, thus adding 18.9% to its value since January. Palladium also benefitted from some buying interest to tread near its four-week high. Bu the week’s end, platinum settled at $1,242 and palladium at $2,305 per ounce.

Base metals also performed strongly, bolstered primarily by nickel and copper which realized the most gains. Concerns surrounding the shortage of semiconductors prevailed in the market due to the impact of automotive manufacturers, slowing their production and possibly dragging back most of the supply chain. Copper began trading the week at $8,007 per tonne, and by Friday it had gained 3.5% to end the week at $8.292. Zinc rallied from its year-to-date low of $2,539 per tonne to be valued at $2,726 on Friday, representing a gain of 7.3%. Nickel added 2.9% to end Friday at $18,599 per tonne, on news that demand for the metal will rise in tandem with the electric vehicle sector. Lead made a modest gain, opening at $2,052 and ending the week at $2,082.50 per tonne.

Energy and Oil

The major story this week was the Texas electricity crisis. Approximately 45 gigawatts of electricity generation from renewables, coal and natural gas went offline on Tuesday, interrupting power to 4 million people. Much of the power was restored by Friday, and as repair works continued, attention was drawn to issues impacting the state’s grid policy. These include the lack of weatherization of Texas power generation assets, the isolation of the state grid from the rest of the country, and the lack of a capacity market. The power outages, wellhead freeze overs, and other equipment failures sidelined around 4 mb/d of U.S. oil production. The restoration process could take weeks as restarting frozen or shuttered wells may be necessarily straightforward.

The supply situation is expected to ease up in the coming weeks as Saudi Arabia is poised to reverse its 1-mb/d voluntary production cut. The returned barrels are expected to hit the market in April, a favorable development for the industry. In the U.S., the shale industry could be in a better financial position with WTI surging to $60 per barrel. Drillers are likely to focus on cash generation rather than aggressively pursue spending plans. Concerning its neighbor to the north, Canadian shale gas drilling increased rapidly for the year consistent with the increase in the country’s gas exports to the U.S. As U.S. drillers cut back, Canadian drillers are looking forward to capturing a larger share of the U.S. market.

Natural Gas

Natural gas spot prices surged at most locations over the past week in response to the record-setting low temperature across the lower 48 states and losses in production as far south as the Gulf Coast. The Henry Hub spot price climbed to $23.61per million British thermal units (MMBtu) from $3.68/MMBtu. In nominal terms, this week’s close was the highest price since 1993; in real terms, it was the highest since February 2003. At the New York Mercantile Exchange (Nymex), the March 2021 contract rose by $0.31/MMBtu from $2.911/MMBtu to $3.219/MMBtu. The price of the 12-month strip averaging March 2021 through February 2022 futures contracts rose to $3.158/MMBtu, an increase of $0.12/MMBtu.

World Markets

Sideways consolidation saw European shares slightly increase on the back of companies’ quarterly earnings reports, coupled with concerns about the rising inflation and higher bond yields. The STOXX Europe 600 Index rose 0.21%, as France’s CAC 40 and UK’s FTSE 100 Indexes gaining ground. The German and Italian bourses sustained moderate losses as the core eurozone bond yields rose. In some welcome development, the UK and Switzerland are set to ease lockdowns. In England, PM Boris Johnson announced that the country would adopt “a cautious and prudent approach” by opening up in stages beginning with the commencement of face-to-face learning in early March. This is in response to the coronavirus levels in England, Wales and Northern Island falling to their lowest levels since early October. Switzerland also announced the gradual lifting of restrictions in March, starting with the reopening of shops and sports facilities, libraries, gardens and zoos. The EU signed a contract for another 200 million doses of coronavirus vaccine with Pfizer and BioNTech, bringing business expectations for the year ahead to the highest level since April 2018.

Japan’s indexes were mixed for the week, with the Nikkei 225 Stock Average closing at 30,017.92, the first time in three decades that it closed higher than the 30,000 resistance level. It nevertheless remains well below its all-time high of 38,597, established in 1989. The positive gains were due to encouraging economic reports regarding better-than-expected GDP figures, as well as an increase in the manufacturing Purchasing managers’ Index. Year-to-date, the Nikkei is up by 9.38%. The broader equity market benchmarks, the large-cap TOPIX Index and the TOPIX small index sustained modest losses for the week. The yen was slightly weaker, trading above JPY 105 against the dollar by week’s end. The yield of the 10-year government bond ended at 0.11% for the week, its highest level since November 2018. In China, shares also ended mixed in light of the holiday-shortened trading week. The large-cap CSI 300 Index dipped by 0.5% while the benchmark Shanghai Composite Index climbed by 1.1%. The yield on China’s 10-year government bond closed the week five basis points above the pre-holiday close, at 3.31%. Over the Lunar New Year, economic data reflected efforts to discourage travel due to the coronavirus infections that flared up in northern China.

The Week Ahead

The January leading indicator index, durable goods orders, and personal income and spending are among the economic data to be released in the coming week.

Key Topics to Watch

- Leading economic indicators

- S&P CoreLogic Case Shiller home price index (year-over-year)

- FHFA home price index (year-over-year)

- Consumer confidence index

- Fed Chair Jerome Powell testifies

- New home sales (SAAR)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Gross domestic product revision (SAAR)

- Durable goods orders

- Core capital goods orders

- Pending home sales index

- Personal income

- Consumer spending

- Core inflation

- Trade in goods advance report

- Chicago PMI

- UMich consumer sentiment index (final)

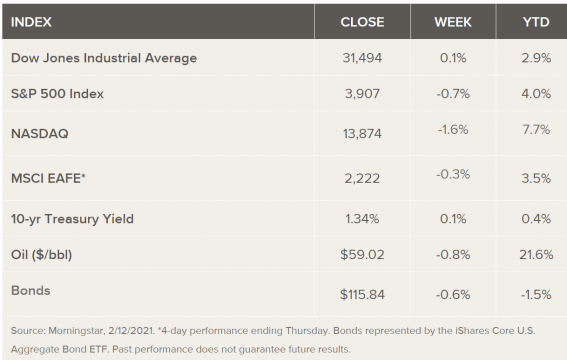

Markets Index Wrap Up