Stock Markets

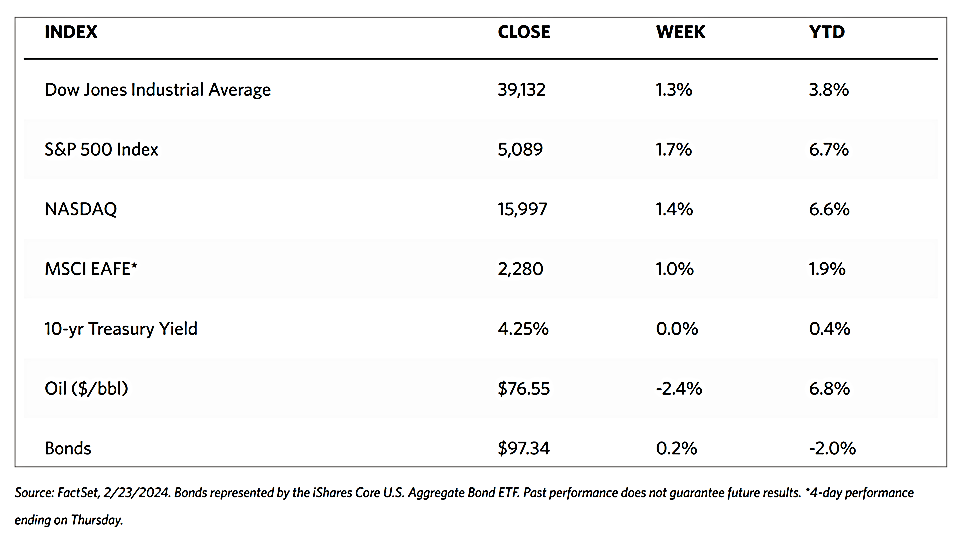

All major stock indexes rose for this shortened trading week to recover the ground lost in last week’s slump. The Dow Jones Industrial Average (DJIA) gained by 1.30%, its transportation sector overperforming with a 1.87% gain compared with the total stock market index that advanced by 1.41%. The broad-based S&P 500 Index climbed by 1.66% and the technology-heavy Nasdaq Stock Market Composite realized a gain of 1.40%, suggesting strong buying across the board. The NYSE Composite went up by 1.19%. The CBOE Volatility Index (Vix) retracted by 3.44%, indicating a lower risk perception by investors.

Both the S&P 500 and the Nasdaq Composite Index hit new intraday highs during the week, with the latter posting its biggest daily gain in its year-to-date performance on Thursday. On that day, NVIDIA’s market capitalization added a record $277 billion. The chipmaker exceeded Wall Street estimates when it reported strong quarterly revenue and earnings the day after the runup. The company added to its full-year guidance on robust demand for its chips which are a main component in artificial intelligence applications. The stock rally sparked by NVIDIA’s strong earnings also appeared to be supportive of high-yield bonds, since a lack of sellers in the high yield bond market manifested a solid demand for new issues in the fixed-income markets.

U.S. Economy

Economic releases were light during the week, with most data aligning with expectations. The exceptions were the initial and continuing jobless claims, which both came in below consensus estimates and suggested that the labor market remained tight. In the week ended February 17, 201,000 new claims were filed on a seasonally adjusted basis indicating a decline of 12,000 against that of the preceding week. The number of continuing claims declined by 27,000 to 1.862 million. Also, this week, S&P Global released early estimates of its purchasing managers indexes (PMIs) for manufacturing and services. Business activity in the services sector slightly cooled with its PMI pulling back to 51.3 from 52.5 in January. On the other hand, manufacturing activity rose unexpectedly to 51.5, its highest level in 17 months, which was in part attributable to an increase in export orders. Both gauges remained above 50, the line dividing contraction from expansion with readings north of 50 indicating positive growth. Overall, the economic improvement, though falling short of heating up, does not call for the reversal of interest rates because of the higher-than-expected January inflation reading, coupled with the tight jobs market and the strength of the economy in the fourth quarter.

Metals and Mining

While gold prices continue to hold above the $2,000-per-ounce support level, the price action does not seem to inspire bullish momentum from investors. The tech sector continues to draw investor confidence away from gold, due to advances in Artificial Intelligence. The significant profits reported by AI chipmaker NVIDIA for the fourth quarter of 2023 drew investor interest this week. A report of $22.10 billion in revenues represented a year-on-year rise of 265%, surging net income by 769%. The numbers are drawing market interest away from gold and towards equities due to investors’ fear of missing out.

The spot market for precious metals ended the week mixed. Gold closed this week at $2,035.40 per troy ounce, higher by 1.08% from last week’s close at $2,013.59. Silver ended this week at $22.95 per troy ounce, lower by 2.01% from last week’s ending price of $23.42. Platinum closed this week at $901.91 per troy ounce, a loss of 0.85% from last week’s close at $909.63. Palladium ended this week at $976.13 per troy ounce, 2.60% higher than its previous week’s close at $951.37. The three-month LME prices for base metals were also mixed. Copper gained 3.05% from its previous close at $8,314.00 to its recent weekly close at $8,567.50 per metric ton. Aluminum, which closed last week at $2,224.50, lost 2.00% of this value to end this week at $2,180.00 per metric ton. Zinc gained 2.14% from its close last week at $2,354.50 to end this week at $2,405.00 per metric ton. Tin, which came from $27,293.00 last week, closed this week at $26,382.00 per metric ton for a decline of 3.34%.

Energy and Oil

There has been remarkable volatility in oil trading over the past weeks. Lately, Brent futures moved within a narrow bandwidth between $81 and $84 per barrel. The minor day-on-day moves in crude appear to be dominated by macro factors, responding to warnings by two Federal Reserve governors against interest rate cuts in the next two months. As a result, oil prices are bound to decline slightly towards the end of the week, as Brent is set to close the week at approximately $82 per barrel. In the global sphere, Iraq restarted the 310,000 barrel per day (b/d) Baiji refiner shut down in 2014, and Baghdad expects the plant to be running at 150,000 b/d soon. Furthermore, Venezuela makes its first-ever purchase of Russian crude oil in a sign of the country preparing for a potential snapback of U.S. sanctions in April.

Natural Gas

For the report week from Wednesday, February 14 to Wednesday, February 21, 2024, the Henry Hub spot price rose by $0.09 from $1.51 per million British thermal units (MMBtu) when the week began to $1.60/MMBtu at the end of the week. Regarding Henry Hub futures, the price of the March 2024 NYMEX contract increased by $0.164, from $1.609/MMBtu when the week began to $1.773/MMBtu when the week ended. The price of the 12-month strip averaging March 2024 through February 2025 futures contracts ascended by $0.191 to $2.608/MMBtu.

International natural gas futures prices descended for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.77 to a weekly average of $8.65/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, fell by $0.51 to a weekly average of $7.75/MMBtu. In the week last year corresponding to this report week (week from February 15 to February 22, 2023), the prices were $15.34/MMBtu in East Asia and $15.64/MMBtu at the TTF.

World Markets

European stocks jumped to record levels this past week. In local currency terms, the pan-European STOXX Europe 600 Index surged to end the week 1.15% higher on stellar quarterly results from NVIDIA. The chipmaker’s earnings report stoked a global rally and demand for technology stocks. Italy’s FTSE MIB gained 3.05%, France’s CAC 40 Index advanced 2.56%, and Germany’s DAX ascended 1.76%. The UK’s FTSE 100 Index was only slightly changed, reflecting a weakness in energy and mining stocks. European government bond yields climbed across the board as investors narrowed their bets on the likely number of interest rate cuts this year, in light of the stronger-than-expected purchasing managers’ surveys. Early PMI data for February indicates that the eurozone economy could be stabilizing on the back of a recovery in the services sector. The HCOB eurozone composite PMI for output was provisionally estimated to rise to 48.9 from January’s 47.9. The February figure is an eight-month high but remains in contraction territory.

Japanese equities trading ended on Thursday (the markets were closed on Friday due to the celebration of the Emperor’s Birthday). During this shortened trading week, stocks ended at a new all-time high, with the Nikkei 225 Index breaking the previous record set in December 1989, more than three decades ago. The broader TOPIX likewise ended at its highest level since February 1999, as confidence was underpinned by both a return to steady growth and corporate profitability. It was not all plain sailing, however. What was originally a four-day losing streak was snapped by a Thursday rally ahead of the Emperor’s Birthday holiday. In the fixed-income market, 10-year Japanese government bond yields ended the week at 0.711%, slightly down from the previous Friday’s yield of 0.725%. Regarding Japan’s economy, core machinery orders climbed by a seasonally adjusted 2.7% in December from a contraction of 4.9% in November. Japanese export data was likewise strong as it rose to a record high in January, with an 11.9% increase and marking a second straight month of positive growth. Later in the month, however, data from Japan’s manufacturing sector was lower than expected. The PMI for the manufacturing sector came in at 47.2, down from 48.0 in January.

Chinese stocks rose after a week when trading was suspended in observance of the Lunar New Year. Equities rallied as hopes reignited for economic recovery after a week of holiday spending. The Shanghai Composite Index surged by 4.85% while the blue-chip CSI 300 gained by 3.71%. Meanwhile, the Hong Kong benchmark Hang Seng Index climbed by 2.36%. Over the weeklong Lunar New Year holiday, tourism revenue rose by 47% over the same period in 2023 and surpassed pre-pandemic levels. Domestic trips gained by 34% over that of last year, and international trips likewise increased. Average spending per trip, however, fell by 9.5% from 2019 before the pandemic, which indicates that consumers still have lingering concerns about the robustness of the economic recovery. It should be noted that this year’s holiday lasted for eight days, one day longer than the 2019 holiday. Regarding the real property sector, new home prices in 70 cities fell by 0.3% sequentially in January. This marks the seventh monthly contraction, according to Bureau statistics.

The Week Ahead

PCE inflation data, GDP fourth quarter data, and the ISM manufacturing PMI are among the important economic data scheduled to be released in the coming week.

Key Topics to Watch\

- New home sales for January

- Durable goods orders for January

- Durable goods minus transportation for January

- S&P Case-Shiller home price index (20 cities)

- Consumer confidence for February

- GDP (first revision) for Q4

- Advanced U.S. trade balance in goods for January

- Advanced retail inventories for January

- Advanced wholesale inventories for January

- Atlanta Fed President Raphael Bostic speaks (Feb. 28)

- Initial jobless claims for Feb. 24

- Personal income (nominal) for January

- Personal spending (nominal) for January

- PCE index

- Core PCE index

- PCE (year-over-year)

- Core PCE (year-over-year)

- Chicago Business Barometer (PMI) for February

- Pending home sales for January

- Atlanta Fed President Raphael Bostic speaks (Feb. 29)

- Chicago Fed President Austan Goolsbee speaks

- Cleveland Fed President Loretta Mester speaks

- Kansas City Fed President Jeff Schmid speaks

- S&P U.S. manufacturing PMI (final) for February

- ISM manufacturing for February

- Construction spending for January

- Consumer sentiment (final) for February

- Dallas Fed President Lorie Logan speaks

- Fed Governor Chris Waller speaks

- Atlanta Fed President Raphael Bostic speaks (Mar. 1)

- San Francisco Fed President Mary Daly speaks

Markets Index Wrap-Up