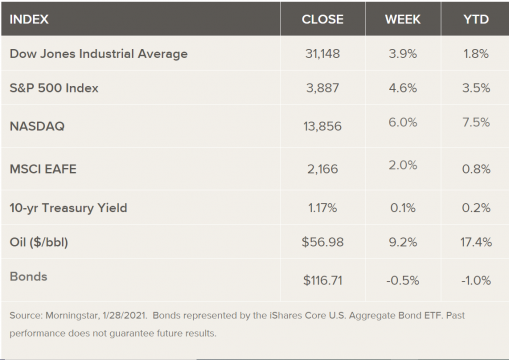

Stock Markets

Major indexes closed at new record highs as U.S. stocks registered their best weekly gain since November. Optimistic outlook for a fiscal stimulus bill and the progress in vaccine distribution continue to provide impetus for the bourse. Crude oil traded at 10% gains for the week, its highest level in more than a year. The week’s activity was dominated by the GameStop play which initially sparked a pullback, and thereafter a strong rally to breakout levels. Speculative volatility, as observed last week, does not show signs of a broader market bubble. The underlying fundamental strength of the economy remains intact as evident in the economic and earnings growth reports. Investors are urged to avoid the risk of being enticed to bet on the fast-moving counters with little fundamentals at the risk of being caught holding the bag in a whipsaw. Instead, they should balance out their portfolio to reduce the distorted view of risk in a fast-moving market. Choose stock for value and not for play.

U.S. Economy

The January jobs report fell below expectations, registering only 49,000 new jobs out of an anticipated 100,000. The outlook for the rest of the year might be brighter, however, with the prospects of an opening economy as a result of the wider vaccine distribution. Also, the initial jobless claims, which is viewed as a more reliable labor market trend metric, fell for the third straight week.

- Additional fiscal stimulus from Washington and monetary stimulus from the Feds, supportive central bank policies, and the vaccine roll-out may further increase economic spending and, therefore, economic recovery. Over time, it is fundamentals that set the trend and pace, and it appears that momentum may build towards the year’s end. The housing market and manufacturing are particularly strong,

- The release of the January employment report showed that the economy gained 49,000 new jobs and unemployment dropped from 6.7% to 6.3%. The improved employment situation is expected to impact household spending that comprises 70% of U.S. GDP. Further improvement in the labor market was partly stalled by renewed lockdowns as monthly job gains averaged only 29,000 for the last three months. This pales in comparison to the average monthly gains from July through October which registered 1.18 million. The second half of the year may see an escalation in jobs growth due to the vaccine rollout and a more open economy.

- Expectations of a 20% hike in corporate profits for 2021 are foreseen to contribute to the positive fundamentals outlook. Earnings rose by 15% or more in only 12 years since 1980, averaging a return of 12%.

Metals and Mining

Gold and silver ended the week at a loss; silver dropped 13.9% from its high of $30.03 on February 1. Silver’s rise was attributed to the WallStreetBets play, with retail investor sentiment dampening after the opening bell. The following day saw silver back to the previous $26 range. Gold felt the downward pressure exerted by a stronger US dollar and rising Treasury yields. The yellow metal traded below the $1,800 per ounce support level set in late November. The first week of February proved to be volatile for gold, dipping as low as $1,784 as safe-haven demand slackened. Despite the possibility of a correction from oversold levels, gold will continue to remain bearish due to the improving currency situation. Gold was priced at $1,808.73 at 11:25 a.m. EST, while silver was trading at $26.42 an ounce.

Platinum rose to $1,125 per ounce, a four-year high, days after the Anglo-American Platinum (Amplats) announced a fourth-quarter production decrease of 49%. The dip in production was caused by the closure of AMPLATS’ convertor plant coupled with COVID-19 fears. The announcement likewise benefitted palladium which remained on an uptrend during the five-day trading week, chalking a 3.7% increase from its Monday open at $2.189 per ounce. Palladium was valued at $2,264,50 per ounce at 11.27 a.m. Friday, while platinum was $1.118.

Base metal prices remained soft for most of the week, moving sideways-to-lower in a consolidation. The absence of a downward momentum suggests that the market merely lacks buying incentive as investors seek to avoid increased exposure. Copper commenced the week’s trading at $7,827 a tonne, and slid lower to $7,800 by Tuesday. It recovered to trade at $7,864 by Friday. Increased demand from China as economies recover post-COVID vaccine deployment is seen to keep copper demand up. Other metals continued to move sideways, with Zinc priced at $2,600, nickel at $17,915, and lead at $2,010 per tonne in Friday’s trading.

Energy and Oil

For the first time in 2021, Brent is closing in on $60 per barrel as crude inventories in both the U.S. and China fell for the week, signaling tightening market supply. Oil price is seen to continue its surge on the back of unchanged OPEC+ shipments in the face of narrowing world supply. As prices continue to rise, however, division may increase between OPEC+ members. In the meantime, legal challenges by the PennEast Pipeline Col. LLC will be taken up by the Supreme Court to condemn private land through eminent domain, to build a project that could carry shale gas to east coast refineries. The result of the case could have broad repercussions for energy companies’ use of eminent domain.

The Biden administration announced that it would restart the issuance of permits for the first major U.S. offshore wind farm, a project mothballed in the preceding administration. Jennifer Granholm, the nominee to lead the Department of Energy, has cleared the committee vote and heads towards confirmation. She expressed support for U.S. liquid national gas exports coupled with efforts to combat climate change. Meanwhile, the Global Energy Monitor issued a new report that approximately 212,000 kilometers of pipeline, roughly equivalent to the entire length of the U.S. highway system, is under construction or at the drawing board stage. As the country’s energy transition picks up momentum, this could result in $1 trillion worth of pipeline projects getting shelved.

Natural Gas

At most locations, natural gas spot prices increased for the week ending February 3. The Henry Hub spot price rose from $2,71 per million British thermal units (MMBtu) at the start of the week to $2.91 by week’s end. The February 2021 contract at the New York Mercantile Exchange (Nymex) expired on February 3 at $2.760/MMBtu, while the March 2021 contract price rose by $0.09 to $2.789/MMBtu. For the week ending January 29, the net withdrawal from working gas totaled 192 billion cubic feet (Bcf). This is higher than the year-ago level by 2% and higher by 8% than the five-year average for the week.

For the week ending February 3, the natural gas plant liquids composite price at Mont Belvieu, Texas increased by $0.38/MMBtu. The price averaged $7.51/MMBtu over the week, with prices rising by 3% for natural gasoline and propane, 5% for butane, 8% for isobutane, and 11% for ethane. Baker Hughes reported that the natural gas rig count remained flat at 88 for the week ending January 26. The number of oil-directed rigs increased by 6 to 295, bringing the total rig count to 384, an increase of 6.

World Markets

Hopes of a U.S. fiscal stimulus and accelerated economic recovery due to improved coronavirus vaccination distribution spurred European bourses upward. The pan-European STOXX Europe 600 Index closed the week 3.46% higher. Italy’s FTSE MIB Index rallied 7% in response to the fresh mandate given to Mario Draghi, former European Central Bank president, to form a new government. Germany’s Xetra DAX Index and France’s CAC 40 also posted solid gains but not as high as Italy’s. UK’s FTSE 100 Index likewise rose by 1.28% despite disappointing earnings reports and a strengthening currency. The UK pound surged after traders abandoned hope for a possible interest rate cut, and data underscored the rapid rollout of the country’s coronavirus vaccination program.

Demand for core bonds slackened due to expectations of improved economic growth, driving yields higher. The release of better-than-expected eurozone GDP data pushed expectations of a long-term inflation increase, further adding to the increase in yields. Peripheral bond yields fell across the markets, however. Gilt yields kept pace with core markets as the Bank of England kept monetary policy steady and announced that at least six weeks are needed for lenders to prepare for negative interest rates, stifling investors’ bets for an interest rate cut for the rest of the year.

In Asia, Japan’s stock markets rose for the week, with the Nikkei 225 Stock Average advancing by 1,116 points (4%) to close the week at 28,779.19. This brings the bourse to 4.9% ahead of its year-to-date figure. The strong weekly gains covered the broader equity market benchmarks, the large-cap TOPIX Index and the TOPIX Small Index. The yen closed slightly down at a shade above JPY 105 against the U.S. dollar. China’s stocks also rose over the week, with the large-cap CSI 300 Index advancing 2.5% to outperform the Shanghai Composite Index. Behind the improved sentiment is the agreement reached by Alibaba Group with regulators over the restructuring of Ant Group, its fintech affiliate. An impending IPO offering of Ant Group, amounting to $34.44 billion, was canceled in November.

The Week Ahead

Economic data expected to be published this week include the small-business optimism report on Tuesday, the inflation report on Wednesday, and the consumer confidence report on Friday.

Key Topics to Watch

- NFIB small-business index

- Job openings

- Consumer price index

- Core CPI

- Wholesale inventories

- Federal budget

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Consumer sentiment index (preliminary)

Markets Index Wrap Up