Stock Markets

The major stock indexes generally ended on a strong note on the back of a Santa Claus rally, suggesting that the gains for the week are technical year-end seasonal moves. The broad S&P 500 Index ended on a record high although the technology-based Nasdaq Composite moved sideways and closed the week flat. Trading activity was light as many investors remained sidelined, with S&P 500 volumes remaining at less than half their recent averages. The sectors that outperformed were the materials, utilities, and real estate sectors within the S&P 500. Those that underperformed were the larger information technology and communication services sectors, which when combined accounted for more than one-third of the S&P 500 Index. Investors appeared to shrug off the rising number of coronavirus cases, indicating that fears of a resurgence is waning. Hospitalization rates remained stable and the Centers for Disease Control and Prevention (CDC) on Wednesday shortened the recommended quarantine period for asymptomatic individuals who have tested positive for the virus, from ten days to only five days. However, flight cancellations and declines in airline stocks led to the cancellation of several flights.

U.S. Economy

In the face of the threat of the omicron virus, consumers proved resilient and economic activity appeared only moderately affected. Weekly jobless claims were reduced close to their fifty-year low while continuing claims drew back more than was expected, touching the lowest level since the pandemic began. Also showing accelerated growth was an index of manufacturing activity in the Mid-Atlantic region. Pending home sales, however, bucked the trend and ended on the downside, apparently due to high prices and limited inventory disincentivizing buyers.

It appears, though, that customers were motivated to spend on goods, if not on housing and durables. MasterCard’s compiled data indicated that holiday sales increased by 8.5% in December as compared to year-ago figures, recording the most impressive gains in the last 17 years. Sales exceeded pre-pandemic 2019 levels by as much as 10.7%. These data are indicative of easing supply and labor shortages for retailers and enabling them to pass the higher costs to customers. While retail stocks did well as a result of the indicators, the consumer discretionary sector was weighed down as a whole by declines in Amazon.com and casino and cruise ship operators. The latter was a result of a Thursday CDC advisory against cruise ship travel, even for those who are fully vaccinated.

Concerning U.S. Treasury yields, technical factors caused a modest rise in rates, characterized by light trading volumes during a week of few economic data released during the week. The 10-year U.S. Treasury note yield rose to 1.55% on Wednesday, an intramonth high. It retreated to approximately 1.50% by Friday morning, consistent with the trend for rates to generally correct from their increases earlier in the week.

Looking back at the year, there is reason to expect a continuation of the overall robust performance going into the new year. On many fronts, 2021 showed above-average performance for the economy. Stock market returns, economic growth, policy stimulus, and inflation performed strongly even as volatility remained well under control. The coming year will see a moderation in economic growth and market performance, however, as Federal Reserve policy settings and economic trends assume greater consistency with mid-cycle conditions. All-in-all, the gains over the past year still suggest that the coming year will be optimistic.

Metals and Mining

As of December 31, 2021, gold prices suffered their deepest annual drop in the last six years. In the face of a strengthening dollar, the investors are anticipating a year of tightening money supply in the face of the resurgent omicron coronavirus variant. Indicators point to an acceleration of the adoption of more restrictive measures by central banks. This is necessary to mop up the massive liquidity released during the pandemic to jump-start the economy. As the recovering economy whetted investors’ appetites towards riskier assets and curbed interest rates for safe-haven assets such as bullion, gold prices have eased around 4% in 2021. While bullion is regarded as a hedge against inflation that typically follows the release of stimulus money, rising interest rates will amount to growing opportunity costs of investing in gold, since precious metals bear no interest income.

Over the past week, the spot price of gold moved up 1.5%, from $1,810.26 per troy ounce to $1,829.20. Silver also rose, ending the week at $23.31 per troy ounce from the previous close at $22.87 for an increase of 1.92%. Not all precious metals fared well during the week, however. Platinum lost 1.26% when it closed at $968.75 per troy ounce from a previous $981.10. Palladium fell 2.23% from $1,948/32 to $1.904.84 per troy ounce.

Base metals also went sideways in directionless trading. The power shortage in China and Europe impacted aluminum prices, driving them up 40% for a second consecutive year of gains. For the coming year, base metals are expected to outperform based on demand-driven by energy transition in a supply-chain-bottleneck situation. Copper was up by 21% across 2021. It is expected to expand further in the coming year as a result of governments’ willingness to prioritize clean energy. For the week, copper gained 1.13% and zinc rose 0.20%, while aluminum and tin each lost ground by 1.35% and 0.10% respectively.

Energy and Oil

As the impact of the omicron variant continues to influence the global oil demand, the oil markets are positioned to see a strong end to 2021. Supply disruptions across several continents pushed oil prices to higher levels. Libya continues to withhold 300,000 barrels per day (b/d) from the market due to the resumption of political infighting. Ecuador is still in the process of repairing its pipeline system damaged in the floods. Nigeria is also dealing with unavoidable problems at the Forcados Terminal. These developments combined with news that U.S. crude inventories are facing another week-on-week decline, brought the WTI to $76.5 per barrel and the Brent complex rose to $79.5 per barrel.

Natural Gas

A severe power crunch swept across Europe to India and China in the past year due to record coal and natural gas prices. At the same time, Asian liquefied natural gas (LNG) rose more than 200% and the region’s benchmark coal prices grew 100%. Researchers determined that global LNG increased by 20 million tonnes per year in 2021, driven almost entirely by Asian demand. Chinese growth in LNG demand surged to 20%, making China overtake Japan as the world’s top LNG importer. This appears to be unsustainable, however, as constantly high LNG spot prices will possibly tend to dampen overall growth in demand, particularly in South and Southeast Asia as they are more price-sensitive markets.

World Markets

In Europe, share prices rose on thin-volume trading as worries about the impact of the omicron variant abated and investor optimism regarding the continued economic recovery solidified. In terms of the local currency, the pan-European STOXX Europe 600 Index closed the week with a gain of 1.09% for an annual surge of 22.0%. The major indexes also rose as the UK, France, and Italy ended near their highest levels for the year. Germany’s Xetra DAX Index climbed by 0.82% week-on-week, France’s CAC 40 rose 0,94%, and Italy’s FTSE MIB gained 1.22%. UK’s FTSE 100 Index moved sideways with hardly any change. The surge in coronavirus cases across most of Europe approached record levels. Tighter measures were reinstated in France, the U.K., Italy, Portugal, Denmark, and Greece, to head off an anticipated increase in the spread of the virus during the New Year festivities. The omicron is now the dominant strain in Portugal, for which reason work from home will become mandatory in that country come January. In France, the work from home mandate will cover three days a week, while in the U.K. any further mandates have been held off pending an assessment of the impact on that country’s hospital care capacity before additional measures are adopted.

Japan’s stock markets were quiet over the holiday-shortened trading week, with the Nikkei 225 Index gaining a slim 0.03% and the broader TOPIX rising by 0.28%. As with the other markets, the spread of the omicron coronavirus variant through community transmission posed a disincentive to establishing a stronger presence in the market. Despite the suspension of the entry of foreigners into the country, the continued spread of the virus does not appear to be contained. Comparatively, the total number of cases does remain small when set against the fifth wave that caused the government to declare states of emergency in different territories in the country. The yield on the 10-year Japanese government bond rose to 0.07% from 0.06% during the week before. In the currencies market, the yen fell against the dollar to around JPY 115.1 from the earlier weeks’ JPY 114.4.

In China, 2021 was a year of volatility although the week ended with modest losses for the bourses. The large-cap CSI 300 Index slid 0.2% while the Shanghai Composite Index declined 0.1%. Investor sentiment was boosted somewhat by the positive manufacturing data and encouraging comments by Chinese officials regarding the country’s struggling property sector. On an annual basis, the CSI 300 Index lost by 5.2%, its worst performance over the last three years. The Shanghai Composite Index gained 4.8%, while in Hong Kong, the benchmark Hang Seng Index fell by 14%, its worst showing in ten years. The Hang Seng China Enterprise Index plunged 23% over the last year. The yield on the 10-year Chinese government bond dipped to 2.793% from the earlier week’s 2.846% and a deep descent from the 3.19% yield at the end of 2020. However, the yuan strengthened against the dollar to 6.3672 from the previous week’s 6.3709. The Chinese currency chalked up an impressive performance as the best in the region for the year, with a gain of 2% compared to the other Asian currencies which recorded losses.

The Week Ahead

Among the important data to be released in the coming week are the Consumer Credit, Unemployment rate, and Job openings reports

Key Topics to Watch

- Markit manufacturing PMI (final)

- Construction spending

- ISM manufacturing index

- Job openings

- Job quits

- ADP employment report

- Markit services PMI

- FOMC minutes

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Trade deficit

- ISM services index

- Factory orders

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Consumer credit

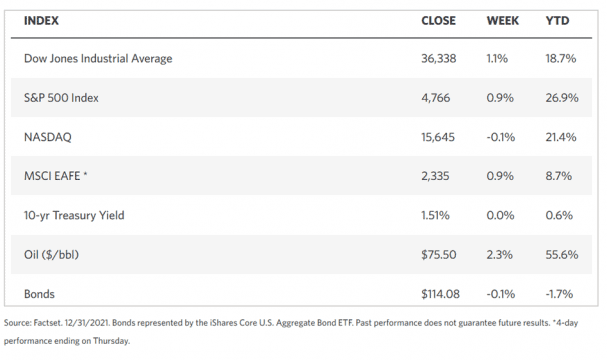

Markets Index Wrap Up