Stock Markets

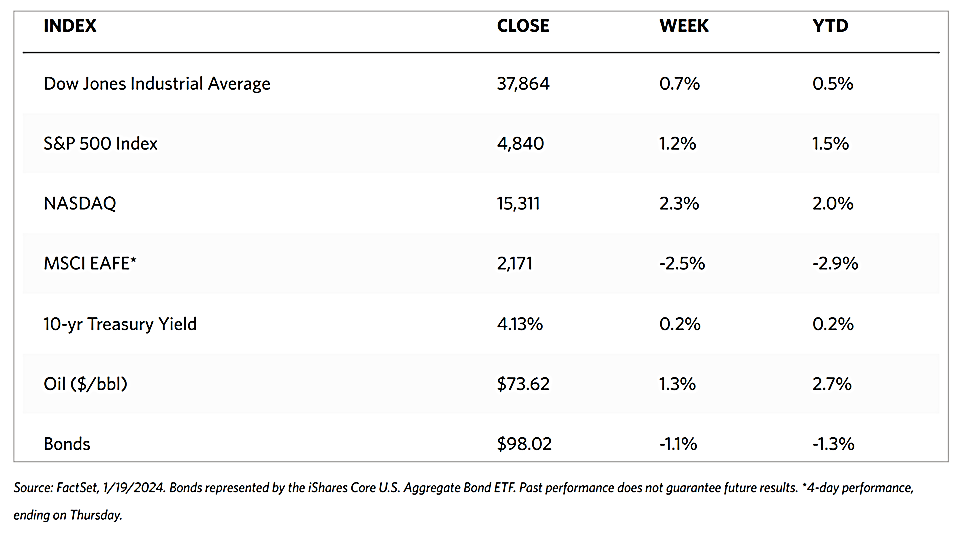

Thus far, despite a strong and optimistic start, markets in this new year have been subdued. Not surprisingly, this may be a technical consolidation after the very strong rally that took place in the final weeks of 2023. According to the Wall Street Journal (WSJ) Markets report, the Dow Jones Industrial Average (DJIA) gained by 0.72% while the Dow Jones Total Stock Market Index rose by 1.03%. The broad S&P 500 Index advanced by 1.17% and the technology-heavy Nasdaq Stock Market Composite surged ahead by 2.26%. The NYSE Composite went against the grain and instead declined by 0.42%. The CBOE Volatility (VIX) Index, which tracks investor risk perception, rose by 4.72%.

Beneath the surface, some segments of the market, including the broader equal-weight S&P 500, small-cap stocks, and investment-grade bonds, appear to have come under some pressure in the first few weeks of 2024. Some sectors continue to remain more resilient such as technology and communication services, however, some defensive sectors, such as health care and consumer staples, continue to outperform. For the holiday-shortened week just ended (markets were closed on Monday in commemoration of Martin Luther King, Jr. Day), information technology stocks outperformed due to a rally in semiconductor shares. Particularly strong was artificial intelligence (AI) chip maker NVIDIA and its rival, Advanced Micro Devices (AMD). The fourth-quarter earnings reporting season is just beginning, with results from only 23 companies in the S&P 500 expected to be released in the coming week. Last Tuesday, shares of DJIA component Boeing plunged sharply following an analyst downgrade warning of possible delivery delays should regulators uncover more safety issues related to the company’s 737 MAX airliners. However, the stock recovered most of its decline towards the end of the week.

U.S. Economy

Investors demonstrated some uncertainty about the economy’s health when an index of manufacturing activity in the New York region took a dive and surprised on the downside, although these concerns later abated in the week. On the other hand, the retail sales numbers for December that were released on Wednesday exceeded expectations and suggested that consumption in the economy remained on solid footing, Retail sales climbed by 0.6% in October with online sales expanding by 1.5% to hit a new record peak. On Friday, a preliminary report issued by the University of Michigan showed a jump in its January index of consumer sentiment to reach its highest level in almost three years and by the most since 2005. This index also rose over the past two months by the greatest margin since 1991, suggesting that consumers believe that the uptrend in inflation has truly reversed.

Metals and Mining

The uncertainty in the direction the Federal Reserve will take regarding rate hikes (or cuts) will continue to dominate the financial markets and gold, in particular. Investors’ expectations of a potential rate cut have been sharply pared back by healthy economic data released this week, The data showed that holiday spending during December was highly robust, signaling that consumers continue to remain resilient to persistent inflation as well as the aggressive tightening policy of the Federal Reserve. This trend could continue, based on the results of the preliminary consumer sentiment survey by the University of Michigan showing that consumer sentiment rose to its highest level since July 2021. Simultaneously, one-year consumer inflation expectations have returned to pre-pandemic levels. These conditions do not suggest a bull market for gold anytime soon since investors expect that soft economic growth may force the Fed to cut interest rates despite inflation remaining above the 2% target.

Over the week, the spot price of precious metals modestly descended. Gold, priced at $2,049.06 at the end of the week prior, closed at $2,029.49 per troy ounce this week for a decline of 0.96%. Silver, which closed at $23.19 last week, ended this week at $22.62 per troy ounce, dipping by 2.46%. Platinum, the former weekly of which was at $911.64, closed this week at $903.27 per troy ounce for a drop of 0.92%. Palladium, which closed at $977.83 one week ago, ended at $950.61 per troy ounce this week for a loss of 2.78%. The three-month LME prices for industrial metals ended the week mixed. Copper came from its closing price one week ago of $8,339.00 to close this week at $8,351.00 per metric ton for a modest gain of 0.14%. Zinc, which closed one week ago at $2,514.00, ended this week at $2,462.00 per metric ton for a slide of 2.07%. Aluminum closed last week at $2,219.50 and this week at $2,166.00 per metric ton to lock in a loss of 2.41%. Tin, which closed one week ago at $24,631.00, closed this week at $25,298.00 per metric ton, gaining 2.71%.

Energy and Oil

The conflict in the Middle East which began with the Hamas invasion of Israel has escalated, with Pakistan and Iran now exchanging missile attacks and further intensifying the geopolitical risk in the region. In addition, the cold snap in the U.S. has shut in a significant portion of Bakken output in what became the first U.S. supply disruption in many months. Exacerbating the effect of these supply concerns, an improvement in the demand sentiment is further contributing to the upward pressure on oil prices. The International Energy Agency (IEA) has adjusted its 2024 demand figure upward for the third time in a row to 1.24 million barrels per day (b/d). As a consequence, Brent has approached within range of the $80 per barrel mark before falling slightly back toward the $79 level. In the meantime, OPEC published its first monthly market report for the year. In the report, the group divulged its expectation that global oil demand growth would slow down to 1.85 million b/d but left its 2024 demand increase unchanged at 2.25 million b/d.

Natural Gas

For the report week from Wednesday, January 10, to Wednesday, January 17, 2024, the Henry Hub spot price fell by $0.36 from $3.23 per million British thermal units (MMBtu) to $2.87/MMBtu. The Henry Hub price reached a high of $13.08/MMBtu on Friday, the highest daily closing price since February 2021, indicating a run-up in prices observed across the country for that day. For the Henry Hub futures, the price of the February 2024 NYMEX contract decreased by $0.169, from $3.039/MMBtu at the start of the report week to $2.870/MMBtu at the week’s end. The price of the 12-month strip averaging February 2024 through January 2025 futures contracts declined by $0.048 to $2.960/MMBtu.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.93 to a weekly average of $10.51/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.72 to a weekly average of $9.62/MMBtu, the first time averaging below $10.00/MMBtu since mid-summer. By comparison, in the week last year that corresponds to this report week (the week from January 11 to January 18, 2023), the prices were $24.85/MMBtu in East Asia and $20.10/MMBtu at the TTF.

World Markets

In Europe, stocks headed lower for the week. The pan-European STOXX Europe 600 Index ended the week 1.58% lower due primarily to comments from central bank policymakers that caused markets to scale back expectations that interest rates will soon be reduced. The major stock indexes in the region ended mostly softer. Italy’s FTSE MIB slid lower by 0.61%, Germany’s DAX descended by 0.89%, and France’s CAC 40 Index dropped by 1.25%. The UK’s FTSE 100 Index declined by 2.14%. Also ending the week down were European government bonds (when bond yields rise, prices of existing bonds fall). The yield on Germany’s two-year sovereign note rose to more than 2.7%, while the yield on Italy’s two-year note climbed to 3.2%. In the U.K., the yield on the two-year gilt increased to 4.2% after data indicated that inflation had risen, dampening hopes that interest rates would soon be reduced.

Japan’s stock markets rose over the week as the yen’s weakness drove stronger performance among exporters. The Nikkei 225 Index gained by 1.1% to reach a 34-year high while the broader TOPIX Index inched up by 0.6%. Other signs that inflationary pressure was easing further dampened expectations among investors regarding any shift in the monetary stance of the Bank of Japan (BoJ) at its meeting scheduled for January 22-23. The possibility that Japan’s central bank may exit its negative rates policy soon has already been reduced due to the economic impact of the deadly Noto Peninsula earthquake on New Year’s Day. In reaction to the dissipation of hopes of an imminent interest rate hike in Japan, the yen weakened to about JPY 148 against the U.S. dollar from its high-144 range in the prior week. In a further reaction to the more hawkish tone adopted by the U.S. Federal Reserve officials, the yield on the 10-year Japanese government bond rose to 0.66% from 0.59% at the end of the previous week.

Chinese stocks fell in reaction to the latest indicators which highlighted the country’s weak economic outlook. The Shanghai Composite Index dropped by 1.72%, its eighth drop in the past nine weeks. The Shanghai Composite is popular among domestic investors and the index they refer most to in tracking the markets. The blue-chip CSI 300 lost 0.44%, its ninth-weekly drop in ten weeks. Hong Kong’s benchmark Hang Seng Index plummeted by 5.76% for the week. China’s GDP was reported to have expanded in the final quarter over last year, meeting the official annual growth target of Beijing. The economy grew by a quarterly rate of 1.0% compared to the 0.8% third-quarter growth. The quarterly growth readings provide a better picture of China’s underlying economic expansion than the year-on-year growth rates because major cities were still under pandemic lockdown in 2022, the base year. Other data have nevertheless underscored pockets of weakness in China’s economy. Retail sales grew by a lower-than-expected 7.4% in December year-on-year, down from a 10.1% increase in November. Amid higher infrastructure growth, fixed-asset investment expanded by an above-forecast 3.0% for the full year, although there was a deeper decline in real estate investment. Industrial production rose more than expected in December from one year ago; however, urban unemployment rose to 5.1% from 5.0% in November.

The Week Ahead

Among the important economic data scheduled to be released this week are the fourth-quarter gross domestic product (GDP) results and personal consumption expenditure (PCE) inflation.

Key Topics to Watch

- U.S. leading economic indicators for December

- S&P flash U.S. services PMI for January

- S&P flash U.S. services manufacturing PMI for January

- Fourth-quarter GDP (prelim)

- Initial jobless claims for January 20

- Durable goods orders for December

- Durable goods minus transportation for December

- Advanced U.S. trade balance in goods for December

- Advanced retail inventories for December

- Advanced wholesale inventories for December

- New home sales for December

- Personal income for December

- Personal spending for December

- PCE Index for December

- Core PCE Index for December

- PCE (year-over-year)

- Core PCE (year-over-year)

- Pending home sales

Markets Index Wrap-Up