Stock Markets

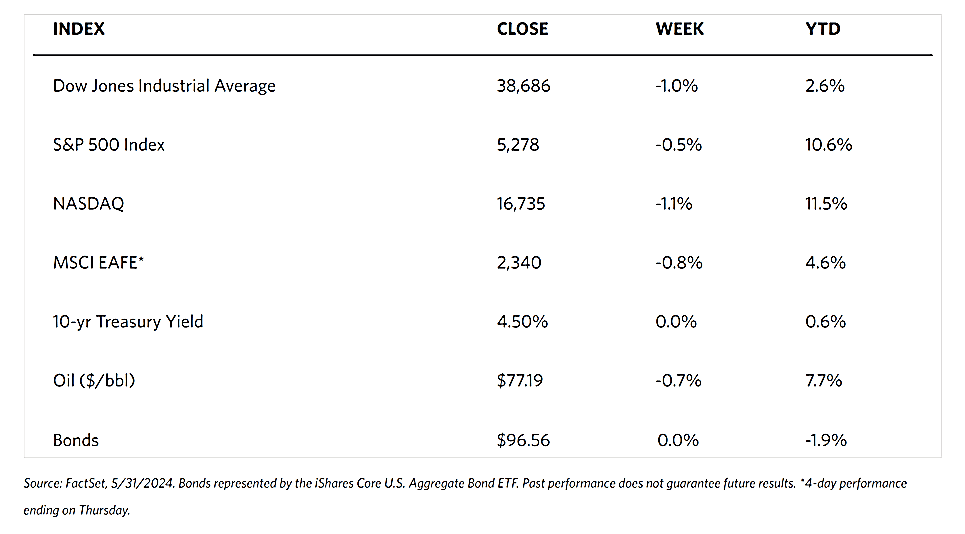

The major stock indexes lost ground over the shortened trading week. On Monday, markets were closed in commemoration of Memorial Day, and trading was resumed on Tuesday. The 30-stock Dow Jones Industrial Average (DJIA) withdrew by a modest 0.98% while the Total Stock Market Index fell by 0.58%. Mirroring the Total Stock Market, the broad S&P 500 Index slid by 0.51%, but the technology-heavy Nasdaq Stock Market Composite fell by twice as much, giving up 1.10%. the NYSE Composite slid marginally by 0.15%. The CBOE Volatility Index (VIX), an indicator of investor risk perception, rose by 8.30% for the week.

The last week’s underperformance nevertheless rounded out a month of gains. The Nasdaq Composite was particularly weak in last week’s trading, in part due to a sharp decline in cloud software provider Salesforce. The counter plummeted sharply after the release of its first-quarter revenues that missed consensus estimates. The week’s light economic calendar contributed to the difficulty in detecting the catalysts for the week’s moves. Economic releases were generally aligned with expectations, particularly the Commerce Department’s personal consumption expenditure (PCE) price index report which was released on Friday morning.

U.S. Economy

In the week’s economic news, Core PCE prices (excluding food and energy), which is generally considered the Federal Reserve’s preferred gauge for inflation, rose by 0.2% in April which is down slightly from the prior two months. The April reading seems to be an extension of the two months of calming inflation pressures after the 0.5% spike in January. “Supercore” inflation – PCE services excluding energy and housing – provided a more mixed picture, rising 0.3% which is slightly down from March but higher than February’s increase. The Case-Shiller index of housing prices in major U.S. cities was reported on Tuesday as having risen by 7.4% over the 12 months ended in March. This is its highest level since October 22. The impact of the continued increase in home prices and mortgage rates was seemingly reflected in a 5.7% fall in mortgage applications over the previous week, the biggest decline since February. Pending home sales in April also dropped by 7.7%, their biggest fall in more than three years and well below expectations.

Metals and Mining

The spot prices of precious metals were mixed for this week. Gold corrected by 0.28% from its close last week at $2,333.83 to end this week at $2,327.33 per troy ounce. Silver, which closed last week at $30.26, ended this week at $30.41 per troy ounce for a gain of 0.50%. Platinum gained 1.00% over its closing price last week of $1,028.15 to settle at $1,038.45 per troy ounce by this week’s end. Palladium closed this week at $916.86 per troy ounce, 5.33% lower than last week’s closing price of $968.44. The three-month LME prices of industrial metals were generally lower. Copper closed at $10,040.00 per metric ton, 2.75% lower than its closing price last week of $10,324.00. Aluminum ended this week at $2,652.50 per metric ton, 0.36% lower than $2,662.00, last week’s closing price. Zinc, which closed last week at $3,057.00, lost 2.86% to close this week at $2,969.50 per metric ton. Tin corrected by 0.56% from last week’s close of $33,229.00 to finally settle at $33,042.00 per metric ton by the end of this week.

Energy and Oil

Typically, the Memorial Day holidays are a time for travel and vacations that trigger a momentary increase in gasoline consumption. This year, however, the holidays failed to drive an increase in fuel demand, which added further downward pressure to oil prices. Looming large over the summer months are concerns over this year’s consumption patterns that overshadow higher refinery runs in the U.S. Attention is focused on OPEC+ heading into the weekend as the group meets in Vienna. At $81 per barrel, Brent futures is headed for another weekly loss, prospects that are likely to disappoint the likes of Saudi Arabia or Russia. In further developments, India’s largest private refiner Reliance entered into a one-year contract with Russia’s Rosneft to buy at least 3 million barrels of oil, with Urals prices set at a $3 per barrel discount to Dubai, to be paid in Russian roubles rather than U.S. dollars.

Natural Gas

For the report week beginning Wednesday, May 22, to Wednesday, May 29, 2024, the Henry Hub spot price fell by $0.30 from $2.51 per million British thermal units (MMBtu) to $2.21/MMBtu. Regarding the Henry Hub futures price, the June 2024 NYMEX contract expired at the end of the report week at $2.493/MMBtu, down $0.35 from the start of the week. The July 2024 NYMEX contract price decreased to $2.666/MMBtu, down $0.39 for the week, The price of the 12-month strip averaging July 2024 through June 2025 futures contracts declined by $0.24 to $3.129/MMBtu.

International natural gas futures prices increased over the report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.49 to a weekly average of $12.00/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid increased by $0,66 to a weekly average of $10.86/MMBtu. By comparison, in the week last year corresponding to this report week (May 24 to May 31, 2023), the prices were $9.31/MMBtu in East Asia and $7.98/MMBtu at the TTF.

World Markets

European stocks slid marginally lower for the week on the back of hotter-than-expected eurozone inflation which increased uncertainty about policy easing by the European Central Bank (ECB) beyond June. The pan-European STOXX Europe 600 Index closed lower by 0.46%, while major indexes also ended weaker. Italy’s FTSE MIB moved sideways and ended flat, Germany’s DAX slid by 1.05%, and France’s CAC 40 Index declined by 1.26%. The UK’s FTSE 100 Index lost by 0.51%. The market-moving news this week was headline inflation in the eurozone which rose for the first time in five months. The year-over-year increase in consumer prices ticked up to 2.6% in May from 2.4% each in March and April. The measure of core inflation (excluding energy, food, alcohol, and tobacco prices, the more volatile components) increased from 2.7% to 2,9%. Despite the uptick in the inflation rate, the European Central Bank (ECB) Economist Philip Lane signaled that borrowing costs would likely be lowered at the June 6 meeting. The unemployment rate, on the other hand, descended to a record low of 6.4% in April from 6.5% in the preceding five months. There were 100,000 fewer unemployed people from the previous month, bringing the number of jobless people to 10,998,000.

Japanese equities were mixed for the week. The Nikkei 225 Index fell by 0.4% while the broader TOPIX Index gained 1.1%. The likelihood that the Federal Reserve may cut interest rates at least once before the end of the year was increased due to a downward revision to U.S. economic growth data. This development lent some support to risk appetite among global markets, including Japanese stocks. The prospect and likely timing of further monetary policy normalization by the Bank of Japan (BoJ) remained firmly in investors’ focus. The yield on the 10-year Japanese government bond (JGB) rose from 1.00% at the end of the preceding week to 1.07% at the end of this week, amid the continued uncertainty about the duration of time until the BoJ could next raise short-term interest rates. The central bank ended its negative interest rate policy in March. Nevertheless, the country’s monetary policy remains among the world’s most accommodative. In currencies, the yen softened to about JPY 157.3 against the U.S. dollar from around JPY 157 at the end of the preceding week. The yen continued to tread around 34-year lows while investors awaited data that may suggest how much authorities spent on currency intervention from April 26 to May 29. There is speculation that authorities stepped into the foreign exchange markets on two separate occasions late in the period to support the yen.

Chinese stocks were hardly changed after the release of unexpectedly weak manufacturing data that underscored growth headwinds in the economy. The Shanghai Composite Index was broadly flat. The blue-chip CSI 300, on the other hand, dipped by 0.6%. The Hong Kong benchmark Hang Seng Index plunged by 2.84%. The official manufacturing purchasing managers’ index (PMI) fell to a below-consensus level of 49.5 in May from 50.4 in April. The below-50 May reading is the first monthly contraction since February. The PMI’s subindexes for new orders and exports likewise fell. Construction and services activity which constitute the nonmanufacturing PMI dropped from 51.2 in April to a weaker-than-expected 51.1 in May amid slower construction growth. Conversely, profits at industrial firms advanced by 4% in April from one year ago, recovering from a decline of 3.5% in March, according to the National Bureau of Statistics. Analysts attribute April’s increase to heightened overseas demand as well as a push by government for domestic companies to upgrade their aging equipment. Although some pockets of weakness remain in China’s economy, as indicated by both manufacturing and services PMI readings, most economists are optimistic that China will meet its growth target of 5% for the year.

The Week Ahead

The May nonfarm payrolls report, the national trade deficit for April, and the ISM manufacturing PMI are among the important economic releases expected this week.

Key Topics to Watch

- S&P flash U.S. manufacturing PMI for May

- Construction spending for April

- ISM manufacturing for May

- Auto sales for May

- Factory orders for April

- Job openings for April

- ADP employment for May

- ISM services for May

- U.S. productivity (final revision) for the First Quarter

- U.S. trade deficit for April

- S&P flash U.S. services PMI for May

- Initial jobless claims for June 1

- Consumer credit for May

- Wholesale inventories for April

- U.S. employment report for May

- U.S. unemployment rate for May

- U.S. hourly wages for May

- Hourly wages year over year

Markets Index Wrap-Up