Stock Markets

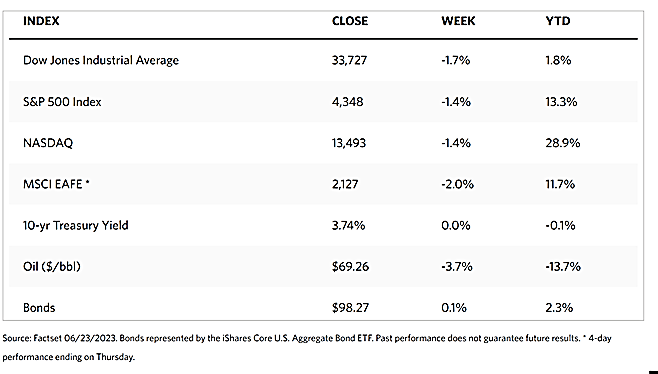

Stocks broke their two-month winning streak as the major stock benchmarks closed lower in the past week. The markets were closed on Monday in celebration of the Juneteenth Day holiday when all markets were closed. During the four days of trading conducted, the Dow Jones Industrial Average (DJIA) slipped by 1.67% and the total stock market fell by 1.62%. The broad-based S&P 500 Index lost 1.39% of its value, its first weekly loss in six weeks, while the technology-tracking Nasdaq Stock Market Composite gave up 1.44%. The NYSE Composite corrected by 2.06%. CBOE Volatility, an indicator of investor risk perception, dipped by 0.74%.

For much of the week, anticipation that the Federal Reserve may raise rates soon weighed on investor sentiment. Fed Chair Jerome Powell testified before Congress on Wednesday and Thursday that it will be appropriate to raise interest rates somewhat further before the year ends. In the Fed’s most recent Summary of Economic Predictions, the majority of the policy committee members expect at least two more quarter-point rate hikes next year. Investors’ fears also appear to have been intensified by news last Thursday of the acceleration of rate hikes by the Bank of England and Norges Bank, Norway’s central bank. In any case, analysts believe that the Fed will likely pause its interest rate hiking cycle in the second semester of 2023.

U.S. Economy

Most of the economic data that were released over the week seemed to deepen concerns that a U.S. recession was inevitable as a result of the Fed’s tight monetary policy. S&P Global reported on Friday that its gauge of U.S. manufacturing activity had fallen back to its lowest level since December and well below consensus estimates. According to the report, presumably in response to weak demand, suppliers were cutting prices at the fastest pace since May 2020, the height of the pandemic lockdown. Although the Fed chairman maintained in his Congressional testimony that the labor market remained tight, weekly jobless claims hit 264,000, matching the revised number for the previous week and still at the highest level since October 2021. There was some strength shown by the housing sector, however, as housing starts were reported at their highest level in more than a year and well-exceeding forecasts. Sales of existing homes were also surprisingly though modestly higher than expected.

Looking forward to the next half of 2023, the labor market is expected to remain resilient as it still boasts an unemployment rate of near multi-decade lows at 3.7% and a healthy wage growth of 4.3%. This supports consumer spending as people are generally more comfortable spending when they are fully employed and feel secure in their jobs. The perceived strength of the labor market is partly attributable to a pandemic distortion as many left the labor force during this period. Certain industries still struggle to find workers, particularly those in sectors that require in-person and frontline workers. There are early signs, however, that the labor market and the economy may be starting to cool. The rising jobless claims, lower quits rates, and falling job openings are some leading indicators that point to a pending softness. Furthermore, some activity indicators such as the ISM manufacturing and services indexes, and more importantly the new order components, are all descending. The manufacturing components are already in contraction, and traditional U.S. leading economic indicators have begun to decline.

Metals and Mining

Prices begin to hover near their lowest levels in March, making June an increasingly disappointing month for gold and silver prices. Central banks worldwide continue to raise interest rates, causing gold prices to further struggle. The Bank of England (BoE) surprised with a 50-basis point increase this past week. Norway’s central bank simultaneously raised interest rates by 50% while the Swiss National Bank also hiked by 25 basis points. Even Turkey raised interest rates to 15% to support its failing currency. Global bond yields are moving upward, thus creating headwinds for gold since the latter does not provide investors with a yield income. However, in an attempt to cool inflation, central banks are aggressively raising rates to slow the economy, causing investors and analysts to expect the likelihood of a hard recession to follow. Strategists believe that this real threat to the global economy will continue to support long-term gold prices.

Over the week, the spot prices of precious metals closed lower than the previous week. Gold lost 1.88% of its previous price of $1,957.99 to its recent close at $1,921.21 per troy ounce. Silver descended by 7.31% from its price one week ago of $24.20 to its recent price of $22.43 per troy ounce. Platinum ended the week 6.60% lower from its week-ago price of $986.84 to this week’s close at $921.70 per troy ounce. Palladium lost 9.06% of its value from its previous week’s price of $1,416.62 to this week’s closing price of $1,288.28. The three-month LME prices of base metals ended generally down. Copper inched higher by 0.19% from its previous price of $8,558.00 to this week’s closing price of $8,574.00 per metric ton. Zinc ended down by 0.99% from its price last week of $2,480.50 to its closing price this week of $2,456.00 per metric ton. Aluminum descended this week by 2.16% from last week’s close at $2,249.50 to this week’s close at $2,201.00 per metric ton. Tin came down by 0.54% from last week’s closing price of $27,225.00 to this week’s closing price of $27,079.00.

Energy and Oil

The impact exerted by central banks on the oil markets continued this week. The Bank of England surprised with a 0.50 percentage point interest rate hike, which happened on the same day that Norway and Switzerland took a similar move. This raised concerns that Europe faces an impending recession similar to that of the U.S. Macroeconomic headwinds have pushed Brent futures to $73 per barrel while WTI is down at $68 per barrel. In the meantime, at Cushing, the delivery point for U.S. crude oil futures, stockpiles have been climbing for eight consecutive weeks after falling earlier this year. Cushing’s inventories have now soared to a 2-year high at 42.1 million barrels, the highest since June 2021, as U.S. Midwest downstream runs were hampered by outages at BP’s Toledo refinery and Phillips 66’s Borger refinery.

Natural Gas

For the report week beginning Wednesday, June 14, and ending Wednesday, June 21, 2023, the Henry Hub spot price rose by $0.15 from $2.08 per million British thermal units (MMBtu) to $2.23/MMBtu. The price of the July 2023 NYMEX contract increased by $0.255, from $2.342/MMBtu at the beginning of the report week to $2.597/MMBtu at the end of the week. The price of the 12-month strip averaging July 2023 through June 2024 futures contracts climbed by $0.148 to $3.171/MMBtu. Natural gas prices rose at most locations for the week except for a few locations in the Northeast.

International natural gas futures prices increased for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $2.21 to a weekly average of $11.50/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, rose by $1.77 to a weekly average of $12.17/MMBtu. In the corresponding week last year (the week from June 15 to June 22, 2022), the prices were $35.76/MMBtu and $38.23/MMBtu in East Asia and at the TTF, respectively.

World Markets

Stocks in Europe generally descended this week, mainly on concerns that interest rate increases might cause a recession in Britain and the eurozone. The pan-European STOXX Europe 600 Index fell by 2.93% in local currency terms. The major stock indexes in the region struggled. Germany’s DAX plunged by 3.23%, France’s CAC 40 Index lost by 3.05%, and Italy’s FTSE MIB slid by 2.34%. The UK’s FTSE 100 Index likewise dipped by 2.37%. China’s disappointing economic recovery as well as hawkish comments by U.S. Fed Chair Jerome Powell likewise added to the sullen investor sentiment. The growing fears of a hard recession pushed European government bond yields lower. According to purchasing manager surveys, private sector business activity has significantly slowed, weighing down on 10-year German bond yields. French and Swiss yields also declined. The UK’s 10-year government bond yield weakened as the economic outlook turned south after the Bank of England accelerated the pace of interest rate increases by half a percentage point to 5.0%, its highest level since 2008.

Japan’s stock markets corrected from their 33-year highs, as the Nikkei 225 Index fell by 2.7% and the broader TOPIX Index finished 1.6% lower for the week. Profit-taking accounted for some of the declines following the markets’ strong year-to-date performance. Japan’s hot May core consumer inflation weighed on sentiment, fueling speculation that the Bank of Japan (BoJ) would revise its inflation forecasts upward for July. Although the BoJ suggested previously that a sudden change in policy might be unavoidable, recent comments by BoJ board member Seiji Adachi seemed to rule out the change that the central bank’s yield curve control policy may be modified at its meeting next month. The yield on the 10-year Japanese government bond fell to 0.36% from 0.41% at the end of the week. The BoJ continued to signal its continuing commitment to its ultra-loose monetary policy and its continued divergence from the increasingly restrictive direction taken by other major central banks. The yen weakened to about JPY 143.1 to the U.S. dollar from about JPY 141.8 the week before.

Chinese stocks pulled back after a holiday-shortened trading week due to the waning investor confidence over a lack of stimulus measures amid a struggling post-pandemic recovery. The Shanghai Stock Exchange Index fell by 2.3% and the blue-chip CSI 300 lost 2.51%. The Hong Kong benchmark Hang Seng Index descended by 5.74%, its biggest drop in three months. The financial markets in mainland China suspended trading on Thursday and Friday for the Dragon Boat Festival holiday, while the Hong Kong Exchange was closed on Thursday and reopened for trading on Friday. No major economic news was released in China over the week, although the mounting evidence of China’s slackening recovery is renewing fears about the country’s economic outlook. The lackluster indicators over recent weeks have caused economics at several key banks to reduce their 2023 growth forecasts for China in light of its slowing export demand, a yearslong housing market slump, and weak business and consumer confidence. As expected, Chinese banks have lowered their one- and five-year loan prime rates by 10 basis points for the first time since August 2022, after the People’s Bank of China (PBOC) cut its medium-term lending facility rate last week.

The Week Ahead

In the week ahead, among the important economic data scheduled for release are the Personal Consumption Expenditure (PCE) data, durable goods data, and home sales.

Key Topics to Watch

- Durable-goods orders

- Durable-goods minus transportation

- S&P Case-Shiller home price index (20 cities)

- New home sales

- Consumer confidence

- Advanced U.S. trade balance in goods

- Advanced retail inventories

- Advanced wholesale inventories

- Fed Chair Powell speaks (June 28)

- Fed Chair Powell speaks (June 29)

- Initial jobless claims

- Pending home sales

- Personal income (nominal)

- PCE index

- Core PCE index

- PCE (year-over-year)

- Core PCE (year-over-year)

- Chicago Business Barometer

- Consumer sentiment (final)

Markets Index Wrap Up