Stock Markets

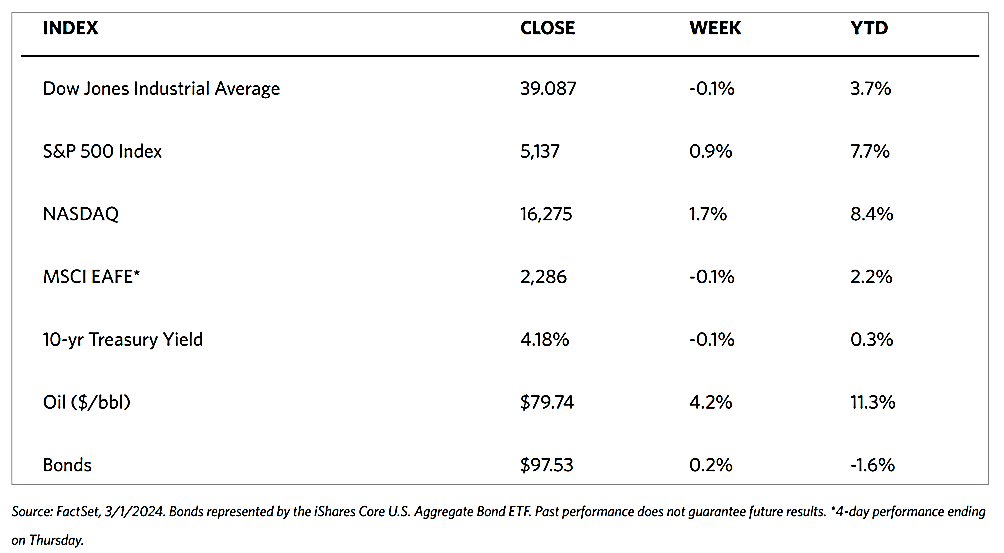

Markets were generally up this week except for the Dow Jones Industrial Average (DJIA), which closed by a modest 0.11% lower this week from last week. The Total Stock Market Index, however, ended slightly higher by 1.13%. The broad-based S&P 500 Index gained 0.95% while the Nasdaq Stock Market Composite climbed by 1.74%, reflecting the outperformance of technology-oriented stocks. The NYSE Composite ended with a 0.64% gain with all Russell Indexes ending up for the week. Investor risk perception, as measured by the CBOE Volatility Index (VIX) came down by 4.65%. The Nasdaq Composite joined the S&P 500 in record territory for the first time in over two years, underscoring the equity markets’ increasing strength. February was a particularly strong month for the S&P 500 which marked its strongest beginning two months of the year since 2019, as observed by the Wall Street Journal. In terms of market sentiment, the defining event of the week appeared to be the release by the Commerce Department on Thursday of the core (less food and energy) personal consumption expenditures (PCE) price index, an indicator of inflation.

U.S. Economy

The PCE price index rose by 2.8% for the 12 months ended in January, which aligns with expectations. The Commerce Department’s report seems to calm investors’ worries surrounding the Labor Department’s earlier pronouncement that shows that core prices rose by 3.9%, above the expected 3,7%. The core PCE price index is generally acknowledged to be the preferred gauge of the Federal Reserve regarding overall inflation pressures. In other economic news, the gauge for manufacturing activity by the Institute for Supply Management (ISM) came in significantly below expectations, Starting from an 18-month high of 49.1 in January, the metric fell back to 47.8 in February, keeping in mind that readings below 50 indicate contraction while those above 50 indicate expansion. A more reassuring picture was provided by durable goods, though, rising 0.1% in the month when the defense and aircraft sectors, both volatile components, are excluded. Personal incomes for February surprised on the upside, jumping 1.0% which is the biggest monthly gain of the year. In reaction to the PCE data and ISM report, by the end of the week, the yield on the benchmark 10-year Treasury note fell to its lowest intraday level since February 13. Recall that yields and bond prices move in opposite directions. As yields decreased U.S. Treasuries also generated positive returns amid a healthy Treasury supply concession.

Metals and Mining

This week, the gold futures market ended the week at a record high. Gold rallied by more than 2% this week, despite elevated bond yields and persistent strength in the U.S. currency, suggesting that underlying demand remains strong despite the lure of alternative investments. Some analysts express uncertainty as to whether the current rally in gold prices is sustainable. Despite growing bullish sentiment in the market, the recent rally does not appear to have solid fundamental support, therefore cautious optimism is advised. Gold has been trading within a tight range for the past few months, thus it is not surprising to see an outsized move as the market was bound to release some pressure. The market has to see some material weakness in the U.S. dollar for gold to maintain its upward momentum.

The spot prices for precious metals ended the week mixed. Gold rose by 2.33%, from last week’s closing price of $2,035.40 to this week’s closing price of $2,082.92 per troy ounce. Silver gained 0.74% from its end last week at $22.95 to this week’s end at $23.12 per troy ounce. Platinum lost 1.51% from last week’s close at $901.91 to this week’s close at $888.26 per troy ounce. Palladium descended by 1.85% from its last trade last week at $976.13 to its last trade this week at $958.04 per troy ounce. The three-month LME prices of industrial metals were also mixed. Copper descended by 0.86% from its last price one week ago at $8,567.50 to its last price this week at $8,493.50 per metric ton. On the other hand, aluminum gained 2.20% from its closing price last week at $2,180.00 to its closing price this week at $2,228.00 per metric ton. Zinc rose by 0.87% this week, from $2,405.00 to $2,426.00 per metric ton. Tin also rose, this time by 0.66% from last week’s close at $26,382.00 to this week’s close at $26,556.00.

Energy and Oil

The trading patterns for crude failed to respond to diverging macroeconomic news as China and Europe continued to struggle with below-expectations manufacturing activity and the U.S. nears the point of first interest rate cuts. Brent maintained at a level around the $83 per barrel support throughout the week. Looking forward, the next expected price-moving catalyst in the oil markets will be OPEC+ announcing whether it will revise or extend its voluntary production cuts next week (although revisions will be highly unlikely at this point). In the meantime, the market, particularly Indian importers of thermal fuel, is broadly expected to reduce their purchases of Russian coal, which is up by 20% year-on-year in 2023 at 10.06 million tons, after the US-sanctioned SUEK and Mechel, Russia’s top coal exporters.

Natural Gas

For the report week beginning Wednesday, February 21, and ending Wednesday, February 28, 2024, the Henry Hub spot price rose by $0.03 from $1.60 per million British thermal units (MMBtu) to $1.63/MMBtu. Regarding the Henry Hub futures price, the March 2024 NYMEX contract expired on Tuesday, Feb. 27, at $1.615/MMBtu, down by $0.16 from the start of the report week. The April 2024 NYMEX contract price increased to $1.885/MMBtu, up by $0.02 from the start to the end of the report week. The price of the 12-month strip averaging April 2024 through March 2025 futures contracts rose by $0.09 to $2.817/MMBtu.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia dropped by $0.39 to a weekly average of $8.26/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, descended by $0.11 to a weekly average of $7.64/MMBtu. In the week last year corresponding to this report week (beginning February 22 and ending March 1, 2023), the prices were $14.76/MMBtu in East Asia and $15.10/MMBtu at the TTF.

World Markets

The European equity markets showed an underlying resilience, maintaining near their highs for the week despite the lack of buying momentum, keeping the pan-European STOXX Europe 600 Index little changed. Investors reassessed the magnitude and timing of interest rate cuts by the European Central Bank in 2024, due to sticky inflation data. The major stock indexes were mixed in the region. Germany’s DAX climbed by 1.81% and Italy’s FTSE MIB rose by 0.71%. France’s CAC 40 Index gave back 0.41%, and the UK’s FTSE 100 lost by 0.31%. As expected, European government bond yields ended broadly higher. Inflation remains a concern as both headline and core inflation readings slowed less than expected in February. In the eurozone, annual consumer price growth decelerated modestly to 2.6% while core inflation slowed to 3.1%, which disappointed as it remained above the consensus estimate of 2.9%. For February, the European Commission’s economic sentiment indicator unexpectedly fell to 95.4. Confidence remained broadly stable in the industrial sector amid weak production expectations and a likely bottoming out of a drop in new orders. Confidence worsened in the services sector, however, due to lower demand. In both goods and services, selling price expectations eased.

Japanese equities were strong this week as the Nikkei hovered at around new highs, gaining about 2.1%, to elevate February’s gains to about 10.0%. The TOPIX likewise gained ground, ending the week higher by 1.8%. The monetary policy of the Bank of Japan (BoJ) remained highly accommodative as BoJ Governor Kazuo Ueda emphasized that it was too soon to conclude that the central bank had achieved its 2% inflation target sustainably. Ueda, stressed that prices rising in tandem with wages was a precondition for the BoJ to change its current stance. Japan’s consumer inflation, as indicated by the core consumer price index (CPI), slowed to 2.0% year-on-year in January from December’s 2.3%. Regarding the nation’s currency, while the yen remained broadly unchanged for the week at about JPY 150.5 versus the U.S. dollar, historic weakness in the yen provided an advantage for share price gains, especially for Japan’s exporters due to increased revenues derived from overseas. The yield on the 10-year Japanese government bond moved only slightly this week, settling at about 0.71%.

In China, equities rose on expectations that Beijing may attempt to stimulate growth by boosting monetary easing measures. The Shanghai Composite Index rose by 0.74% while the blue-chip CSI 300 gained by 1.38%. On the other hand, Hong Kong’s benchmark Hang Seng Index slid by 0.82%. February’s economic reports continued to portray a mixed outlook for the country/ The official manufacturing purchasing managers index (PMI) fell from January’s 49.2 rating to February’s 49,1, remaining below the 50-mark threshold delineating growth from contraction. The reduction was attributed to declines in production and exports. Seasonal factors likewise weighed in since factories were closed for the Luna New Year holiday from February 10 to February 19. The non-manufacturing PMI, on the contrary, rose to a better-than-expected 51.4 from 50.7 in January. By comparison, the private Caixin/S&P Global survey of manufacturing activity climbed up to 50.9 in February, marking its fourth month of expansion and coming in higher than expected.

The Week Ahead

The ISM services PMI, the nonfarm payrolls report, and factory orders for January are some of the important economic news scheduled to be released this week.

Key Topics to Watch

- Factory orders for January

- ISM services for February

- ADP employment for February

- Fed Chair Jerome Powell testifies to Congress (Wed., March 6)

- U.S. wholesale inventories for January

- Job openings for January

- San Francisco Fed President Mary Daly speaks

- Federal Reserve Beige Book

- Minneapolis Fed President Ned Kashkari speaks

- Initial jobless claims for March 2

- U.S. productivity (revision) for Q4

- U.S. trade balance for January

- Fed Chair Jerome Powell testifies to Congress (Thurs., March 7)

- Cleveland Fed President Loretta Mester speaks

- Consumer credit for January

- New York Fed President John Williams speaks

- U.S. nonfarm payrolls for February

- U.S. unemployment rate for February

- U.S. hourly wages for February

- Hourly wages year-over-year

Markets Index Wrap-Up