Stock Markets

This shortened trading week ahead of the Holy Week holy days, the Dow Jones Industrial Average (DJIA) ended higher by 0.07% and the DJ Total Stock Market gained by 0.32%. The broad S&P 500 Index rose by 0.24%; however, the technology-heavy Nasdaq Stock Market Composite lost by 0.14%. The NYSE Composite Index climbed by 0.54%. The indicator of investor risk perception, the CBOE Volatility Index (VIX), inched up by 0.70%, suggesting the expectation of increased volatility ahead.

As indicated by the S&P 500 Index which recorded new closing and intraday highs to end the week, the market’s advance was notably broad as most of the indexes ended the first quarter of 2024 with strong gains. The equal-weighted version of the S&P 500 Index gained 1.64% which is well ahead of the gains realized by the market-weighted version. Small-cap stocks easily outperformed large caps; the Russell 1000 Value Index surged by 1.79%, outperforming its growth counterpart which declined by 0.60%. Markets were closed on Friday in observance of the Good Friday holiday. They are scheduled to reopen on Monday ahead of other international markets. When they do reopen, analysts expect trading volumes to pick up to some degree as investors weigh the impact of the collapse of the Francis Scott Key Bridge in Baltimore and the degree to which it cut access to the nation’s largest ports. The port of Baltimore is the primary port for car and truck shipments.

U.S. Economy

The broader economic implications of the Baltimore port shutdown remain uncertain amid promises made by President Joe Biden that federal aid will soon be coming to quickly reopen the port. This week’s economic calendar saw a report released by the Commerce Department that durable goods rose by 1.4% in February which is slightly more than expected. Part of this increase, however, was due to a revision in January’s steep decline, from 6.2% to 6.9%. If volatile defense and aircraft segments were excluded (to arrive at a gauge that is considered more closely reflective of business spending plans), orders are seen to rise by a solid 0.7%, much more than anticipated and partly reversing two months of declines. In February, new home sales fell unexpectedly, although the report of the decline came in the wake of previous news of a jump in sales of existing homes.

Consumer indicators released this week were mixed, indicative of uncertainty in the direction of the economy. The Conference Board announced on Tuesday that its index of consumer confidence slightly declined in March, which defied consensus expectations for an increase. The Board’s chief researcher noted that “Consumers’ assessment of the present situation improved in March, but they also became more pessimistic about the future.” A different and more optimistic assessment by another research institute came on Thursday from the University of Michigan’s rival gauge of consumer sentiment. This metric was revised upward to its highest level in 21 months, attributable in large part to waning inflation concerns. This chief researcher noted that “Over the first three months of 2024, consumers have consistently expressed that the economy appears to be holding its course. However, with the general election looming on the horizon, many mentioned that their views remain tentative and subject to change.”

Metals and Mining

This week, the spot prices of precious metals gained over the previous week. Gold rose by 2.98%, from $2,165.44 to this week’s $2,229.87 per troy ounce. Silver appreciated by 1.18%, rising from the previous week’s close at $24.67 to this week’s close at $24.96 per troy ounce. Platinum climbed by 1.44% from its previous weekly closing price of $898.35 to this week’s closing price of $911.29 per troy ounce. Palladium added 2.90% to its previous week’s close of $987.93 to this week’s close of $1,016.55 per troy ounce. The three-month LME prices of industrial metals were mixed. Copper lost 0.93% from last week’s close at $8,950.50 to this week’s close at $8,867.00 per metric ton. Aluminum gained by 1.54% from its last weekly closing price of $2,301.50 to this week’s closing price of $2,337.00 per metric ton. Zinc fell by 3.39% from the previous week when it closed at $2,524.50 to this week’s close of $2,439.00 per metric ton. Tin gave up 1.51% of its previous week’s end at $27,872.00 to close this week at $27,451.00 per metric ton.

Energy and Oil

Oil market players appear to increasingly rely on OPEC+ production cuts remaining in place for the rest of the year. If this continues as expected, combined with an improving macroeconomic outlook, crude prices could be expected to reach $90 per barrel sooner than previously thought. If the U.S. fourth-quarter GDP proves to be better than expected, it may consolidate market expectations surrounding an interest rate cut by June and dispel the demand woes of early 2024. This week ICE Brent hovers about $87 per barrel whilst WTI trades around $83 per share. In the meantime, the U.S. ramps up its sixth round of targeted Iran sanctions as the Department of Treasury sanctioned a Houthi-linked network of companies that allegedly moves Iranian oil through forged documents.

Natural Gas

For the report week beginning Wednesday, March 20, and ending Wednesday, March 27, 2024, the Henry Hub spot price declined by $0.13 from $1.57 per million British thermal units (MMBtu) to $1.44/MMBtu. Concerning Henry Hub futures prices, the April 2024 NYMEX contract expired on Tuesday at $1.575/MMBtu, down by $0.12 from the close of the previous week. The May 2024 NYMEX contract price decreased to $1.718/MMBtu, lower by $0.13 from the previous week. The price of the 12-month strip averaging May 2024 through April 2025 futures contracts declined by $0.09 to $2.728/MMBtu.

This week, International natural gas futures price changes were mixed. The weekly average front-month futures prices for LNG cargoes in East Asia rose by $0.21 to a weekly average of $9..48/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.11 to a weekly average of $8.74/MMBtu. In the week last year corresponding to this report week (the week from March 22 to March 29, 2023), the prices were $12.72/MMBtu in East Asia and $13.47/MMBtu at the TTF.

World Markets

In a week of generally light trading ahead of the Easter holiday weekend, most European markets saw modest gains. The STOXX Europe 600 Index reached a record intraday high this week, gaining by 0.59% in local currency terms. The market’s gains were noteworthy since they came despite confirmation of a significant slowdown in some major economies. As the European Central Bank (ECB) flagged a possible rate cut for June, European government bond yields declined over the week. The decision to cut rates depends on whether wage growth continues to moderate. ECB council member Fabio Panetta was the latest to flag a turn in the rate cycle, with data showing eurozone bank lending stagnated again in February. The UK entered a technical recession in the fourth quarter of 2023 for the first time since early 2020. The economy contracted by 0.3% following a third-quarter contraction of 0.1%, as confirmed by the UK’s Office of National Statistics. In Germany, the Federal Statistical Office reported that sales in that country plunged by 1.9% in February, well below consensus expectations for a small increase and the biggest drop in 17 months. Leading economic institutions in that country expect the economy to grow by 0.1% in 2024, cutting the prior forecast of 1.3%. Hopes for a stronger recovery have been dented by high-interest rates, weak global demand, and political uncertainty. On the whole, however, data suggests that European consumers are growing slightly more optimistic because of the region’s easing energy concerns.

Japan’s stock markets plummeted through Thursday’s trading as investors focused on the sharp decline of the yen. The currency hovered near JPY 152 against the dollar, a sign that many perceived may trigger authorities to intervene in the foreign exchange markets to prop up the yen. After a meeting on Wednesday, the country’s three main monetary authorities suggested that they could be ready to stage an intervention. It is the strongest hint to date after the currency dipped to a 34-year low. Since Japan’s large-cap exporters derive a significant share of their earnings from overseas, they benefited largely from the historic weakness in the yen which is now threatened by a possible government intervention. The yield on the 10-year Japanese government bond dipped to about 0.70% on Thursday from 0.74% at the end of the weak prior. This dovetailed the historic monetary policy shift by the Bank of Japan (BoJ) wherein it raised interest rates from negative territory for the first time in nearly seven years. The market’s expectations are for two more BoJ interest rate hikes within the coming 12 months. The end of the central bank’s negative rates policy is the first step toward monetary policy normalization.

Chinese stocks ended the week on Thursday, down due to concerns about the continuing property sector downturn which continues to weigh on investor confidence. The Shanghai Composite Index declined by 1.23% while the blue-chip CSI 300 retreated by 0.68%. The Hong Kong benchmark Hang Seng Index inched upward by 0.25%. At the China Development Forum, an annual summit for global business leaders, Chinese Premier Li Qiang announced to the Forum participants that the country is open to foreign investment. He also pledged that the government will accelerate measures to support growth in several sectors, including biological manufacturing artificial intelligence, and the data economy. Beijing’s pro-business message, however, coincides with many investors seeking evidence that China will further increase policy support to meet its growth goals. If the government conducts pro-market reforms, International Monetary Fund Managing Director Kristalina Georgieva said that China’s economy could expand a further 20% over the next 15 years.

The Week Ahead

The March nonfarm payrolls report and the ISM manufacturing PMI are among the important economic data scheduled for release this week.

Key Topics to Watch

- S&P U.S. manufacturing PMI (final) for March

- Construction spending for February

- ISM manufacturing for March

- Fed Governor Lisa Cook speaks

- Factory orders for February

- Job openings for February

- Fed Governor Michelle Bowman speaks (Tuesday, April 2)

- Cleveland Fed President Loretta Mester speaks (Tuesday, April 2)

- San Francisco Fed President Mary Daly speaks

- U.S. auto sales for March

- ADP employment for March

- S&P U.S. services PMI (final) for March

- Fed Governor Michelle Bowman speaks (Wednesday, April 3)

- ISM services for March

- New York Fed President John Williams moderates discussion

- Fed Chair Jerome Powell speaks

- Fed Vice Chair for Supervisions Michael Barr speaks

- Fed Governor Adriana Kugler speaks (Wednesday, April 3)

- Initial jobless claims for March 30

- U.S. trade balance for February

- Philadelphia Fed President Patrick Harker speaks

- Richmond Fed President Tom Barkin speaks (Thursday, April 4)

- Chicago Fed President Austan Goolsbee speaks

- Cleveland Fed President Loretta Mester speaks (Thursday, April 4)

- Minneapolis Fed President Neel Kashkari speaks

- Fed Governor Adriana Kugler speaks (Thursday, April 4)

- U.S. nonfarm payrolls for March

- U.S. unemployment rate for March

- U.S. hourly wages for March

- Hourly wages year-over-year

- Richmond Fed President Tom Barkin speaks (Friday, April 5)

- Dallas Fed President Lorie Logan speaks

- Fed Governor Michelle Bowman speaks (Friday, April 5)

- Consumer credit for March

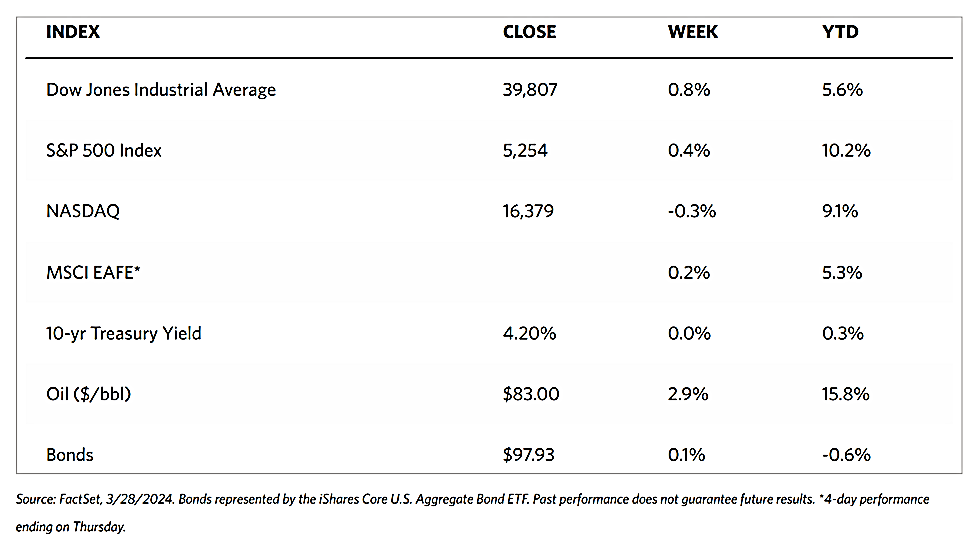

Markets Index Wrap-Up