Stock Markets

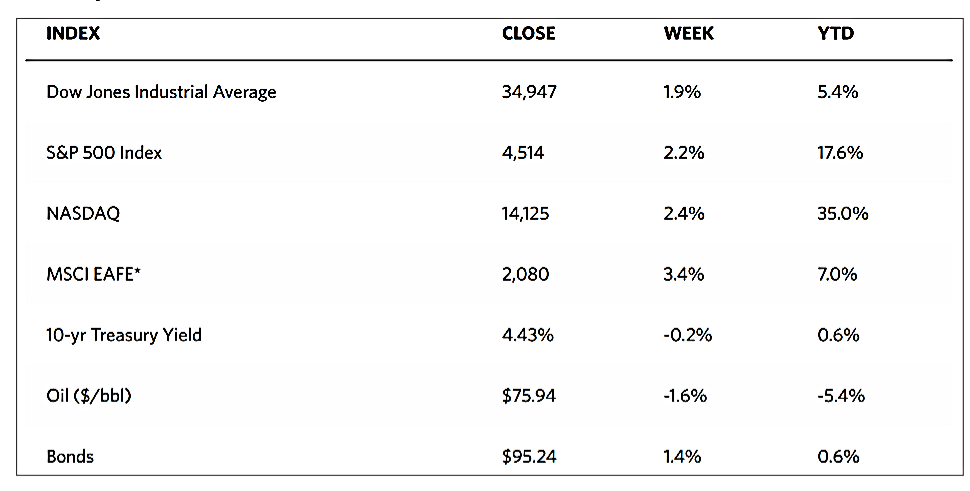

All stock indexes were up this week in apparent reaction to inflation resuming its downward trajectory in October from its brief acceleration in late summer. The Dow Jones Industrial Average (DJIA) ended the week 1.94% higher than the week before, with the broader DJ Total Stock Market Index ending 2.55% up. The global S&P 500 Index closed 2.24% up for the week while the technology-heavy Nasdaq Stock Market Composite similarly surged by 2.37%. The NYSE Composite gained by 2.76%. The indicator for investors’ risk perception, the CBOE Volatility (VIX) Index ended lower by 2.61%.

This week’s performance saw the S&P 500 Index moving above the 4,500 barrier for the first time since September, thus building on its strong gains over the previous two weeks. The advance registered across the board as the equally weighted S&P 500 Index outperformed its market-weighted version by a full percentage point. The Russell 1000 Value Index likewise did better than its growth counterpart as it moved back into positive territory for the year to date. Similarly, outperforming were the small cap indexes. Strong performance results from retailers Target and Walmart seem to contribute to the rally, but since the third-quarter reporting season was winding down, the surge could be largely attributed to macroeconomic factors.

U.S. Economy

The Labor Department reported on Tuesday that its headline consumer price index remained unchanged in October, due in part to a sharp decrease in energy costs. Core CPI (excluding food and energy prices) rose 0.2%, which resulted in an increase in the year-over-year figure to 4.0%. This is the indicator’s slowest rate in two years. The producer price inflation rate, released the following day, was also surprisingly lower than expected. Another hopeful sign that inflation might have peaked was the American Farm Bureau’s annual Thanksgiving survey which it released on Wednesday. The report showed that a typical dinner was expected dinner to cost 4.5% less in 2023 compared to the year before, due to falling prices for seven out of 11 food items (including turkey). While the may be a bit of good news, the meal still costs significantly more than it had in 2021, totaling $61.17 compared to $53.31 two years ago.

Other news that lifted investor sentiments was contained in Wednesday’s retail sales report from the Commerce Department. Unadjusted for inflation, retail sales fell by 0.1% in October, which was lower than expected and partly due to a reduction in gasoline and auto sales. Home-related spending on furniture and building materials continued to decline, although consumer spending continued to increase at bars and restaurants and online. The signs of cooling inflation contributed to a further drop in long-term Treasury yields. The benchmark 10-year note briefly touched an intraday low of about 4.40% on Friday, its lowest level since mid-September. The falling yields confirm a change in Fed policy. Overall, economic data are reflecting the right balance, not too hot nor too cold, leaving the October correction as a thing of the past.

Metals and Mining

Solid bullish momentum was reflected in the gold market this week as prices bounced off a three-week low, but confirmation is still elusive as the precious metal has not yet sustained a convincing breakout above the $2,000 resistance level. In the right economic environment, gold’s price action hints at much potential. However, the consensus of analysts is that the conditions are not yet in place to sustain a rally to all-time highs. This week, gold’s 2% rally was helped by the U.S. CPI showing annual inflation rising 3.2% in October. Simultaneously, core inflation rose by 4.0%, the smallest 12-month increase since September 2021. Producer inflation also dropped by 0.5% in October, the biggest one-month decline since April 2020. The weak inflation figures drew investor attention once more to a potential change in the Fed’s monetary policy and the possibility of a rate cut by May. But until the Fed reverses its tightening bias, investors in gold should patiently look for tactical buying opportunities while waiting for the bullish market with the strong return of institutional investors.

The spot prices of precious metals are up this week. Gold gained 2.09% from last week’s closing price of $1,940.20 to this week’s closing price of $1,980.82 per troy ounce. Silver advanced by 6.51% from last week’s close at $22.27 to this week’s close at $23.72 per troy ounce. Platinum surged by 6.73% from its week-ago price of $845.83 to its latest close at $902.72 per troy ounce. Palladium soared by 9.88% from its prior weekly close at $961.77 to its close this week at $1,056.78 per troy ounce. The three-month LME prices of industrial metals were mixed this week. Copper went from its closing price last week of $8,035.50 to its closing price this week of $8,267.00 per metric ton for an appreciation of 2.88%. Zinc declined by 0.27% from last week’s close at $2,562.00 to this week’s close at $2,555.00 per metric ton. Aluminum slid by 0.36 from its price last week of $2,215.00 to its price this week of $2,207.00 per metric ton. Tin climbed by 1.01% from its closing price last week of $24,603.00 to its closing price this week of $24,852.00 per metric ton.

Energy and Oil

Oil prices saw their lowest prices this week since July. WTI fell to $73 per barrel on its fourth straight weekly loss. The decline resulted from a combination of weak U.S. economic data and CTA trading patterns that aggravated the decline. Labor market data out this week in the U.S. points to signs of cooling off, with initial jobless claims rising to their highest since August, and continuing jobless claims also on the rise, hitting their highest in two years. However, both remain below their historical averages over the past 50 years. The softening labor demand signals that companies will slow hiring to protect their profitability. In any case, the WTI has shed its previous levels of steep backwardation (a situation where future prices are lower than spot prices) and is now in contango (situation where future prices are higher than spot prices) in the prompt months (the calendar months when the arrival period ends). Oil prices did, however, begin to bounce back on Friday despite the negative sentiment, with Brent rising to $78.50 and WTI trading at $73.86.

Natural Gas

For the report week beginning Wednesday, November 8, and ending Wednesday, November 15, 2023, the Henry Hub spot price advanced by $0.66 from $2.21 per million British thermal units (MMBtu) when the week began to $2.87/MMBtu by the week’s end. In Henry Hub futures, the price of the December 2023 NYMEX contract increased by $0.003, from $3.106/MMBtu at the start of the report week to $3.109/MMBtu by the week’s end. The price of the 12-month strip averaging December 2023 through November 2024 futures contracts declined by $0.022 to $3.284/MMBtu.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia declined by $0.29 to a weekly average of $17.17/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.33 to a weekly average of $14.97/MMBtu. In the week last year corresponding to this report week (November 9 to November 16, 2022) the prices were $27.06/MMBtu in East Asia and $34.10/MMBtu at the TTF.

World Markets

European stocks ended higher for the week on hopes in financial markets that central banks would soon be cutting interest rates. The pan-European STOXX Europe 600 Index climbed for the week and ended 2.82% above last week’s close in local currency terms. Major stock indexes rose sharply in the region. France’s CAC 40 Index gained by 2.68%, Italy’s FTSE MIB added 3.49%, and Germany’s DAX surged by 4.49%. The UK’s FTSE 100 Index ascended by 1.95%. Bond yields throughout Europe declined as a result of data indicating that inflationary pressures have eased. The yield on the 10-year German government bond inched lower on the perception that central banks may embark on rate cuts next year. Similarly, Swiss, French, and Italian sovereign bond yields moved lower. The yield on the 10-year UK government bond slipped toward 4.1%. European Central Bank (ECB) President Christine Lagarde announced that policymakers expected that inflation may accelerate at the start of next year, but even if it did, another interest rate increase may not be needed.

In Japan, the stock market rose as risk appetite was boosted by the recent U.S. inflation data. The Nikkei 225 Index gained by 3.1% while the broader TOPIX Index advanced by 2.3%. Earnings announcements that surprised on the upside provided some of the momentum for stock price gains, while weak third-quarter gross domestic product (GDP) data had no impact on investor sentiment. The U.S. inflation report which came below expectations signaled the imminence of an economic soft landing, furthering hopes that interest rates have peaked. The yield on the 10-year Japanese government bond (JGB) plunged to 0.72% from 0.85% at the end of the previous week, following the growing weakness of U.S. bond yields. As a result, the Bank of Japan was prompted to reduce the offer amounts for its regular purchase of JGBs in an attempt to limit volatility in yield movements. Expectations of an end to U.S. monetary policy tightening provided support to the yen, which ended the week higher, at about JPY 149 to the U.S. dollar.

Chinese equities ended mixed after official indicators underscored the country’s economic fragility. The Shanghai Composite Index climbed by 0.51% while the blue-chip CSI 300 Index fell by 0.51%. Hong Kong’s benchmark Hang Seng Index gained by 1.46%. A mixed picture of China’s economy was reflected in the official data for October. Surprising on the plus side, industrial production and retail sales grew year-on-year by more than forecasted. On the other hand, fixed asset investment growth was poorer than expected due to weaker infrastructure growth and real estate investment. Unemployment remained unchanged from September. New bank loans rose by RMB 738.4 billion in October which was higher than consensus estimates, but which was lower than September’s reading of RMB 2.31 trillion due to seasonal downturn in corporate lending. Official data also showed that the slump in the housing market deepened in October. Investment in property development fell by 9.3% in the first 10 months of the year which exceeded consensus, compared to a 9,1 decline in the January to September period, as determined by the National Bureau of Statistics. Between January and October 2023, property sales slumped by 7.8% compared to the same period in 2022. New home prices in 70 of China’s largest cities fell by 0.38% last month from September, marking the largest month-on-month drop since February 2015.

The Week Ahead

This week, important economic data expected for release include the November S&P Global Purchasing Managers Index (PMI) data for service and manufacturing, and the U.S. leading economic indicators for October.

Key Topics to Watch

- U.S. leading economic indicators for October

- Richmond Fed President Tom Barkin TV appearance

- Existing home sales for October

- Minutes of Fed’s Oct. 31 – Nov. 1 FOMC meeting

- Initial jobless claims for Nov. 18

- Durable goods orders for October

- Durable goods minus transportation for October

- Consumer sentiment (final) for November

- S&P flash U.S services PMI for November

- S&P flash U.S. manufacturing PMI for November

Markets Index Wrap-Up