Stock Markets

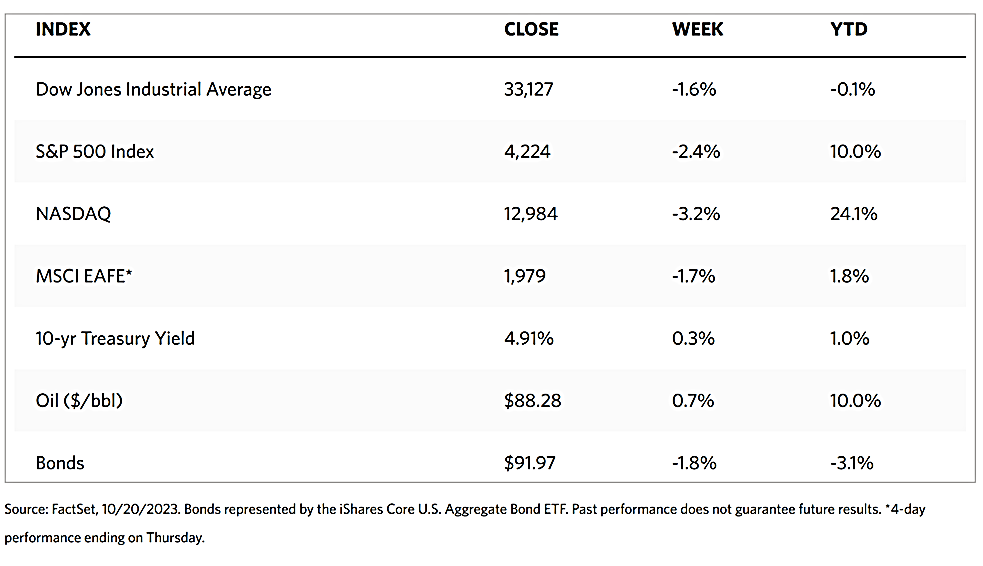

Equities lost some ground this week due to the continued rise of Treasury bond yields. The 10-year Treasury yield in particular is attracting investors’ attention as it approaches 5%, a rate last seen in 2007. All major indexes are down for the week. The Dow Jones Industrial Average (DJIA) corrected by 1.61% and the D.J. Total Stock Market Index fell by 2.41%. The broad-based S&P 500 Index similarly plunged by 2.39% while the technology tracker Nasdaq Stock Market Composite fell even deeper by 3.16%. The NYSE Composite Index dropped by 1.90%. The risk perception indicator CBOE Volatility (VIX) Index shot up by 12.37%, according to data from the Wall Street Journal Markets tracker.

Simultaneous with the rise in long-term bond yields, a host of macro and geopolitical concerns have pushed stock markets down and the Nasdaq almost into bear market territory, ending the week 19.91% below its intraday highs in early 2022. Investor sentiment weighed down on the S&P 500 Index which saw its biggest weekly decline in a month. The stock market began its week on a strong note, however, as it recorded the S&P 500 Index’s 15th straight Monday gain. The opening rally was helped by limited negative news coming from the Middle East turmoil over the weekend. The early gains were supplanted by deepening tensions as the week progressed. Share prices sharply fell on Thursday afternoon after news reports that a U.S. Navy destroyer shot down a cruise missile heading towards Israel and that a drone attack took place on a U.S. base in Iraq.

U.S. Economy

Officials of the Federal Reserve this week were markedly less dovish in their pronouncements about the direction inflation is expected to take. Richmond Fed Reserve President Thomas Barkin commented before real estate conference attendees in Washington that he still needs to see further confirmation of slowing demand and cooling inflation. While Fed Chair Jerome Powell admitted before the Economic Club of New York on Thursday that there appeared to be encouraging signs of a clear tightening in financial conditions, the Wall Street Journal nevertheless reported a sharp pullback in the markets after Powell admitted that there were no signs that the current stance of the Fed would result in a possible push into an economic recession.

Some economic data suggest that interest rates will remain higher for longer. The Commerce Department reported on Tuesday that retail sales rose 0.7% in October, amounting to almost double the consensus expectations. Online retailers, restaurants and bars accounted for most of the increase, suggesting that discretionary spending continued to remain strong. Sales rose 3.8% over the preceding 12 months which is roughly in line with consumer inflation. In any case, weekly jobless claims fell below 200,000 for the first time since January, thus surprising on the downside. Commerce data also indicated that the industrial side of the economy remained significantly weaker. Although overall industrial production remained roughly flat over the preceding year (up 0.8%), it rose by 0.3% in September. The impact of rising rates was further evident in the tight labor supply and the housing sector. September housing starts rose more than expected while building permits, a more forward-looking indicator, fell by 4.4%, its sharpest decline in 10 months.

Metals and Mining

Gold’s move in the last two weeks is pleasantly surprising to those who decided to accumulate during the low phase. The yellow metal fell to a seven-month low on October 6, testing the $1.820 per ounce support briefly, and has bounced back with a fury without once looking back since. It rallied more than 9% in the last two weeks as prices pushed above $2,000 per ounce before the weekend. Silver is likewise remarkable, briefly dropping below $21 per ounce two weeks ago and now ending the week slightly short of $23.50, resulting in a 13% rally. Throughout the summer, bearish sentiment dogged the gold market as investors continued to react to the aggressive monetary policy stance of the Fed which will continue to restrict interest rates through the first semester of 2024. What ignited the new rally, however, appears to be the news of Hamas’s surprise attack that killed more than 1,000 Israelis. Gold is thus performing its role as a safe-haven asset during chaotic times

Precious metal spot prices were generally higher this week. Gold rose by 2.51% from its week-ago close of $1,932.82 to its closing price this week of $1,981.40 per troy ounce. Silver, which came from $22.72 the previous week, ended at $23.37 per troy ounce this week for a gain of 2.86%. Platinum closed this week at $899.61 per troy ounce for an increase of $1.75% over its previous week’s close of $884.13. Palladium ended lower by 4.28% this week to close at $1,150.56 per troy ounce from its previous week’s price of $1,101.28. The three-month LME prices of industrial metals generally closed lower for the week. Copper lost 0.01% from its previous week’s close at $7,949.00 to this week’s close at $7,948.50 per metric ton. Zinc closed lower by 0.33% from its previous week’s closing price of $2,446.00 to this week’s closing price of $2,438.00 per metric ton. Aluminum ended the week lower by 0.82% from last week’s close at $2,199.50 to this week’s close at $2,181.50 per metric ton. Tin lost 0.41% from last week’s close at $25,087.00 to this week’s close at $24,985.00 per metric ton.

Energy and Oil

The U.S. government was one of the key players who influenced oil prices this week. It announced the easing of Venezuelan sanctions as well as a possible replenishment of the U.S. Special Petroleum Reserve (SPR). The announcement of the easing of sanctions against Venezuela first sent oil prices downward, but the potential replenishment of the US SPR drove prices sharply upward. The U.S. Department of Energy announced that it would seek to purchase 6 million barrels of crude oil for delivery to the SPR in December to January and that it seeks to sign purchase contracts at $79 per barrel or less. Coupled with these announcements is the escalation of the Israel-Gaza crisis that further stoked fears that it may spread into a wider regional war. The geopolitical risk premium added further upside to prices. On Friday morning, WTI traded above the $90 per barrel level while ICE Brent neared the $94 per barrel mark.

Natural Gas

For the report week beginning Wednesday, October 11, and ending Wednesday, October 18, 2023, the Henry Hub spot price fell by $0.28 from $3.18 per million British thermal units (MMBtu) to $2.90/MMBtu. Making the Henry Hub price among the highest of all major U.S. hubs outside of California. The price of the November 2023 NYMEX contract decreased by $0.321, from $3.337/MMBtu at the start of the report week to $3.056 at the week’s end. The price of the 12-month strip averaging November 2023 through October 2024 futures contracts retreated by $0.154 to $3.375/MMBtu.

International natural gas futures prices advanced this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $2.32 to a weekly average of $16.50/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $2.49 to a weekly average of $15.78/MMBtu. In the week last year corresponding to this week (from October 12 to October 19, 2022), the prices were $32.11/MMBtu in East Asia and $37.30/MMBtu at the TTF.

World Markets

The European stock markets retracted amid uncertainty concerning the interest rate outlook and fears of a possible escalation of the Middle East conflict. The pan-European STOXX Europe 600 Index ended 3.44% lower for the week. A series of disappointing earnings reports exacerbated the worsening investor mood as all major Continental stock indexes also closed significantly downward. Germany’s DAX fell by 2.56%, France’s CAC 40 Index plunged by 2.67%, and Italy’s FTSE MIB plummeted by 3.12%. The UK’s FTSE 100 Index dropped by 2.60%. As investors weighed the prospects that interest rates would remain higher due to sticky inflation, European bond yields broadly climbed. The yield on the benchmark government bonds in the U.K. rose after inflation data was reported as unchanged instead of slowing further. Germany’s benchmark 10-year government bond yield rose and closed the week just short of 2.9%. Italian bond yields advanced, with the yield differential between German and Italian 10-year debt increasing to more than 200 basis points.

Japanese bourses fell over the week as the Nikkei 225 Index dropped by 3.3% and the broader TOPIX Index declined by 2.3%. The disappointing market performance occurred despite a slight easing of inflationary pressure in Japan, however, wage growth drew attention amid signs of a move higher in pay demands for next year. The news that the interest rates in the U.S. may remain higher for longer prompted a surge in bond yields. The yield on the 10-year Japanese government bond rose to its highest level in around 10 years at 0.83%, from 0.76% at the end of the previous week. The Bank of Japan (BoJ) announced an unscheduled bond-purchase operation during the week in an attempt to intervene to slow the pace of increases, The yen traded within the upper end of the JPY 149 against the U.S. dollar range, approaching the JPY 150 threshold that many speculate could prompt the Japanese authorities to intervene to arrest the currency’s slide. If the government fails to take action, such an excessive swing may cause harm to the real economy, causing regular people and businesses to suffer.

China’s stock prices also fell sharply mainly due to deepening property sector concerns that offset optimism of a better-than-expected gross domestic product report. The Shanghai Composite Index lost 3.4% of its value while the blue-chip CSI 300 plunged by 4.17%, obliterating the gains made from the reopening rally earlier this year. The Hong Kong benchmark Hang Seng Index declined by 3.6%. Despite receiving a 30-day grace period in August, China’s largest property developer, Country Garden, announced this week that it was unable to meet all of its offshore debt payments. The company’s missed dollar bond interest payment signifies that it will almost certainly default on a dollar bond for the first time, underscoring the troubles faced by China’s real estate market. Home price data, in the meantime, indicates no improvement in the ongoing property market slump. In 70 of China’s largest cities, new home prices fell by 0.3% in September from August. This is the third consecutive month of home price declines. Also announced during the week is a surprisingly strong GDP performance, with China’s economy expanding by an above-forecast 4.9% in the third quarter year-over-year, slowing from a 6.3% rise recorded in the second quarter.

The Week Ahead

Important economic data scheduled to be released this week include PCE inflation data and third-quarter GDP.

Key Topics to Watch

- S&P Case-Shiller home price index (20 cities) for August

- S&P flash U.S. services PMI for October

- S&P flash U.S. manufacturing PMI for October

- New home sales for September

- Gross Domestic Product for Q3

- Initial jobless claims for Oct. 21

- Durable goods orders for September

- Durable goods minus transportation for September

- Advanced U.S. trade balance in goods for September

- Advanced retail inventories in September

- Advanced wholesale inventories in September

- Pending home sales

- Personal income (nominal) for September

- Personal spending (nominal) in September

- PCE index for September

- Core PCE index for September

- PCE (year-over-year)

- Core PCE (year-over-year)

- Consumer sentiment (final)

Markets Index Wrap-Up