Stock Markets

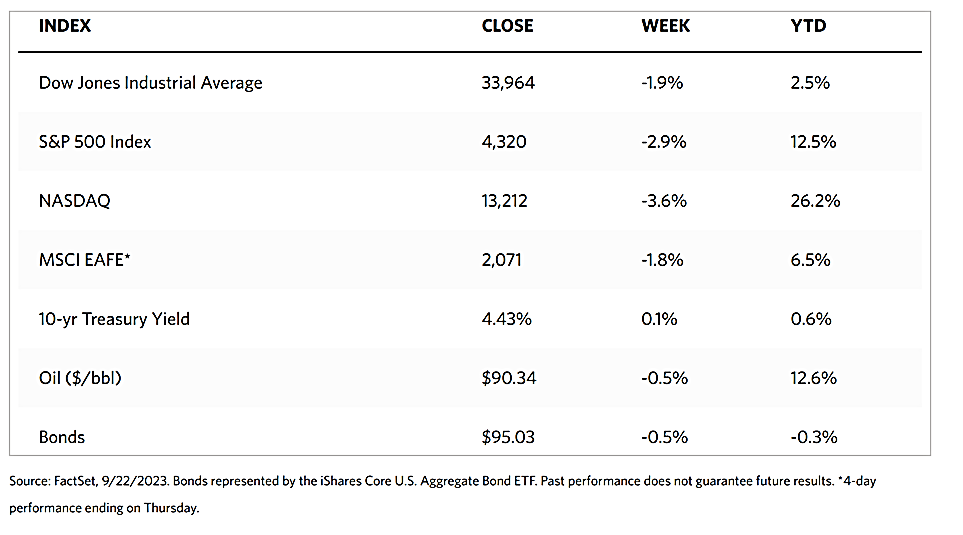

Investors’ reaction to rising U.S. Treasury yields and hawkish forecasts from the Federal Reserve’s latest meeting weighed on the major U.S. stock market benchmarks in the trading week just concluded. The Dow Jones Industrial Average (DJIA) descended by 1.89% while the D.J. Total Stock Market recorded a 3.03% loss. The broad-based S&P 500 Index came down by 2.93% while the technology-tracking Nasdaq Stock Market Composite fell by 3.62%. The NYSE Composite Index slid by 2.53%. The investor risk perception indicator CBOE Volatility Index (VIX) shot up by 24.73%. On Thursday, the S&P 500 Index suffered its worst single-day loss in six months. This week was its third consecutive week of losses.

Additionally, investors are concerned about the repercussions of the United Auto Workers’ strike that began with three plants on September 15 and has now expanded to include 20 states nationwide. There is also the potential that the U.S. government will shut down for failure to pass the 12 annual appropriation bills that fund government operations before the current fiscal year ends on September 30. The market sell-down may also have been worsened by tax-loss harvesting before the fiscal year-end. The Fed maintained its short-term lending benchmark rate at a target level set during the previous meeting in July of 5.25% to 5.50%. The market was surprised, however, when policymakers declared an outlook for rates in 2024 that was significantly higher than expected, with a correspondingly higher rate prediction for 2025. The Fed raised its growth forecast which is an admission that the economy has been more resilient than expected.

U.S. Economy

The next move by the Federal Reserve regarding future rate cuts will depend upon the trajectory of the economy. It forecasts stronger growth in 2023 to 2024 which led to the likelihood of raising interest rates once more to intercept a further increase in inflation due to the heating economy. But if growth is maintained while inflation eases up, then the Fed may gradually normalize rates by gradually reversing it to a neutral level. The biggest surprise out of this week’s meeting is that the Fed sees only two potential rate increases next year, down from the initial four rate cuts it projected in June.

Early signs are evident of easing in consumption and the labor market, but the Fed’s forecast of 2024 growth indicates only moderate cooling, to 1.5% annual growth, before returning to 1.8% in 2025. It places the unemployment rate at a constant 3.8% for the current year, and growing to no higher than 4.1% for the cycle, well below the 10-year average of 5.0% unemployment. The initial reaction in the market has been a greater than proportional move higher in Treasury yields and a rapid descent in stocks. Both the 2-year and the 10-year U.S. Treasury yields hit highs of this cycle after the Fed meeting. The laggards in recent days have been the longer-duration parts of both fixed-income and equity markets. Since a rapid rise in yields has weighed particularly on higher valuation growth parts of the market historically, this trend may continue in the short term.

Metals and Mining

While the gold market may not just yet have the momentum to break out of its neutral trading channel around $1,950, it nevertheless remains well-positioned to benefit if and when sentiment turns, a possibility that may materialize sooner than expected. The U.S. has so far been able to avoid a recession and expectations of a soft landing are gradually firming up, but many analysts continue to doubt whether this optimistic goal can be realistically achieved. Gold’s price action is proving that investors are more cautious about protecting themselves against a downturn. Gold’s resilience is more remarkable considering how, in the past week, the Federal Reserve decided against raising interest rates during its meeting but maintained its hawkish stance.

The spot price of precious metals moved sideways for the week. Gold went up by only 0.07% from the previous week’s close at $1,923.91 to close at $1,925.24 per troy ounce this week. Silver went down significantly by 3.99% from the earlier week’s closing price of $23.04 to the recent closing price of $22.12 per troy ounce. Platinum, which was formerly at $29.69, ended this week at $930.73 per troy ounce, for an increase of 0.11%. Palladium gained 0.27% from last week’s closing price of $1,250.89 to close this week at the price of $1,254.23 per troy ounce. The three-month LME prices of industrial metals are generally down. Copper receded by 2.66% from last week’s closing price of $8,417.50 to end this week at the price of $8,194.00 per metric ton. Zinc declined by 2.18% from its previous price of $2,570.00 to end this week at $2,514.00 per metric ton. Aluminum inched down by 0.56% from its closing price last week of $2,224.50 to its close this week at $2,212.00 per metric ton. Tin ended this week 1.09% lower from its previous week’s close at $25,895.00 to close at $25,613.00 per metric ton.

Energy and Oil

Diesel price were once again boosted by Russia’s decision to ban fuel exports for an undetermined period. Moscow has temporarily banned exports of gasoline and diesel to all countries except for Belarus, Kazakhstan, Armenia, and Kyrgyzstan, to stabilize runaway fuel prices that have been hitting record highs almost every day in September. As a consequence, Europe is experiencing a stunning $45 per metric ton day-to-day surge on its middle distillates. The rise in distillates likewise pushed oil prices higher, offsetting the downward pressure caused by economic developments. Europe is almost certain to head into contraction in the third quarter of this year, while the U.S. Fed reiterated its “higher for longer” interest rate policy, Oil prices were kept largely unchanged by the worsening macroeconomic outlook compared to a week ago, with ICE Brent still hovering around the $94 per barrel price level.

Natural Gas

For the report week beginning on Wednesday, September 13, and ending on Wednesday, September 20, the Henry Hub spot price increased by $0.01 from $2.76 per million British thermal units (MMBtu) to $2.77/MMBtu. Regarding the Henry Hub futures market, the price of the October 2023 NYMEX contract increased by $0.053, from $2.680/MMBtu at the start of the week to $2.733/MMBtu at the end of the week. the price of the 12-month strip averaging October 2023 through September 2024 futures contracts declined by $0.06 to $3.180/MMBtu.

International natural gas futures prices ascended this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia rose by $0.47 to a weekly average of $13.83/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.31 to a weekly average of $11.29/MMBtu. In the week last year corresponding to this report week (from September 14 to September 21, 2022), the prices were $43.97/MMBtu in East Asia and $56.63/MMBtu at the TTF.

World Markets

European stocks followed the cue in the U.S. markets. The pan-European STOXX Europe 600 Index ended lower by 1.98% as the region’s central banks signaled that interest rates will remain elevated for some time into the future. The economic outlook was further clouded by higher oil prices and poor business activity data. Major country stock indexes likewise went south. Italy’s FTSE MIB dipped by 1.13%, Germany’s DAX declined by 2.26%, and France’s CAC 40 slumped by 2.67%. The UK’s FTSE 100 Index hardly changed either way in local currency terms as investor perception of equities earning in dollars was propped up by a depreciation of the UK pound’s exchange rate to the U.S. dollar. Since many UK-listed firms are multinationals with overseas revenues, a weaker British pound sterling provides support to the index. After European Central Bank (ECB) officials announced that they could not rule out another interest rate increase, and after the Fed indicated they would maintain their rates higher for longer, Eurozone government bond yields increased.

Japan’s stock markets also fell for the week. The Nikkei Index ended lower by 3.4% week-on-week and the broader TOPIX declined 2.2% for the same period. The signals sent by the US. Federal Reserve regarding keeping its interest rates higher for longer to bring inflation under control impacted heavily on investor sentiment in Japan. Japan, on the other hand, continued to maintain its ultra-loose monetary policy as expected by market players. This, in turn, dashed hopes that the central bank would hint at an exit from negative interest rates. The continued monetary policy divergence between the Fed’s hawkish stance and the dovish Bank of Japan (BoJ) pushed the yen lower against the U.S. dollar, from around JPY 147.8 the previous week to about JPY 148.3 per greenback this week. Finance officials signified that it would not rule out any options to respond to excessive currency volatility on the occasion that speculators take advantage of the situation regarding concerns about potential intervention in the foreign exchange markets to prop up the yen.

Chinese stocks climbed as investors grew increasingly optimistic about the brighter economic future of the country. The blue-chip CSI 300 Index gained by 0.81% while the Shanghai Composite Index added 0.47%. Hong Kong’s benchmark Hang Seng Index lost by 0.7%. The official data for August which was released the prior week provided some evidence of economic stabilization, although no major economic indicators were released in China this week, Retail sales, industrial production, and lending activity increased more than forecasted last month compared to one year ago. However, fixed-asset investment grew less than expected as the drop in property investment worsened. On Thursday, the State Council, which is China’s cabinet, promised to accelerate measures to consolidate China’s recovery and continue supporting growth in 2024, according to state media. Senior officials acknowledged that China is facing economic challenges, but are optimistic that historical trends point to the country’s economic improvement over the long-term. In the meantime, Chinese banks kept their one- and five-year loan prime rates unchanged after the People’s Bank of China (PBOC) kept its medium-term lending facility rate on hold the week before simultaneous with reducing the reserve requirement ratio for the second time this year. PBOC officials feel there is sufficient policy room to support China’s recovery, signaling that there may be further easing following this month’s pause.

The Week Ahead

Included among the important economic data scheduled for release in the coming week are a read on consumer confidence, new home sales, and PCE inflation data for August.

Key Topics to Watch

- New home sales

- S&P Case Shiller home price index (20 cities)

- Consumer confidence

- Fed Gov. Bowman speaks

- Durable goods orders

- Durable goods minus transportation

- Initial jobless claims

- GDP (revision)

- Fed Gov. Cook speaks

- Fed Chairman Powell speaks

- Personal income

- Personal spending

- PCE Index

- Core PCE Index

- PCE (year-over-year)

- Core PCE (year-over-year)

- Advanced U.S. trade balance in goods

- Advanced retail inventories

- Advanced wholesale inventories

- Chicago Business Barometer

- Consumer sentiment (final)

Markets Index Wrap Up