Stock Markets

The holiday-shortened week ended lower across all the major indexes as Monday saw the markets closed in observance of the Labor Day holiday. According to the WSJ Markets report, the Dow Jones Industrial Average (DJIA) slipped 0.75% down as the DJ Total Stock Market Index gave up double that with a loss of 1.47%. The broad-based S&P 500 Index descended by 1.29% while the technology-heavy Nasdaq Stock Market Composite declined by 1.93%. The investor risk perception indicator, CBOE Volatility Index, rose by 5.73%. The dip in equities may be a technical correction from the previous week’s gains, but it is also driven by positive economic signals that sent interest rates higher. Growth stocks outperformed value shares, while large-cap counters fared better than small-caps by a wider margin.

A decline in Apple’s share price accounts for the deeper slump in the Nasdaq compared to the broader indexes. Apple’s sell-down was precipitated by news that Chinese government employees would henceforth be forbidden from using iPhones. Another source of discouragement for investors is reports that the upcoming iPhone15 will have a much higher tag price than current models. Also weighing down on the indexes were declines in NVIDIA and other chipmakers.

U.S. Economy

While the week’s economic calendar was not especially heavy this week, the released reports seemed to drive investor sentiment by generally surprising on the upside. The Institute for Supply Management’s report on August services sector activity appeared to stand out as the main market mover. It shows that the services sector activity for that month jumped unexpectedly to its highest level since February. According to the report, new orders were growing at a faster pace but inventories had risen considerably as order backlogs fell sharply. Export orders likewise remained robust, despite the growing worries through the week about a sharp slowdown in the Chinese economy.

The data that emerged this week also showed that productivity rose by 3.5% last quarter which is the strongest productivity growth rate since 2020. If the distortions from the pandemic are excluded, the productivity rate registered was the highest reading since the third quarter of 2017. Stronger productivity should drive upward support to GDP, particularly when occurring simultaneously with growth in the labor force, as the next section shows. Rising productivity can exert a dampening effect on inflation, especially in a moderating wage-growth environment as is the case at present. This confluence of economic factors could actually help the Fed in pausing and possibly reversing the recent interest rate hikes.

The weekly jobless claims report that was released on Thursday came in lower than expected. This suggested that the strength in labor demand continues despite the solid increase in the unemployment rate from 3.5% to 3.8% in August. The number of Americans applying for unemployment in the previous week, which was expected to increase slightly, fell to 216,000, its lowest level in six months. Continuing claims fell to its lowest level since mid-July at 1.58 million. The jobless numbers triggered an increase in short-term bond yields. The yield on the two-year U.S. treasury note briefly returned above the 5% threshold on Thursday afternoon.

Metals and Mining

Most traders are focused on trading the top two precious metals, gold and silver, but they tend to ignore the precious metal that may be one of the most essential in the coming decade. Platinum has a growing potential overlooked by many, as industrial demand for it continues to grow in an environment where supply growth is stagnating. The market faces a deficit of one million ounces this year while total platinum demand in the second quarter this year increased by 27% compared to the second quarter of last year. At the same time, automotive demand rose by 19% compared to last year, according to the latest estimates from the World Platinum Investment Council. The automotive sector represents about 80% of global platinum demand. This precious metal is a critical element in catalytic converters, which are used to reduce harmful emissions in diesel and gasoline-powered engines.

The spot prices of precious metals fell across the board this week. Gold came from $1,940.06 last week and ended at $1,919.08 per troy ounce this week for a loss of 1.08%. Silver, which ended at $24.19 one week ago, closed at $22.93 per troy ounce this week for a drop of 5.21%. Platinum descended by 6.98% this week from last week’s e at $963.85 to end at $896.60 per troy ounce. Palladium lost 1.85% of its value from the previous week’s closing price of $1,221.87 to this week’s closing price of $1,199.23 per troy ounce. The three-month LME prices of base metals also took a dive over this week. Copper came from $8,500.50 last week to end at $8,242.50 per metric ton this week for a decline of 3.04%. Zinc, which closed last week at $2,485.50, ended this week at $2,443.50 per metric ton for a drop of 1.69%. Aluminum came from last week’s price of $2,237.00 to end this week at $2,183.50 per metric ton, registering a slide of 2.39%. Tin descended from its price last week of $25,806.00 to this week’s price of $25,573.00 per metric ton, a decline of 0.90%.

Energy and Oil

Weaker-than-expected macroeconomic data from China capped market sentiment earlier this week. However, firm support for ICE Brent to stay at around $90 per barrel was provided by the fourth consecutive crude inventory draw in the United States combined with another week-on-week drop in gasoline stocks. Global balances were not materially altered by the extension of Saudi and Russian supply and export cuts until December 2023. However, it reiterates the bullish narrative of light supply further down the road. In the meantime, the Biden administration canceled the last remaining oil and gas leases along the coast of the Arctic National Wildlife Refuge. Much to the ire of the Alaskan authorities, the administration claimed that the Trump-era lease sales were “seriously flawed” and were based on legal deficiencies.

Natural Gas

For the week spanning August 30 to September 6, 2023, the Henry Hub spot price remained flat at $2.49 per million British thermal units (MMBtu). Regarding the Henry Hub futures price, the price of the October 2023 NYMEX contract decreased by $0.286, from $2.796/MMBtu at the start of the week to $2.510/MMBtu at the week’s end. The price of the 12-month strip averaging October 2023 through September 2024 futures contracts declined by $0.138 to $3.208/MMBtu. The NYMEX January 2024 contract reflects a premium of about $1.17/MMBtu to the October 2023 contract.

The international natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.07 to a weekly average of $13.26/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.46 to a weekly average of $10.75/MMBtu. The corresponding prices last year (for the week ending September 7, 2022) to this week’s prices were $56.07/MMBtu in East Asia and $66.49/MMBtu at the TTF.

World Markets

The pan-European STOXX Europe 600 Index closed lower by 0.76% this week on concerns that elevated interest rates may push the economy into a slowdown and eventually a recession. Among the major stock indexes, Italy’s FTSE MIB slumped by 1.46%, France’s CAC 40 Index declined by 0.77%, and Germany’s DAX descended by 0.63%. The UK’s FTSE 100 Index bucked the general trend and rose by 0.18%. The yields on German and Italian 10-year sovereign bonds inched higher amid worries about the eurozone economy. The yield on the 10-year government bond in the U.K. ended higher but pulled back from the highs it attained midweek. A series of economic data provided more indications that the eurozone economy continues to incur obstacles. The gross domestic product (GDP) in the bloc ticked up by 0.1% in the second quarter while a drop in exports contributed to Eurostat’s downward revision of its initial estimate of 0.3% expansion. Weaker automotive fuel purchases were reflected in the drop in retail sales volumes in the eurozone by 0.2% sequentially in July. The year-over-year decline was 1.0%.

Japanese bourses were mixed this week. The Nikkei dipped by 0.3% while the broader TOPIX gained by 0.4%. Investor risk appetite was weighed down by worries about China’s economic slowdown and the impact on global demand. Japan’s economy may not be doing as well as originally thought as suggested by some weak economic data releases. Further dampening sentiment was a downward revision made to second-quarter economic growth. Japan’s second-quarter 2023 gross domestic product expanded by 4.8% quarter-on-quarter on an annualized basis, which is weaker than the 6,0% growth estimated preliminarily. Also coming in softer than anticipated were capital spending, private consumption, and public investment. The yield on the 10-year Japanese government bond (JGB) remained steady at around the 0.6% range. The yen weakened to around JPY 147 per U.S. dollar, its lowest level in more than 10 months, from the JPY 146 at the end of the earlier week. This prompted Japan’s Ministry of Finance to issue its strongest warnings to date on foreign exchange market intervention to prop up the end.

Chinese stocks fell back this week as the latest economic indicators confirmed speculation about the country’s weakening outlook. The Shanghai Composite Index declined by 0.53% while the blue-chip CSI 300 Index descended by 1.36%. The Hong Kong benchmark Hang Seng Index fell for the week that ended Thursday as financial markets were closed on Friday due to a heavy rainstorm that flooded the city. The private Caixin/X&P Global survey or services activity dropped to 51.8 in August which is below the forecast and July’s 54.1. The gauge remains above eh 50 threshold, indicating expansion for the eighth consecutive month,

but it was the slowest increase since December, the outcome of the poor demand that is dragging China’s economy down further. The indicator is broadly consistent with the prior week’s nonmanufacturing Purchasing Managers’ Index (PMI), which also slowed to its lowest level his year. The official nonmanufacturing PMI remained in contraction for the fifth consecutive month but came in slightly above expectations. China’s trade fell by 8,8% in August from one year earlier, somewhat moderating from the sharp 14.5% drop in July. Imports shrank by 7.3%, and both readings were above expectations, suggesting that some sectors in China’s economy may be rounding the bottom. China’s renminbi currency fell to a record low of 7.36 against the U.S. dollar in overseas trading after the central bank set its yuan fixing rate at a two-month low.

The Week Ahead

Among the important economic data expected this week are the retail sales data, the CPI inflation report, and capacity utilization.

Key Topics to Watch

- Consumer price index

- Core CPI

- CPI (year-over-year)

- Core CPI (year-over-year)

- Initial jobless claims

- Producer price index

- Core PPI

- PPI (year-over-year)

- Core PPI (year-over-year)

- U.S. retail sales

- Retail sales minus autos

- Business inventories

- U.S. import prices

- Empire State manufacturing survey

- Industrial production

- Capacity utilization

- Consumer sentiment (prelim)

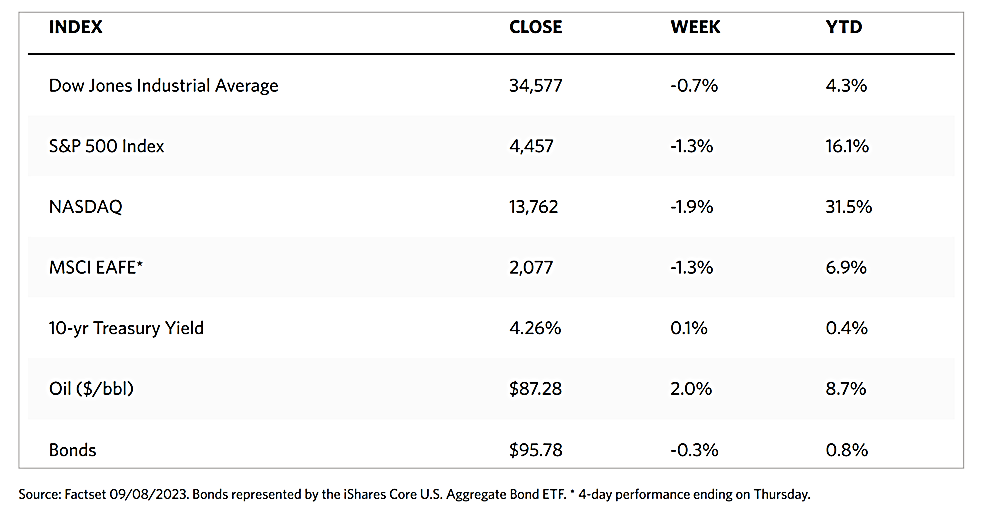

Markets Index Wrap Up