Weekly Market Review – January 11, 2020

Stock Markets

Stock markets closed at near new all-time highs last week after the U.S. and Iran recoiled and avoided expected escalation in geopolitical tensions. Iran took retaliatory steps for the death of its general with missile strikes against U.S. military bases in Iraq. There were no casualties, whether on purpose or not, but President Trump eased tensions by offering an olive branch. As a result, oil declined 6% on the week, recording its worst weekly performance since July of 2019. Where the economy is concerned, December jobs reports showed a slowdown in the overall job gains, but that was to be expected since it followed what was a very over performing November. And while wage growth was not quite as strong, the data shows wages are still growing faster than consumer prices. That’s adding a big boost to consumer confidence and spending, both big drivers of the current market.

U.S. Economy

The US economy remains surprisingly robust. An escalation in military tensions and the strong employment report combined to send the Dow briefly above the 29,000-mark last week for the first time in history. It appears that the stock market has picked up in 2020 right where it finished 2019. Even the combination of political uncertainties and widely positive economic conditions have not really changed. Analysts expect three things will dominate the investment perspective this year; 1. policy/political risks, 2. Domestic and global economic trends, and 3. The potential for this market rally to based on what takes place in numbers 1 and 2. These are the narratives to follow closely and mine for information that will dominate the economy this year.

Metals and Mining

Precious metals benefited greatly from growing geopolitical uncertainty in the Middle East following last week’s attack on an Iranian military personnel. Both gold and palladium started the week with highs for the year. Gold then reached a seven-year peak at US$1,578.80 an ounce. Palladium raced above US$2,000 an ounce to US$2,023. Not to be outdone, silver, was also pushed higher by the uncertainty, and reached a year-to-date high of US$18.55 an ounce on Tuesday. Platinum followed the trend on the week and moved to US$989 an ounce on Sunday before dipping lower and staying steady. The aerial assault carried out by Iran on Iraqi targets late Tuesday sent ripples through the market. A rush to safe haven assets pushed gold as high as US$1,610. Once the evaluations came in only to find there were no reported casualties, all metals prices began to retreat back to their pre-attack levels. Gold was trading for US$1,556.77 as of 10:53 a.m. EST on Friday (January 10). Palladium was the one metal that retained this week’s gains and has even creeped up. The metal, which is used in catalytic converters for gasoline-powered cars, is still vital for reducing emissions from vehicles. It continues to break records as it hit another all-time high selling for US$2,122 Thursday. The driving factors continue to be mine supply concerns from South Africa related to energy generation and load shedding. Continued tightening emissions standards in China are also playing a big part. Platinum has not been able to match gold and palladium, but it did record gains this week. It has risen less than 1 percent year-to-date after reaching a decade low last year. Analysts contend that gold will motivate the platinum price over the coming year. Silver could also benefit from gold’s strength and the increase in investor appetites for the whole field of save haven assets.

Energy and Oil

Oil prices are down sharply for the week, lower than where they were before the Soleimani killing. WTI chimed in at a one-month low. With de-escalation on the rise, it appears the geopolitical risk premium has evaporated for the moment. Crude stocks increased marginally over the past week, but gasoline stocks took a quick rise. Gasoline stocks have increased by more than 22 million barrels over the week. EIA data released after President Trump spoke about Iran led the market to interpret the news as an immediate de-escalation. The combination quickly sent oil prices falling. Following the de-escalation, Iran declared that it wants U.S. out of the Middle East. “It is in their interest that they pack and leave voluntarily, not only Iraq but Afghanistan and the Arabic countries,” Brig. Gen. Amir Ali Hajizadeh said on Thursday. The U.S. is considering its position in Iraq as the country’s parliament and Prime Minister continue to voice open support for expelling American forces from the country. In more domestic news, the EPA has tightened pollution on trucks initiating a process to limit emissions of nitrogen dioxide from heavy trucks. The industry supports it, as analysts say the move could head off stricter state-level standards in California. Natural gas spot prices rose at most locations this week. The Henry Hub spot price rose from $2.05 per million British thermal units (MMBtu) last week to $2.08/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the February 2020 contract increased 2¢, from $2.122/MMBtu last week to $2.141/MMBtu to this week. The price of the 12-month strip averaging February 2020 through January 2021 futures contracts climbed 3¢/MMBtu to $2.319/MMBtu.

World Markets

Stocks in Europe were up as Middle East tensions faded and traders focused on the fact that that the U.S. and China are expected to sign a phase-one trade deal. The pan-European STOXX Europe 600 Index ended the week 0.39% higher, and Germany’s DAX index gained 2.38%, while the UK’s FTSE 100 Index slipped 0.76%. Business activity in the eurozone strengthened more than expected for December. Gains in the service sector partially offset a decline in manufacturing as indicated in an IHS Markit purchasing managers’ survey out this week. The eurozone consumer price index rose 1.3% in December from a year earlier, a six-month high, due to strong consumer spending in the runup to Christmas. In Europe’s largest economy, German exports fell by a more-than-expected 2.3% in November and outpaced the decline in imports. The trade resulting surplus narrowed to EUR €18.2 billion from EUR €21.3 billion in October. German industrial production rebounded in November, snapping two months of declines.

China’s markets managed to rise for the sixth week in a row. The benchmark Shanghai Composite Index added 0.28%, and the large-cap CSI 300 Index, which tracks blue chips listed on the Shanghai and Shenzhen exchanges, rose 0.44% for the week. Analysts note that the Shanghai Composite and CSI 300 large-cap indices traded in a range that was extremely narrow in light of the geopolitical news taking place the Middle East and involving the US. Chinese equities also appeared to get a boost from the seasonal strength associated with the Lunar New Year holiday. That falls early this year from January 24 and last for one week.

The Week Ahead

It is the unofficial beginning of the earnings season this week starting with major U.S. banks who will be reporting fourth-quarter results. It is also expected that the U.S./China “phase one” trade deal will be signed this week. The key economic data being reported this week includes inflation, consumer price index, retail sales, housing starts industrial production, and job openings.

Key Topics to Watch

- Federal budget

- NFIB small business index

- Consumer price index

- Core CPI

- Producer price index

- Empire state index

- Weekly jobless claims

- Retail sales

- Retail sales ex-autos

- Philly Fed

- Import price index

- Business inventories

- NAHB home builders’ index

- Housing starts

- Building permits

- Patrick Harker speaks

- Industrial production

- Capacity utilization

- Consumer sentiment index

- Job openings

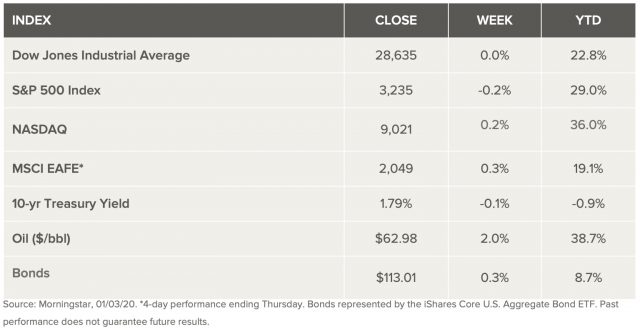

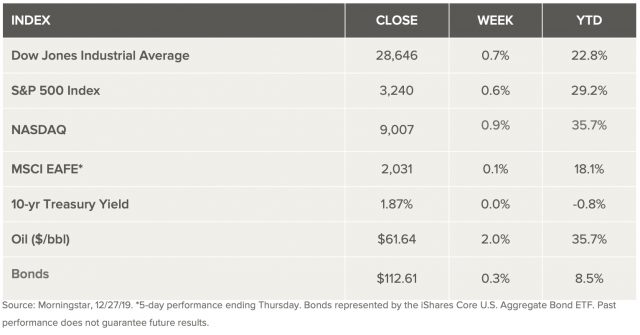

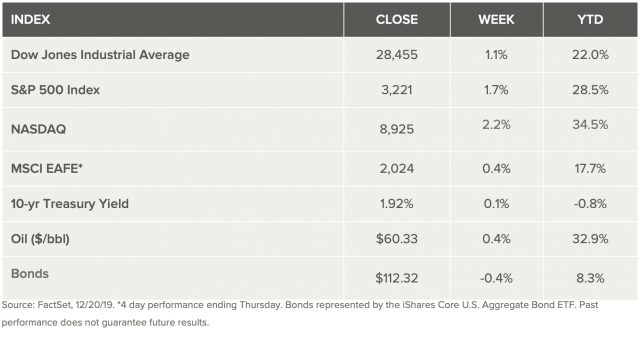

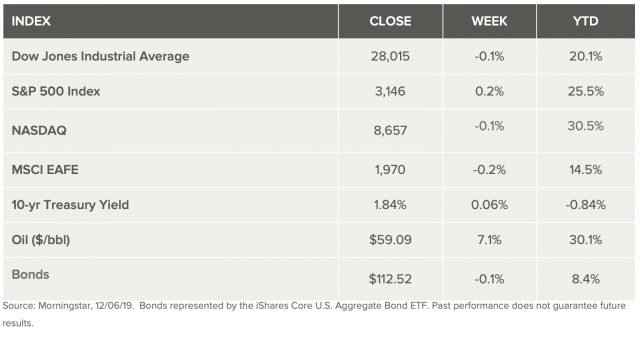

Markets Index Wrap Up