Equities Q4 Forecast: Global Stocks’ Strength Masks Vulnerabilities

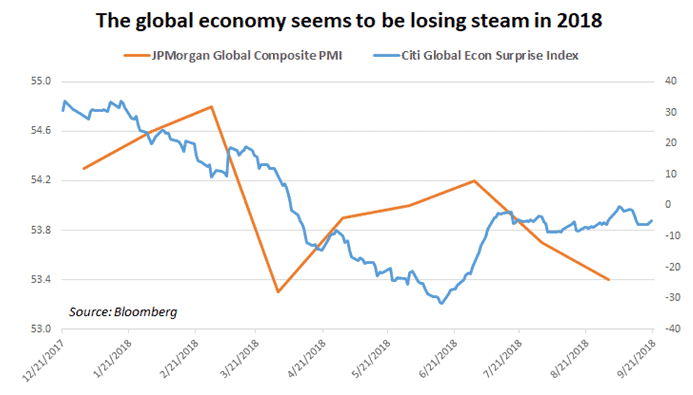

Global share prices accelerated upward in the third quarter, building on the rebound started in the preceding three months. The benchmark MSCI World stock index is on pace to add 5-6 percent for the period. That such performance can be had against a backdrop of a deepening trade war between the US and China as well as increasing emerging market instability is almost improbably impressive. One might conclude perseverance against such odds speaks to hearty underlying strength, making continuation likely. Still, critical vulnerabilities are much too glaring to ignore; the global economy has decelerated in 2018.