Weekly Market Review – March 12, 2022

Stock Markets

The equities market showed weakness over the past week marked by extreme volatility influenced by Russia’s invasion of neighboring Ukraine. On Tuesday, the intraday low saw the Nasdaq Composite fall to a depth almost 22% from its recent peak. This is more than the 20% threshold that signaled entry into bear market territory. The S&P 500 was approximately 14% off its peak when it descended to its low for the week, which is still within correction territory and therefore not as severe as the Nasdaq reaction. The sector that noticeably underperformed was consumer staples stocks. Coca-Cola, PepsiCo, and other food and consumer goods producers experienced a sell-off after announcing that they were suspending business in Russia in protest of Russian military aggression in Ukraine. Monday’s sell-down was marked by heavy volume trading with over 19 billion shares traded in the U.S. bourses, the most since the GameStop short squeeze in January 2021. Other technical factors worked to magnify the sell-off, including the rush to cover short positions and meet margin calls.

U.S. Economy

Dominating weekly economic developments was a surge in commodity prices, partly due to the continued inflationary pressures exacerbated by the Russian-Ukraine conflict. Consumers in oil products felt the sting of the sudden rise in oil as crude surged to USD 139 per barrel, its highest level in 14 years. The was the reaction of international markets to the Biden administration’s contemplation of a possible embargo of Russian crude. The U.S. president announced on Tuesday that imports of Russian oil and gas shall be cut off and that American consumers were to prepare for higher gas prices. European nations decided to adopt less stringent measures as they were more reliant on Russian energy imports. By midweek, an official of the United Arab Emirates announced that the UAE was willing to substantially increase oil production, but subsequently, the country’s energy minister appeared to walk back the earlier statement by affirming that the UAE will abide by the existing OPEC production plans.

Most of the economic data released during the week were in line with expectations. The consumer price index rose 0.9% in February and 7.9% over the previous two months, matching market expectations. Weekly job claims registered 227,000 was slightly above expectations but remained at low levels. January job openings exceeded consensus estimates, coming in at 11.26 million; despite drops in the accommodation and food services due to the omicron variant of the coronavirus, the deficit was offset by job openings in other areas. While the data appeared positive, the sentiments of the American consumers remained pessimistic concerning their financial prospects. The preliminary gauge of consumer sentiment tracked by the University of Michigan fell more than expected to a new decade low of 59.7. Principal causes are inflation worries weighed further down by the Russian-Ukraine geopolitical conflict. Amid the continued inflation concerns, the U.S. Treasury yields increased, with supply factors also weighing in such as heavier corporate borrowing and a likely increased debt-issuance by the European Union for energy and defense spending.

Hopefully, if any sign of a de-escalation of the Russian-Ukraine war should be evident, as this remains a fluid situation, it will be highly possible that some of the energy, food, and commodity prices may reverse, and the primary overhand on global markets may be lifted.

Metals and Mining

The Russian-Ukrainian hostilities are about to enter their third week, further escalating the humanitarian crisis. Continued fear and uncertainty have pushed gold prices to new all-time intraday highs, north of $2,000 per ounce. Gold remains at a strong uptrend for the near future, although realistically prices should be expected to consolidate at current levels. Gold continues to serve as a good hedging asset, but the high-risk situation that is pushing gold prices higher – the Russian invasion into Ukraine and the high inflation rates – are not idyllic nor sustainable, and will eventually find a solution that will cause gold prices to contract, therefore care should be taken in using gold as a safe-haven investment.

In the past week, gold ended marginally higher by 0,90%, from $1,970.70 the previous week to $1,988.46 per troy ounce. Silver also inched up by 0.66%, beginning at $25.70 and ending the week at $25.87. Platinum corrected by 4.08% from the close of the prior week at $1,128.07 to the recent close at $1,082.08 per troy ounce. Palladium also followed platinum, ending that past week at $2,807.77 per troy ounce, down by 6.77% from the previous week’s $3,011.50. the 3-month prices for base metals also saw corrections. Copper moved 4.6% down at last Friday’s close of $10,183.50 per metric tonne from the week-earlier close at $10,674.00. Zinc succumbed to a weekly loss of 5.83%, from the prior week’s close of $4,051.00 to this past week’s close of $3,815.00 per metric tonne. Aluminum moved down from $3,849.00 a week ago to this week’s close of $3,483.00 per metric tonne, for a loss of 9.51%. Finally, tin receded from the prior week’s closing price at $47,540.00 to the past week’s $44,100.00 per metric tonne, a drop of 7.24%.

Energy and Oil

With the recent surge in oil prices resulting from the Russian-Ukraine war, oil will likely be headed towards its biggest weekly decline dating back to November 2021 as the governments explore solutions to the speculated supply shortage. U.S. officials have commenced initiatives to secure more oil supply from Venezuela in the future, with the hope of easing the oil hike domestically. The recent U.S. Strategic Petroleum Reserves (SPR) release is also aimed at easing the current supply tightness, with 30 million barrels scheduled to be released over April and May. It is further expected that Russia will supply the needs of Asian buyers even without letters of credit and instead resort to direct telegraphic transfers. The markets will continue to remain constrained in the near future, but there is a general sentiment that the worst-case scenarios will be alleviated.

In the meantime, members of the European Union are discussing the mechanics of an eventual phase-out of Russian fossil fuels. A two-day summit will be held for this purpose in Versailles. In 2021, the EU imported 40% of its gas and 27% of its oil from Russia. The EU intends to be fully independent of Russian gas, oil, and coal, by 2027 at the soonest or 2030 at the latest. In the U.S., top officials of the Biden administration are meeting with Venezuelan President Nicolas Maduro for the first time in years, intending to negotiate a deal to ease sanctions on Petróleos de Venezuela, S.A., the Venezuelan state-owned oil and natural gas company. This is part of the Biden administration’s attempt to condition the easing of sanctions on the PDVSA’s direct oil supply to refiners in the U.S.A.

Natural Gas

For this report week (March 2 to March 9), natural gas spot price movements were mixed. The Henry Hub spot price declined from $4.65 per million British thermal units (MMBtu) at the start of the week, to $4.56/MMBtu at the week’s end. At major hubs this week, prices traded within a narrow band of $1.06/MMBtu. According to data from Natural Gas Intelligence, the price range fell within a high of $5.31/MMBtu at PG&E Citygate in California, and a low of $4.25/MMBtu in New York. Internationally, natural gas spot prices rose again this week due to the unresolved war between Russia and Ukraine, as well as the increasing uncertainty in the European natural gas markets.

In the U.S., prices on the Gulf Coast fell due to warmer temperatures while they remained unchanged in the Midwest with temperatures also remaining warmer than normal. Natural gas prices in the West are mixed with the cooling temperatures. Prices, on the other hand, declined in the Northeast due to warmer-than-normal temperatures and declining natural gas demand. The average supply of U.S. natural gas remains unchanged compared to last week, while average natural gas consumption has dropped across most demand sectors over the past report week. The U.S. LNG exports decreased by one vessel this week compared to the week before.

World Markets

In Europe, share prices rebounded from the declines of the preceding week although trading remained volatile amid inflation fears and geopolitical uncertainties. The gain realized by the week’s end in all likelihood reflects the optimism that a diplomatic resolution may be arrived at by Russia and Ukraine. The pan-European STOXX Europe 600 Index ended 2.23% higher in local currency terms. Germany’s DAX Index rallied 4.07% higher, while France’s CAC 40 Index advanced 3.28%. Italy’s FTSE MIB Index briefly descended into bear market territory during the early part of the week, but later recovered and ended 2.57% higher week-on-week. The UK’s FTSE 100 Index climbed 2.41%. The core eurozone bond yields rose after inflation expectations firmed up. Adding to this is the announcement by the European Central Bank (ECB) that it may wind up its bond-buying program sooner than expected, surprising market participants. The yields of Eurozone periphery bonds shot up, as they were among those that gained the greatest benefits of the ECB’s monetary stimulus, UK gilt yields likewise ascended on the back of rising inflation expectations.

Japan’s bourses receded over the past week, reflecting risk concerns on the continued Russia-Ukraine situation. Global commodity prices surged while central banks began to adopt a more cautious outlook. The Nikkei 225 Index slid by 3.17% while the broader TOPIX Index likewise fell by 2.46%. The yield on the 10-year Japanese government bond increased from the previous week’s 0.15% to this week’s 0.18%. The yen weakened to its lowest level in five years, ending this week at about JPY 115.97 against the U.S. dollar, from JPY 114.82 the previous week. The cause of the devaluation was attributed to policy divergence as the Bank of Japan (BoJ) affirmed its earlier commitment to maintaining a liberal monetary policy. BoJ Governor Haruhiko Kuroda stated the BoJ’s stance against tightening monetary policy and stimulus withdrawal, despite the rising fuel costs and the upward pressure this is exerting on the price of goods traded between companies. The BoJ aims to achieve its 2% inflationary target together with rising wages and corporate profits.

Chinese equities also recorded a loss for the week due to a resurgence in coronavirus cases and the war in Ukraine. Inflationary pressure was felt in the prices of industrial metals and agricultural commodities. The large-cap Shanghai Composite Index fell 3.98% while the blue-chip CSI 300 Index slid by 4.21%. Another rift that weighed on Chinese markets was the possibility that five Chinese companies identified by the U.S. Securities and Exchange Commission would be subject to delisting due to failure to comply with audit requirements. It was late on Friday night when talks reportedly went smoothly between Chinese and U.S. regulators regarding cooperation on audit and regulation that risk markets recovered. The yield on the 10-year Chinese government bond rose to 2.881%, the highest level it has reached in months, before descending to close at 2.836%. The closing price was lower than the previous week’s close at 2.861%, due to fears of inflation and tightening monetary policy. The yuan currency ended unchanged.

The Week Ahead

Inflation, import price, and retail sales data are among the vital economic data to be released in the coming week.

Key Topics to Watch

- Producer price index, final demand

- Empire State manufacturing index

- Retail sales

- Retail sales excluding motor vehicles

- Import price index

- Import price index excluding fuels

- NAHB home builders’ index

- Business inventories (revision)

- FOMC announcement on fed funds rate

- Fed Chair Jerome Powell news conference

- Initial jobless claims

- Continuing jobless claims

- Building permits (SAAR)

- Housing starts (SAAR)

- Philadelphia Fed manufacturing survey

- Industrial production index

- Capacity utilization rate

- Existing home sales (SAAR)

- Index of leading economic indicators

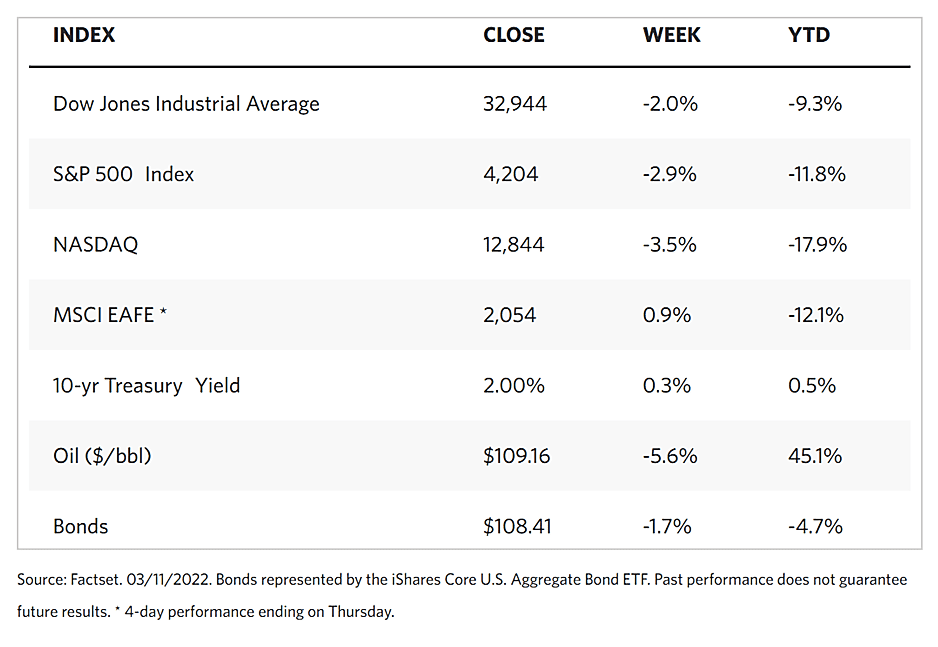

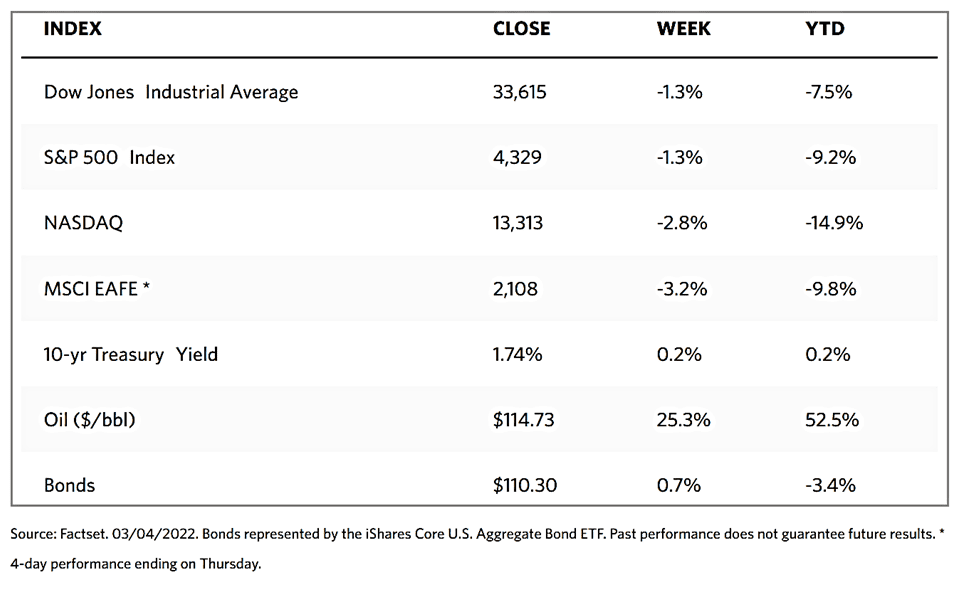

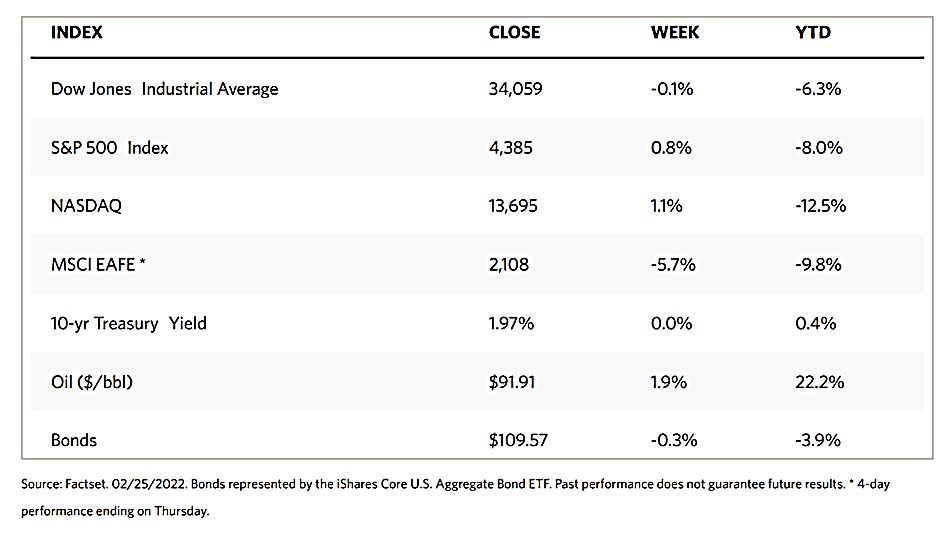

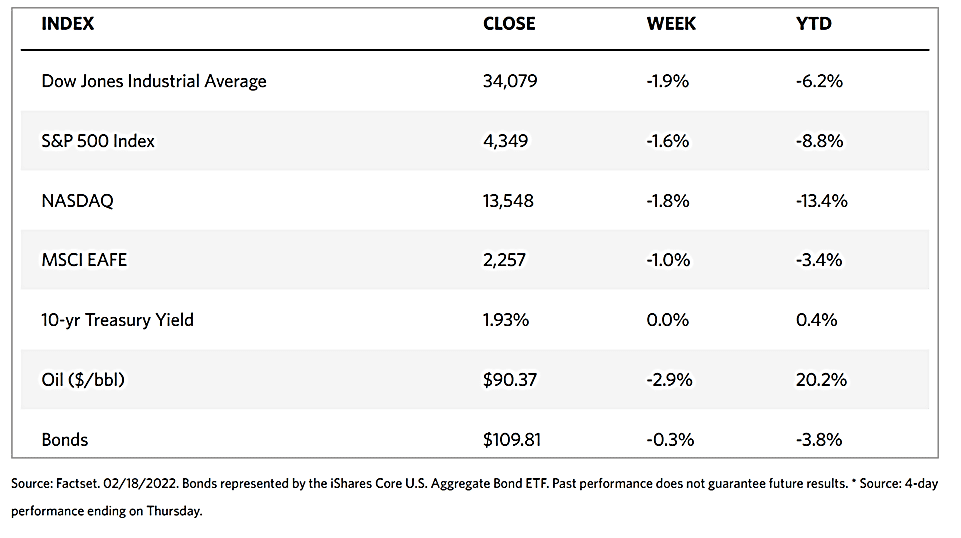

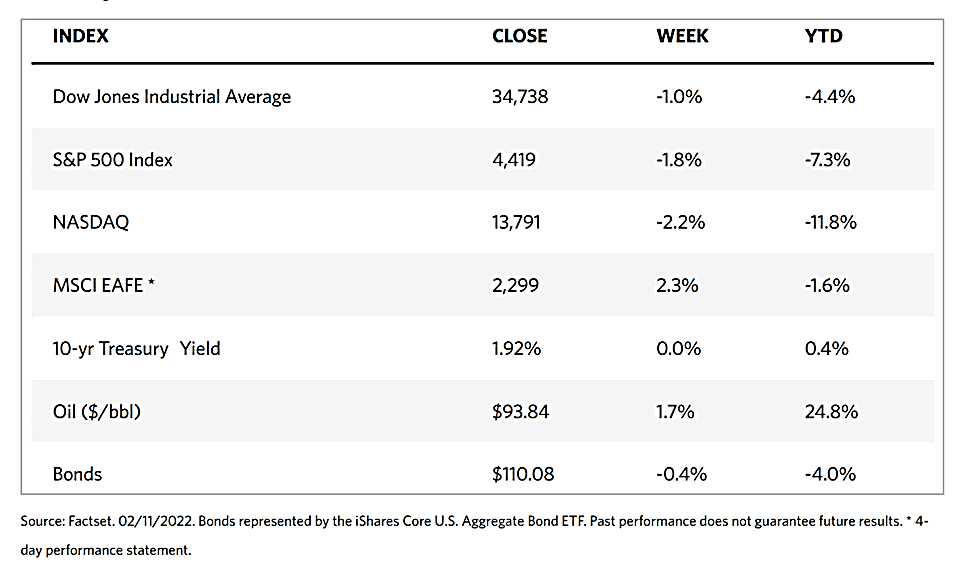

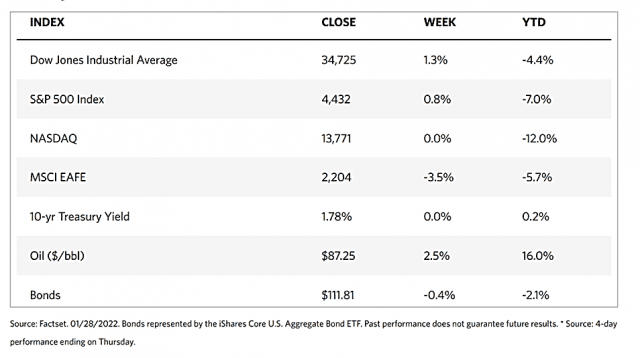

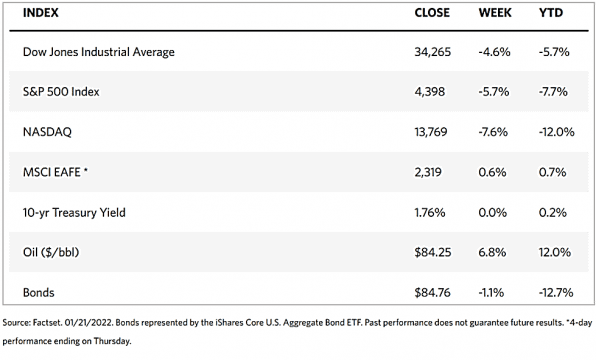

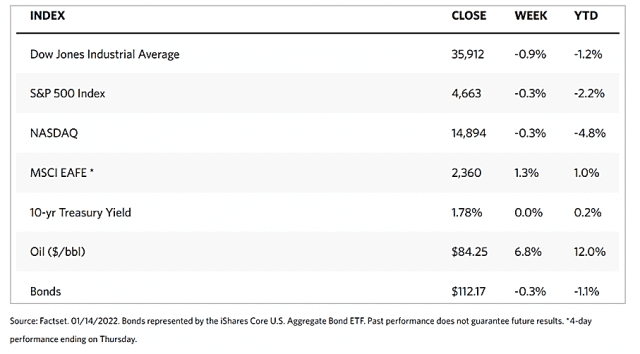

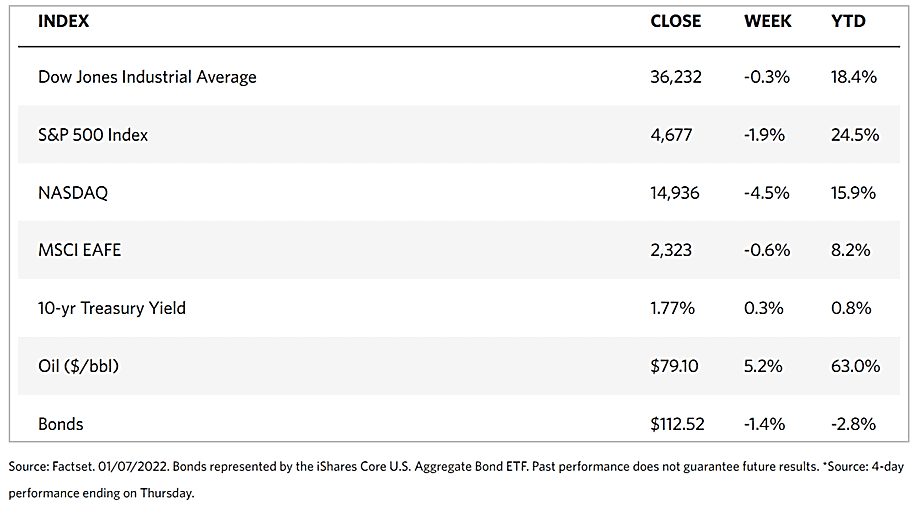

Markets Index Wrap Up