Weekly Market Review – November 30, 2024

Stock Markets

All major indexes are up for the week. The 30-stock Dow Jones Industrial Average (DJIA) inched up by 0.42% while the Total Stock Market gained by 0.52%. The broad S&P 500 Index gained 0.56% and the technology-heavy Nasdaq Stock Market Composite climbed by 0.83%. The NYSE Composite added 0.31% while all the Russell indexes posted gains. The CBOE Volatility Index (VIX), the indicator for investor risk perception, fell by 4.18%.

Stocks recorded another week of solid gains that resulted in record intraday highs for the DJIA, S&P 500 Index, and the S&P 400 MidCap Index. The small-cap Russell 2000 Index hit an intraday high of 2,466.49 on Monday, exceeding the record high it established s little over three years ago. Trading was relatively robust in the runup to the Thanksgiving holiday when the markets were closed in its observance. Markets were also closed on the Friday after the holiday.

During the week, domestic policy and geopolitical factors seem to be the major drivers of sentiment. Monday saw investors welcoming the nomination of Scott Bessent, a veteran hedge fund manager, as President-elect Donald Trump’s Treasury secretary. Bessent is expected to bring a Wall Street mindset to his position, prioritizing economic stability and inflation control with a measured approach to tariffs, easing fears of an out-of-consensus selection.

U.S. Economy

Wednesday saw the release of a host of closely watched economic reports. Most of the data came in line with expectations, but there were some exceptions. In October, personal income rose by 0.6% which is about double consensus estimates. Personal spending climbed by 0.4% which is slightly above expectations. Pending home sales also went against expectations for a decline, and instead rose by 2.0%. In the meantime, September’s increase was revised up to its strongest gain in nearly two years at 7.5%. On the other hand, the manufacturing sector appeared to remain in a slump. Durable goods orders in October missed the expected consensus expectation of 0.5% and rose by only 0.2%. Orders, with the exclusion of defense and transportation goods (a generally accepted proxy for capital investment), fell by 0.2%.

Metals and Mining

The past weeks proved volatile for the gold market, a trend that does not appear to be diminished anytime soon. The yellow metal has been relatively resilient as it holds fast to its critical support level at $2,600 per ounce, but the past week revealed that it is balancing at a major decision point as traders and investors await news that will favor one direction or the other. Presently, the U.S. economy is not running too hot nor too cold – a “Goldilocks” scenario. The current scenario does not decisively attract investors to gold as a hedge against inflation and safe-have asset. Inflation pressures remain stubbornly elevated as seen from the core Personal Consumption Expenditure (PCE) Index reading of 2.8% over the last 12 months. This is much higher than the Federal Reserve’s target of 2%. The PCE is the Fed’s preferred gauge for inflation.

Spot prices for precious metals generally ended lower for the week. Gold, formerly at $2,716.19, closed this week at $2,643.15 per troy ounce, down by 2.69%. Silver, which last week closed at $31.35, settled this week at $30.63 per troy ounce for a loss of 2.30%. Platinum ended last week at $966.30 and this week at $949.90 per troy ounce for a decline of 1.70%. Palladium, which a week ago was priced at $1,011.87, closed this week at $983.09 per troy ounce for a drop of 2.84%. The three-month LME prices for industrial metals were mixed. Copper closed this week at $9,010.50 per metric ton, slightly up by 0.02% from its week-ago close of $9,008.50. Aluminum ended this week at $2,594.00 per metric ton, down by 1.43% from last week’s closing price of $2,631.50. Zinc settled at $3,103.00 this week for a gain of 3.78% over last week’s close of $2,990.00. Tin closed this week at $28,913.00 per metric ton, modestly higher than last week’s close of $28,750.00 by 0.57%.

Energy and Oil

The Thanksgiving holidays disrupted the highly eventual week in the global markets that prompted OPEC+ to postpone its December 1 meeting as it ramped up its shuttle diplomacy. The decision to delay its policy meeting to December 5 was due to members reportedly discussing postponing the anticipated output hike due to start in January 2025, to simultaneously coordinate the future of compensation buts with Iraq and Kazakhstan. ICE Brent traversed a very narrow bandwidth of less than $1 per barrel all week, between $72 and $73 per barrel despite the postponement. Meanwhile, in what proved to be the war’s second-largest attack of the past month, Russia attacked Ukraine’s energy assets with 91 missiles and 97 drones this week. Over 1 million people lost power in the immediate aftermath of the strikes and damages were reported in 9 regions. Geopolitics could make a surprise comeback in December as the Russian-Ukraine war intensifies and Iran comes to the forefront of Trump’s policy move. These developments would complement OPEC+’s decisions and push oil prices higher.

Natural Gas

For this report week from Wednesday, November 13, to Wednesday, November 20, 2024, the Henry Hub spot price rose by $0.24 from $2.10 per million British thermal units (MMBtu) to $2.34/MMBtu. Regarding Henry Hub futures, the price of the December NYMEX contract increased by $0.21 from $2.983/MMBtu at the start of the report week to $3.193/MMBtu at the end of the week. The price of the 12-month strip averaging December 2024 through November 2025 futures contracts rose by $0.13 to $3.227/MMBtu. Natural gas spot prices rose at all major regional pricing locations this report week. Price changes ranged from an increase of $0.03 at the Houston Ship Channel to an increase of $2.45 at the Waha Hub.

International natural gas futures prices rose this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.63 to a weekly average of $14.17/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.90 to a weekly average of $14.38/MMBtu. In the week last year corresponding to this report week (beginning November 15 and ending November 22, 2023), the prices were $16.83/MMBtu in East Asia and $14.41/MMBtu at the TTF.

World Markets

European stocks rose despite the looming uncertainty about U.S. trade tariffs and the future direction of interest rates. The pan-European STOXX Europe 600 Index rose by 0.32% in local currency terms. The major stock indexes were mixed, with Germany’s DAX climbing by 1.57%, Italy’s FTSE MIB falling by 0.70%, and France’s CAC 40 losing by 0.29%. The UK’s FTSE 100 added 0.24%. For a second month in November, the annual inflation in the eurozone accelerated to 2.3% from 2.0% in October, based on a preliminary estimate. The increase in inflation was expected because last year’s declines in energy prices are no longer incorporated in the annual rates. The underlying inflation, however, unexpectedly eased. Core inflation (excluding volatile components such as food, energy, alcohol, and tobacco prices) remained at 2.7% while services’ prices inched down from 4.0% to 3.9%. The European Central Bank is still expected by the financial markets to lower borrowing costs next month, but just by how much remains uncertain. Meanwhile, the German economy continued to struggle in the last quarter of this year based on mixed economic data. Seasonally adjusted retail sales in October decreased by 1.5% sequentially, worse than the forecasted 0.5% drop, and still, the seasonally adjusted number of unemployed rose by 7,000, much less than the forecasted 20,000.

Japan’s stock markets sustained modest losses for this week. The Nikkei 225 Index fell by 0.2% while the broader TOPIX Index lost by 0.6%. The slump in the market was due to global investor risk appetite reacting to geopolitical risk pressures driving demand for assets perceived to be safer. The subsequent strength in the national currency lent support to Japan’s export-heavy industries. The yen strengthened to about JPY 150 against the USD, from the prior week’s JPY 154 range since it is perceived to have the characteristics of a safe-haven asset. Further interest in the yen is bolstered by speculation about the potential timing of the Bank of Japan’s (BoJ’s) next interest rate hike, forecasted to be either in December or January. The core consumer price index (CPI) in the Tokyo area, widely regarded as a leading indicator of nationwide trends, ascended by 2.2% year-on-year in November. This is up from 1.8% year-on-year in October and higher than consensus expectations. BoJ Governor Kazuo Ueda has stressed that interest rates will be increased if the economy and prices perform in line with the central bank’s forecasts. Japan’s Prime Minister Shigeru Ishiba outlined his latest policy vision which he intends to pursue with a new stimulus package aimed at boosting the economy, particularly in rural areas. The package is intended to counter the negative effects of inflation on businesses and households by curbing rising energy costs, providing cash handouts to low-income households, and increasing the tax-free salary threshold to boost disposable incomes.

Chinese stocks rose as the market’s hopes for greater government support offset worries about the potential tariff hike in the U.S. The Shanghai Composite added 1.81% while the blue-chip CSI 300 climbed by 1.32%. The Hong Kong benchmark Hang Seng Index ascended by 1.01%. The People’s Bank of China injected RMB 900 billion into the banking system while leaving the lending rate unchanged at 2%, according to expectations. With RMB 1.45 trillion set to expire in December, the operation resulted in a net withdrawal of RMB 550 billion from the banking system for November. A sharp increase in local government bond issuance will increase liquidity pressures in the banking system toward the end of the year as Beijing increases efforts to stimulate the economy. With tighter liquidity conditions and threats of additional U.S. tariffs, analysts expect that the government will implement further economic consolidation policies by 2025. Regarding China’s economy, profits at industrial firms dipped by 10% in October from last year, narrowing from a 27.1% decline in September. This is the third straight monthly decline, according to the National Bureau of Statistics. The slower drop is partly attributable to the government’s support measures and profit growth in the equipment and high-technology manufacturing industries.

The Week Ahead

Nonfarm payrolls data, the Fed Beige Book, and the ISM PMIs are among the important economic releases scheduled for the coming week.

Key Topics to Watch

- S&P final U.S. manufacturing PMI for Nov.

- ISM manufacturing for Nov.

- Construction spending for Oct.

- Job openings for Oct.

- Auto sales for Nov.

- ADP employment for Nov.

- Louis Fed President Musalem speaks (Dec, 4)

- S&P final U.S. services PMI for Nov.

- ISM services for Nov.

- Factory orders for Oct.

- Fed Beige Book

- Initial jobless claims for Nov. 30

- U.S. trade deficit for Oct.

- U.S. employment report for Nov.

- U.S. unemployment rate for Nov.

- U.S. hourly wages for Nov.

- Hourly wages year over year

- Consumer sentiment (prelim) for Dec.

- Chicago Fed President Goolsbee speaks (Dec. 6)

- Consumer credit for Oct.

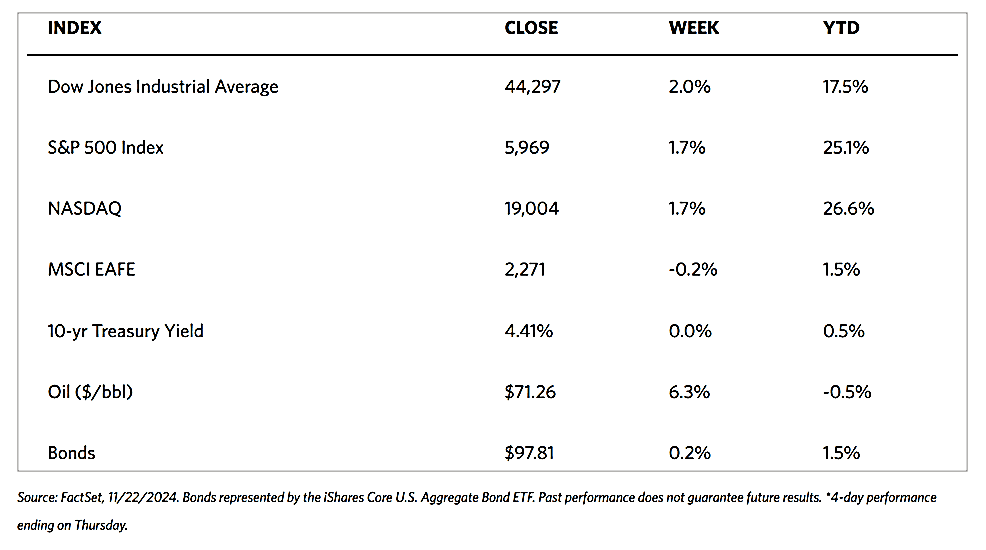

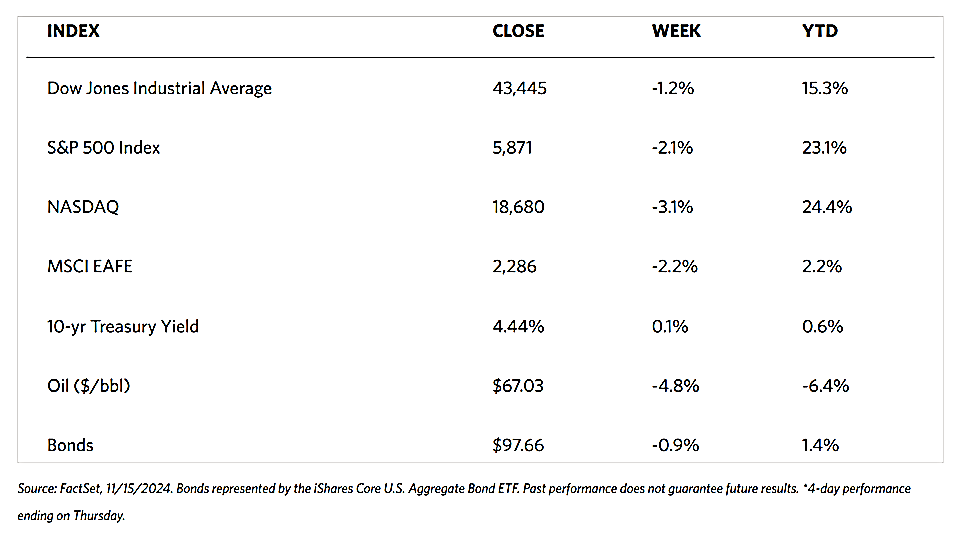

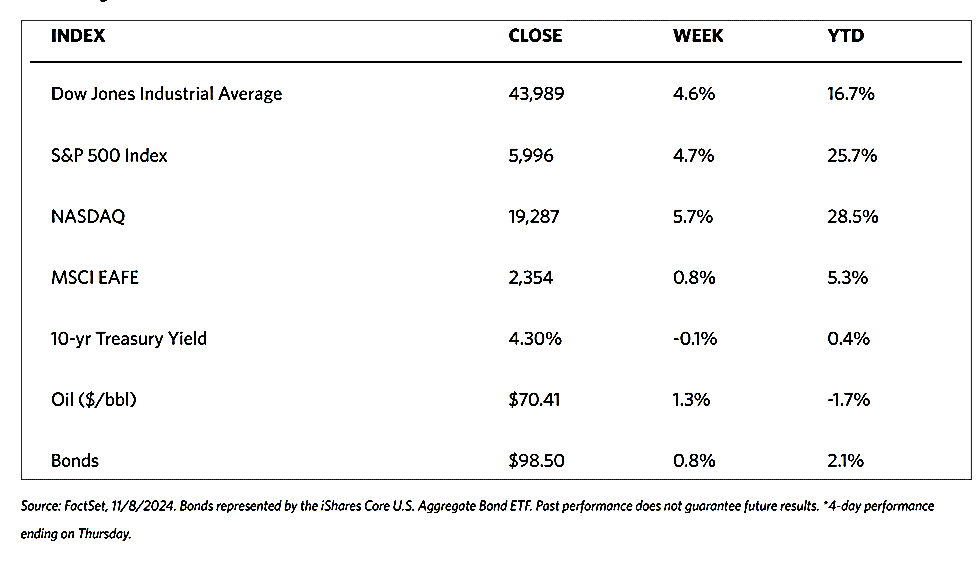

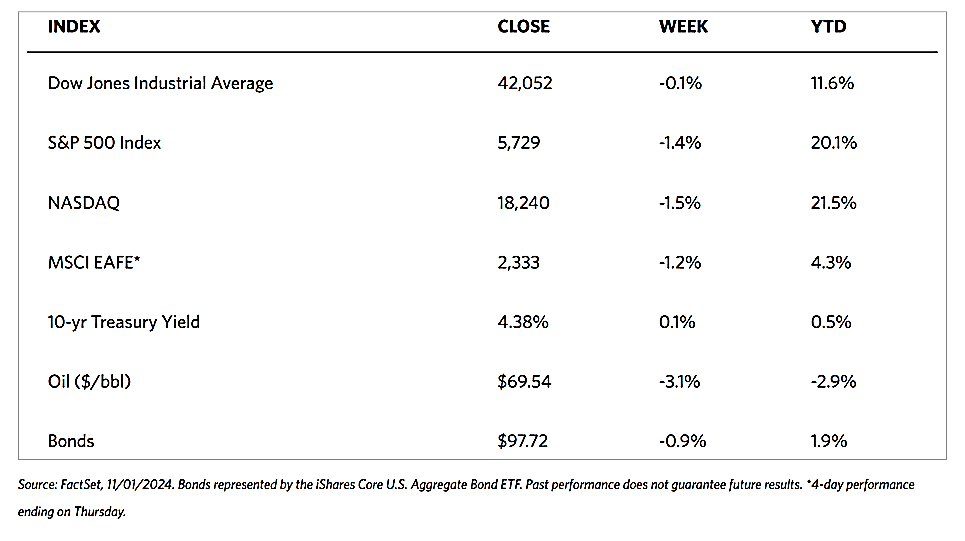

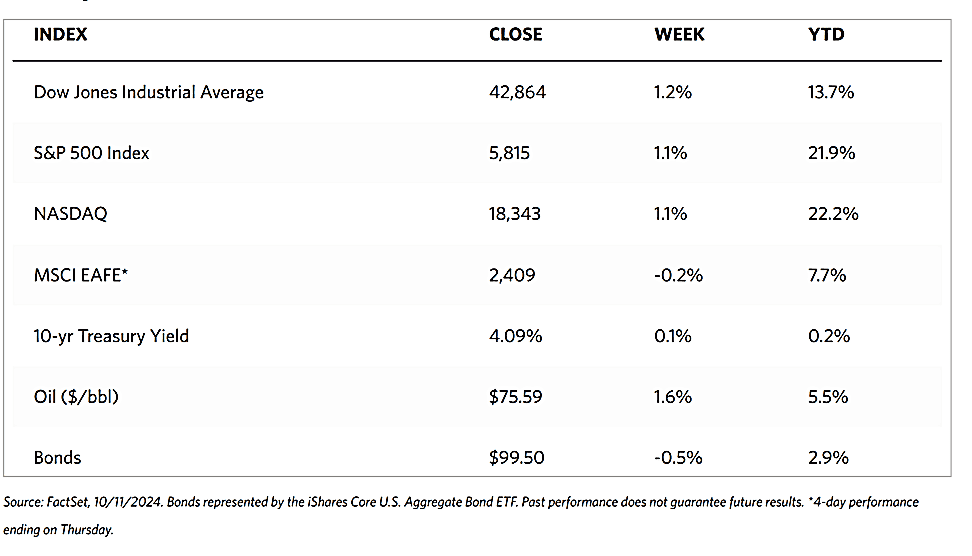

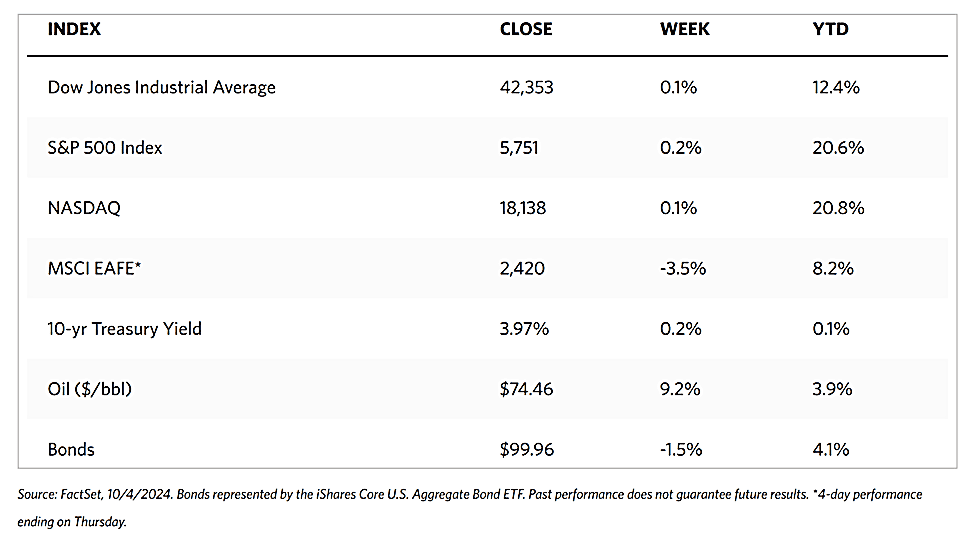

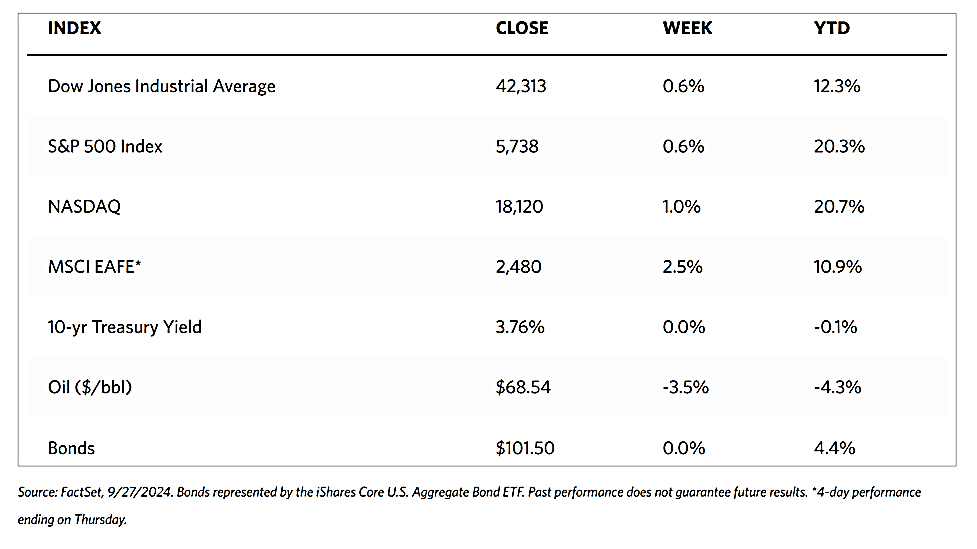

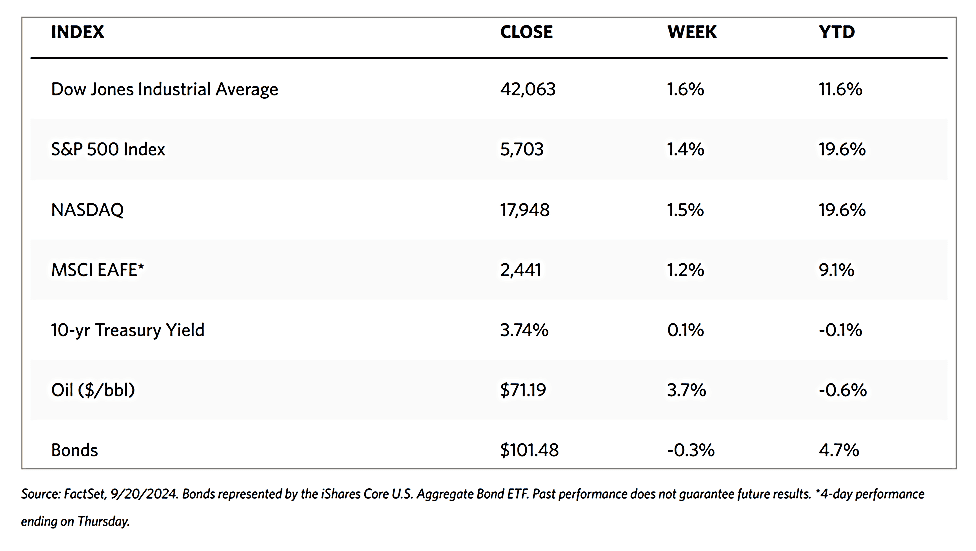

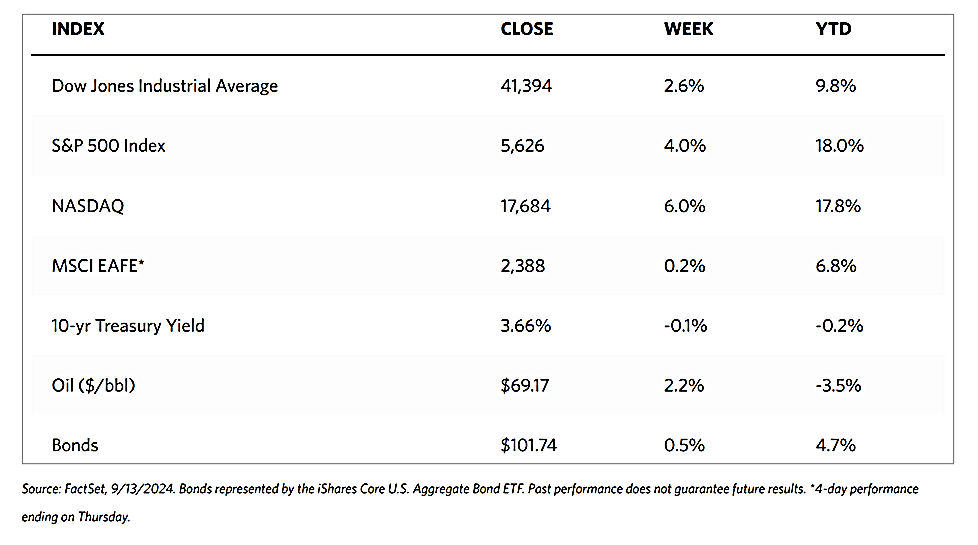

Markets Index Wrap-Up