Weekly Market Review – June 5, 2021

Stock Markets

Trading was truncated this week as markets were closed on Monday in commemoration of Memorial Day. This left major indexes slightly higher for the week with energy shares outperforming other sectors in the S&P 500 Index. The strong performance was attributed to the increase in oil prices to their highest level in two years. Trailing among the sectors were the consumer discretionary shares, pulled down by the decline in Tesla share prices. Volumes traded were light as may be expected during the summer holidays. Buying and selling by retail investors were concentrated among the smaller-cap, consumer-oriented shares popular on social media. Trading particularly heavily and with strong volatility were theater chain AMC shares. There is also some temerity in stock activity as worries about possible inflation increases are still prevalent.

U.S. Economy

Still, the focus of attention was the strengthening economic recovery. The release of the closely monitored monthly nonfarm payrolls report caused a stir on Friday, with the Labor Department reporting the addition of 559,000 jobs in May which was still short of the forecasted 670,000. Job growth may be improving, but recovery is not as speedy as initially estimated. The labor force participation rate also trended lower at 61.6% from 61.7%. There was some good news, though, as the unemployment rate dropped from 6.1% to 5.8%. Average hourly rates grew by half a percentage point, suggesting a contracting labor market. The payroll gains have doubled in May over the preceding month, which signals that hiring momentum may be increasing as the economic reopening gains steam.

- About 7.64 million jobs are still unrecovered compared to pre-pandemic levels, thus there is still much room for expansion in the labor market. There is every reason to believe that the job growth rate will continue to increase for the coming years as jobs lost to the pandemic will return. So far, the strongest gains in hiring are emanating from the leisure and hospitality sectors (292,000) and the education sector (144,000). These were the hardest-hit sectors during the pandemic, suggesting an upturn in the last sectors to have lagged.

- Continued economic expansion may be driven by increased consumer spending resulting from the rise in wages and employment. While the rise in average hourly wages is encouraging in this respect, it also cannot be dismissed that it may also contribute to rising inflation. It is highly improbable at this point, however, that a wage-price spiral may occur because of the depressed income and employment levels during the pandemic. At present, however, the float of stimulus money and current labor shortage may prompt the Federal Reserve to adopt tighter monetary policies to get ahead of inflationary pressures. Although the prospects of increasing inflation may not be dismissed, neither does it seem imminent, thus it is unlikely that the Fed may prematurely impose excess liquidity tightening measures.

Metals and Mining

For most of May, gold prices trended upwards to rise above $1,900 per ounce, an uptrend that prevailed until the end of the month. As of June, however, it appears that the uptrend has been interrupted and prices began to descend. The unemployment report released during the week indicated less than 400,000 applications, prompting worries of more stringent monetary policies by the Federal Reserve. The price of gold plunged to $1,860 per ounce before pulling back higher to close the week at $1,894.96. There is still significant upside, however, since the historic ratios for gold miners’ valuations vs. the price of gold are still multiples ahead.

Silver traded sideways for the last trading session of May, beginning the week at $27.77 per ounce and proceeding higher the following way to $28.44. Pressure then took over to send the metal down to $27, ending the week at $27.77. Platinum also dropped 2.4% for the week that saw prices at their lowest in two months. Despite holding above the $1,160 level for most of May, it dipped to $1.138 per ounce during the week but ended Friday at $1,157.70. Its importance in the production of clean energy suggests that higher prices may be forthcoming. Palladium held above $2.700 per ounce for the week, a correction from its all-time high in May. It ended the week at $2.732, largely on concerns regarding supply issues since palladium is a catalyst metal.

Base metals mirrored the lackluster performance of the precious metals group. Copper moved closer to $10,212.50 per tonne on the first trading day of June, but traded south below $10,000 two days later and ended the week at $9,967. The pullback was not entirely unexpected, although the dips were met with bargain hunting, indicating possible upwards movement after some consolidation. Zinc traded above $3,000 until Wednesday, but Thursday onward saw it drop to end the week on Friday at $2,977.50. The price of Nickel climbed in the last two weeks of May, From $16,781, it rose 8% to $18,147 on the first of June. On Friday, it was valued at $17,945. Finally, lead traded sideways during the week, beginning at $2.208 per tonne, touched $2,228.50 by midweek, and closed Friday at $2,193.50.

Energy and Oil

OPEC+ has drained global inventories worldwide and sent oil prices soaring during the week. While part of the bullish sentiment is due to anticipation of the pandemic’s end, it was also triggered by the likelihood that the US may not agree to a resumption of the Iran nuclear deal. Oil appears to be gearing for a breakout above $70 per barrel as players begin to see this as a sustainable level.

Further signaling threats to oil supply is the suspension by the US of new leases in the Arctic National Wildlife Refuge (ANWR). The suspension may trigger moves toward litigation, but even with this, the ANWR may remain suspended for some time as legal proceedings unfold. Canadian oil has also come under pressure from shareholders to reduce its emission levels which are presently higher than that of US-based companies. Analysts estimate that nearly half of all Canadian oil production has pledged to net-zero emissions in the future. Colombian oil is also under threat as violent anti-government protests threaten the country’s security. Road blockades related to the political unrest are impacting the Colombian petroleum industry as well as the country’s economic recovery in general.

Natural Gas

The prices of liquid natural gas (LNG) are rising together with the strengthening demand. For the second consecutive week, Asian spot prices climbed to return to their highest levels since January driven by strong demand from China and Europe. LNG trade reached record highs last year at the same time its global trade volume soared to peak levels, despite a slowdown in the growth rate resulting from the pandemic. For the report week, May 26 to June 2, natural gas spot price movements were mixed on listless trading. The Henry Hub spot prices increased to $3.05 per million British thermal units (MMBtu) from $2.88/MMBtu at the start of the week. The June 2021 NYMEX contract expired on June 2 at $2.984/MMBtu. The July 2021 contract price rose by $0.05/MMBtu to $3.075/MMBtu during the week. The 12-month strip averaging July 2021 through June 2022 futures contracts were priced at $3.049/MMBtu, higher by $0.05/MMBtu.

World Markets

Optimism prevailed in the European bourses as the prospects of continued economic recovery grew brighter. However, investors’ concerns are growing that the central banks may deem inflationary pressures were intensifying to the point that they may withdraw stimulus sooner than originally anticipated. The pan-European STOXX Europe 600 Index closed on Friday 0.80% higher than last week’s close. Italy’s FTSE MIB outperformed the other indexes, rising 1.59%. Germany’s Xetra DAX Index added 1.11% to last week’s close, while France’s CAC 40 Index rose by 0.49%. The UK’s FTSE 100 Index also gained, by 0.66%. The core eurozone bond yields lost ground as did the peripheral European bond markets which tracked the core. UK gilt followed US Treasury yields higher.

Stock trading in Japan was mixed over the past week as the Nikkei 225 Index slid by 0.71% and the broader TOPIX Index rose by 0.60%. Investor sentiment was tepid as the government extended the coronavirus state of emergency in Tokyo, Osaka, and seven other prefectures to the 20th of June. The Japanese 10-year government bond remained unchanged at 0.08%. Regarding currencies, the yen closed lower against the US dollar at JPY 110.18. Over the longer term, the OECD revised Japan’s economic growth projections upward, to 2.6% in 2021 and 2.0% in 2022. Japan’s GDP per capita is expected to return to its pre-pandemic levels by the third quarter of 2021.

China’s stock market corrected slightly for the week after three weeks of continuous gains. The benchmark Shanghai Stock Exchange dipped lower by 0.2% while the large-cap CSI 300 Index slid slightly further by 0.7%. In May, foreign investors poured money into Chinese stocks and bought up $8.7 billion worth of equities, making this the highest single-month gain in foreign stock investments this year. The bond market’s yield paused in its downtrend. The 10-year Chinese government bond (CGB) yield increased by 2 basis points to 3.11%; compared to other major government bond yields, this modest rise appeared relatively high. Bloomberg’s local currency index for CGBs over the last six months returned 3.4%; comparatively, the spread for 10-year U.S. Treasury yields contracted by almost 100 points.

The Week Ahead

Investors can look forward to the release of the consumer price index (CPI), hourly earnings, and consumer credit reports in the coming week.

Key Topics to Watch

- Consumer credit

- NFIB small-business survey

- Trade deficit

- Job openings

- Wholesale inventories

- Initial jobless claims (regular state program)

- Consumer price index

- Core CPI

- Business formations (year-over-year change)

- Household wealth (year-over-year change)

- Federal budget

- Consumer sentiment index (preliminary)

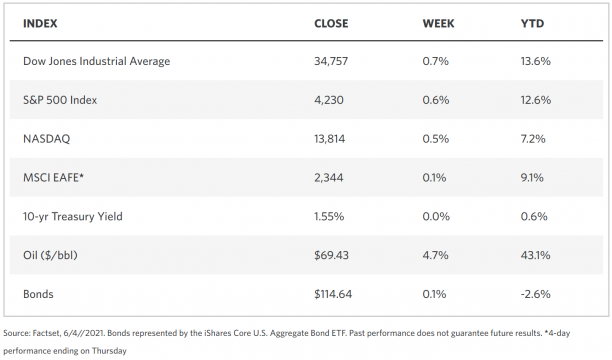

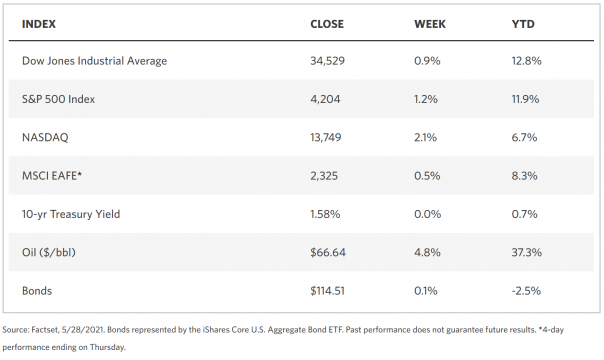

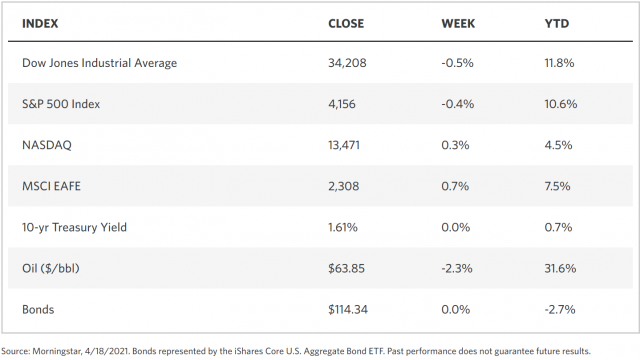

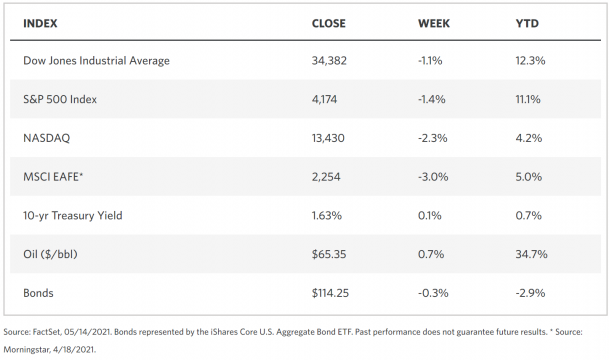

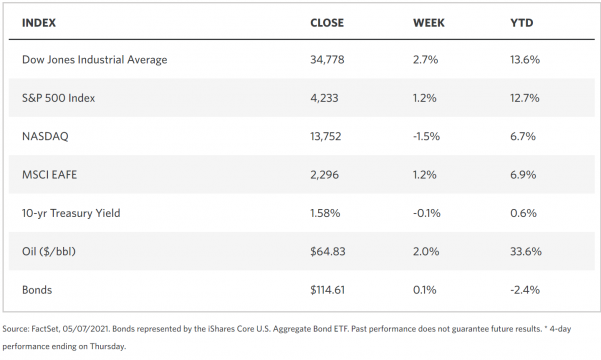

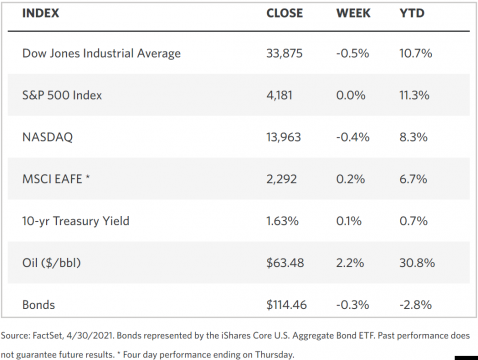

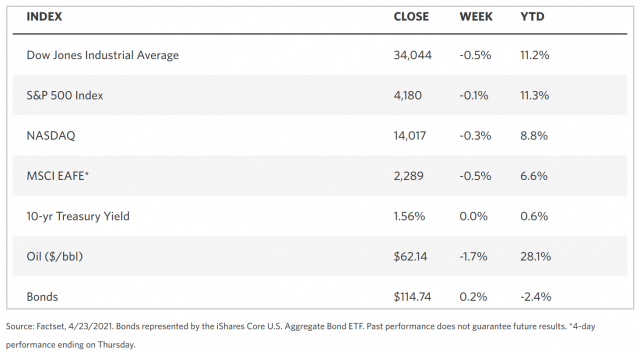

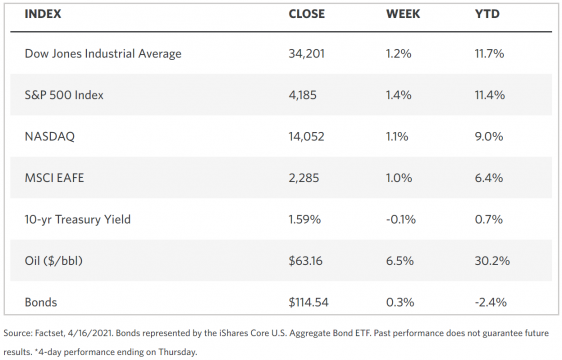

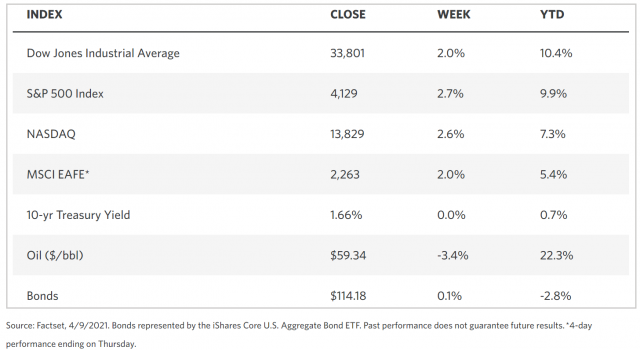

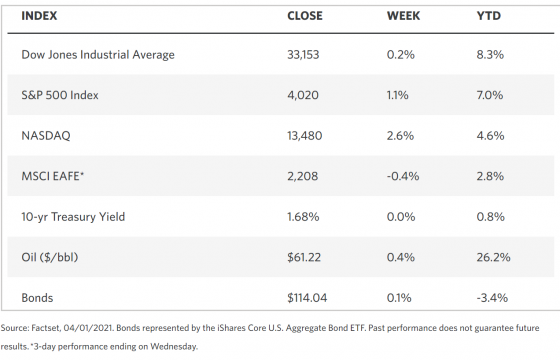

Markets Index Wrap Up