Weekly Market Review – August 14, 2021

Stock Markets

Investors generally discounted news of the continued spread of COVID-19 and its impact on future economic expansion. Equities climbed, with value stocks listed in the S&P 500 Index outperforming the growth stocks. Materials led other sectors in their advance, while energy stocks dipped on worries that oil producers may break ranks on the supply side and demand may be ill-affected by the continuing global coronavirus lockdowns. Information technology stocks also slumped due to the potential weakness in memory prices exerting downward pressure on the semiconductor and semiconductor-equipment industry. Much of the attention of players was on the latest inflation numbers from the Bureau of Labor Statistics, together with the release of other U.S. economic data announcements. The consumer price index (CPI)) rose by 0.5% in July, which is a drop from June’s 0.9% CPI growth; it is also the smallest monthly percentage growth rate registered since March. The gradual drop in the inflation rate appears to confirm the speculation that consumer price increase will only be temporary and will ease as the economy adjusts its supply chain bottlenecks caused by the pandemic. There is some concern, however, that the producer price index (PPI) grew by 1.0% sequentially for the second month in a row, which is higher than most economists anticipated.

U.S. Economy

The data released by the Bureau of Labor Statistics in the past week revealed a record high in job openings, higher than the number of unemployed. Nevertheless, more than 3 million people have exited the labor pool from the beginning of the coronavirus pandemic. It is expected that with the accelerated vaccine roll-out, the reopening of face-to-face classes, and the expiration of enhanced unemployment benefits in the fall, the labor-force participation rate will return to pre-pandemic levels and a return to full employment will be expedited by record job gains.

- The 2020 bear market and economic recession were triggered by a public health crisis that, unfortunately for analysts, does not have a precedent upon which to base a comparative study. The financial crisis brought about by the pandemic triggered speedier and bigger fiscal and monetary support compared to earlier recessions. The Fed promptly provided funding and liquidity to businesses and consumers alike, at the same time expanding its balance sheet over four months by more than $3 trillion. By comparison, during the global financial crisis of 2008, the Fed likewise added the same amount to its balance sheet, but over a four-year duration.

- During the time of the pandemic, almost $6 trillion of financial aid was released by the government. In the past week, the Senate passed the much-awaited bipartisan infrastructure bill. If the Democrat-led $3.5 billion reconciliation package, which is focused on human infrastructure spending, will push through as proposed, government expenditure will expand further and add to GDP growth. If the pattern set by the global financial crisis is any indication, increased government spending may drag economic growth down as it did during the early years of post-financial crisis economic recovery.

Metals and Mining

Early in the week, gold prices plunged to a four-month low but recovered in the latter part of the week, ending at $1,779.75, 0.95% higher than its previous close at $1,763.03 per ounce. The volatility of gold prices was attributed to a stronger-than-expected U.S. jobs report and the investors’ rush to buy the dollar in reaction to the job report release. This is consistent with the inverse relationship that exists between the dollar and gold prices. When the dollar strengthens against other currencies, gold tends to recede because it becomes more expensive in other currencies, pushing demand down. The recovery from the early weakness showed the resiliency of the metal, as analysts attributed the sell-off to the buying of U.S. dollars and selling of gold in the Asian market in response to the strong U.S. payrolls for July. It is possible for gold to trend lower in the future, however, because a gradual increase is expected in U.S. 10-year real yields, the opportunity cost of holding gold, a non-yielding asset, increases. Investors would not forego interest earnings in high-yielding assets by continuing to hold onto gold, and so a sell-off is likely.

Although gold retained its positive gains, silver fell by 2.38% from its previous close of $24.33 per ounce to end the week at $23.75. Other metals still registered gains for the week. Platinum gained 4.93%, rising from $983.58 to $1.032.08 per ounce for the week. Palladium closed at $2,649.96 per ounce this week, up 0.80% from last week’s close at $2.628.80. Base metals did relatively well for the week. Copper closed up 1.08% at $9,570.00 per tonne from its earlier close at $9,468.00. Zinc likewise gained, moving up 1,68% from $2,983.50 per tonne to $3.033.50. Aluminum rose 0.85% from $2,578.00 to $2,600.00 per tonne. Finally, tin gained 1.65% to close the week at $35,324.00 per tonne from the previous week’s close at $34,750.00.

Energy and Oil

Crude prices performed remarkably well over the past week. Brent remained above the $70 per barrel support even as covid fears continue to rise in the U.S. and China. The rising crude prices were of sufficient concern for the U.S. such that President Joe Biden called on OPEC+ to drill more and increase production to arrest the further rise in oil prices. The IEA downgraded its demand forecast for the rest of 2021, aware that the economic recovery in Asia may not be as robust as previously expected. But other analysts foresee crude prices to continue their ascent, possible to average $80 per barrel by the fourth quarter of this year, optimistic that the impact of the Delta variant will be short-lived and the demand and supply well-balanced until the year’s end.

Natural Gas

In this report week (August 4 to August 11), natural gas spot price movements were mixed and volatile. The Henry Hub spot price dropped from $4.12 per million British thermal units (MMBtu) to $4.07/MMBtu through the week. The price of the September 2021 New York Mercantile Exchange (NYMEX) contract lost $0.10, ending at $4.059/MMBtu from the previous $4.158/MMBtu. The price of the 12-month strip averaging September 2021 through August 2022 futures contracts dipped $0.04/MMBtu to $3.819/MMBtu

World Markets

Trading in European shares was robust and the indexes rose in response to investors’ optimism in the recovering economy. Overall, concerns about impending surges in the coronavirus Delta strain infections and the slowing economic response in Asia appear to have been discounted. The pan-European STOXX Europe 600 Index rose 1.25% for the week. Italy’s FTSE MIB Index surged 2.51%, the German Xetra DAX Index climbed 1.37%, and France’s CAC 40 Index ascended 1.16%. The UK’s FTSE 100 Index gained 1.34% on the back of strong corporate earnings and the decline of the British pound against the U.S. dollar. The tendency is for U.S. stocks to rise as the pound descends since many companies whose stocks are listed in the index are multinationals earning revenues in overseas markets.

The core eurozone bonds moved sideways, climbing midweek and dropping on signs that the European Central Bank may remain dovish in the short term. The peripheral eurozone bond yields mirrored the core eurozone bond movements but were slightly weaker. UK gilt yields were relatively unchanged, rising toward the week’s end on the emergence of strong second-quarter economic data. This drove speculations that the Bank of England may withdraw its stimulus sooner than expected.

The Japanese stock market charted modest gains through the trading week. The Nikkei 225 rose 0.56% while the broader TOPIX Index ended with a gain of 1.40%. Investors continued to shy away on prospects that Japan’s coronavirus situation may deteriorate further, thus magnifying economic risks as the government imposed tighter restrictions. The second-quarter economic growth data is expected to be released soon, highlighting expectations that Japan is likely to have avoided a contraction due to its slow vaccination drive. The yield on the 10-year Japanese government bond climbed to 0.02% as the yield remained unchanged at JPY 110.29 against the U.S. dollar.

In China, stocks gained modestly even as worries continued to prevail regarding the government’s increasing oversight. The government’s regulatory pressure over the country’s technology and private education industries are feared to likely spread over the other sectors. The large-cap CSI 300 Index gained 0.5% for the week, while the benchmark Shanghai Composite Index rose by 1.7%. The yield on the 10-year government bond increased 6 basis points to 2.90% in China’s bond market. The renminbi remained unchanged versus the U.S. dollar. The official trade-weighted currency index was close to a five-year high. The index measures the renminbi’s value relative to a basket of foreign currencies.

The Week Ahead

Among the important economic data to expect this week are Housing Starts, Retail Sales Growth, and the Leading Indicators Index.

Key Topics to Watch

- Empire State manufacturing index

- Retail sales

- Retail sales ex-autos

- Industrial production

- Capacity utilization

- Business inventories

- NAHB home builders’ index

- Building permits (SAAR)

- Housing starts (SAAR)

- FOMC minutes

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Philadelphia Fed manufacturing index

- Index of leading economic indicators

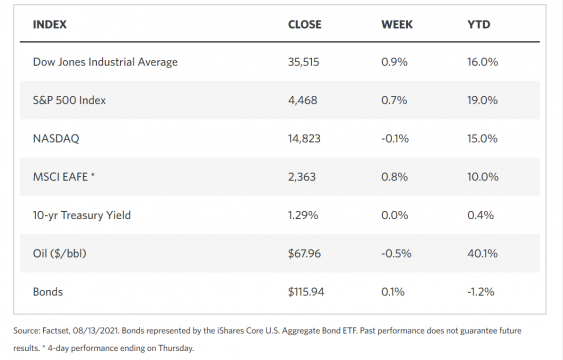

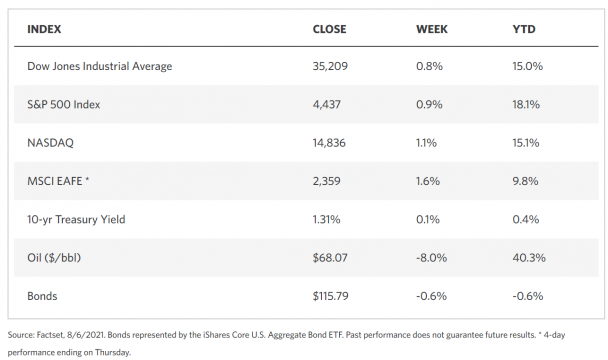

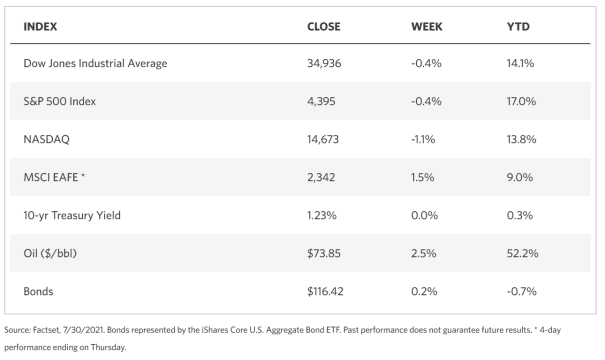

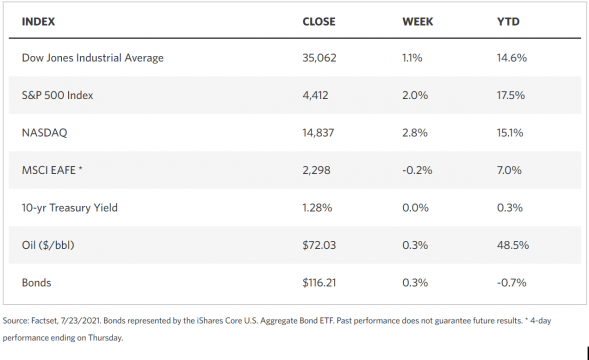

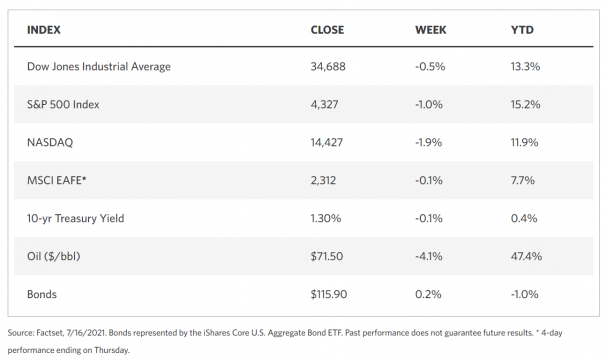

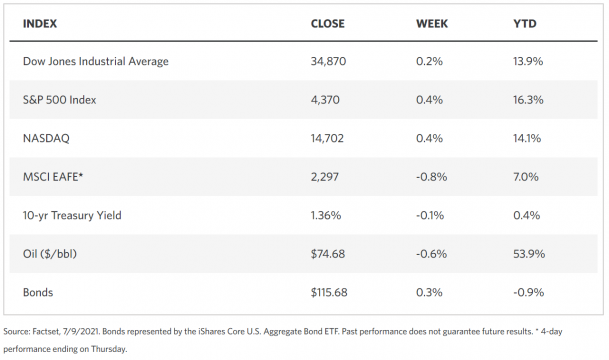

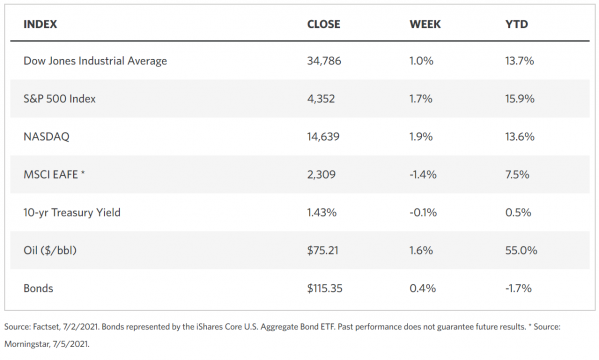

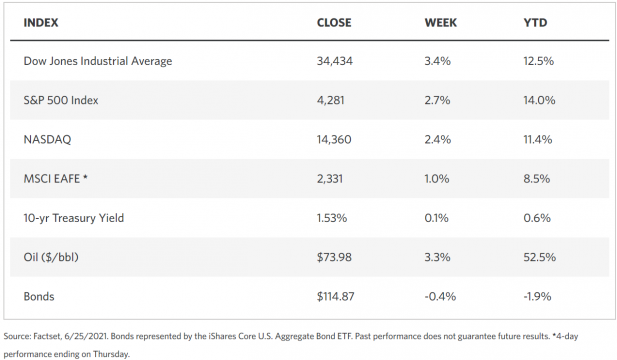

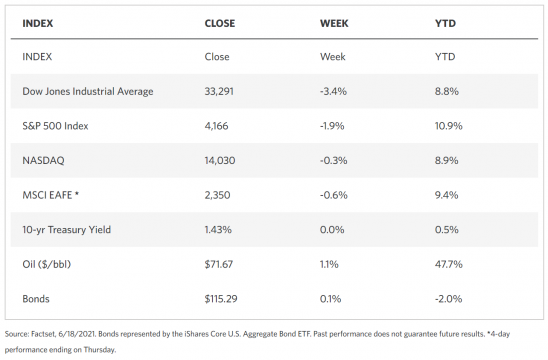

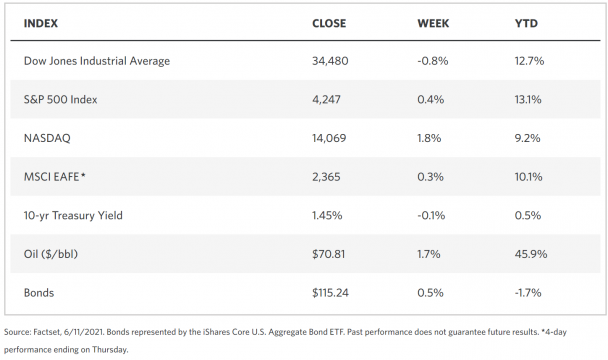

Markets Index Wrap Up