Weekly Market Review – May 11, 2024

Stock Markets

Stocks are moving toward record highs albeit on light volumes, The 30-stock Dow Jones Industrial Average (DJIA) climbed by 2.16% for the week while the Dow Jones Total Stock Market advanced by 1.77%. The broad-based S&P 500 Index added 1.85% where midcaps climbed farther than small caps. Meanwhile, the technology-tracking Nasdaq Stock Market Composite gained by 1.14%, the NYSE Composite rose by 2.05%, and the Russell 1000, 2000, and 3,000 indexes all saw gains. The CBOE Volatility Index (VIX), which measures investor risk perception, declined by 6.97%. The quiet trading week found little impetus in a generally light economic calendar, although certain individual stocks moved in reaction to first-quarter earnings releases.

Corporate profits remain one of the most important determinants of long-term market returns. Last week, the S&P 500 extended its gains for the month and is now less than 1% off its record high. Over the past three weeks, the rebound was driven by a better-than-expected earnings season. Now the first-quarter earnings season is coming to an end, which signifies that the market will once more look to inflation data and Fed policies. Inflation and possible rate cuts by the Federal Reserve will continue to dominate the narrative across financial markets as participants continue to address a “higher-for-longer” interest rate environment.

U.S. Economy

Economic news was generally light throughout the week, except for the weekly jobless claims that were higher than expected and caused a market reaction. In the week ended the previous Wednesday, 231,000 claimed unemployment benefits, the highest level since August. In addition, continuing claims rose to 1.79 million, breaking a four-week downward streak. These developments were taken by investors and analysts as signs that the broader economy might be cooling. Friday appears to have brought confirmation of this. The University of Michigan reported that its preliminary index of consumer sentiment in May fell unexpectedly to 67.4, down from a final reading of 77.2 in April. This marks the indicator’s lowest level in six months. The survey’s chief researcher noted, “While consumers had been reserving judgment for the past few months, they now perceive negative developments on a number of dimensions.” The report surmised that consumers expressed concerns that unemployment, inflation, and interest rates were moving in an unfavorable direction in the year ahead.

Metals and Mining

The gold market saw a robust performance this week, which was mostly perceived by fund managers and market analysts as the continuation of official sector demand that may significantly dominate the marketplace for the foreseeable future. Emerging market central banks have been setting a record pace by purchasing more than 2,000 tons of gold in the last two years. Unlike developed market central banks, the emerging market economies have felt the need to diversify their sovereign debt holdings and exposure to the U.S. dollar. However, the buying pressure is not felt solely among central banks. According to the World Gold Council’s monthly central bank data, the State Oil Fund of the Republic of Azerbaijan bought three tons of gold over the first quarter of 2024. This is a revelation that sovereign wealth funds and other non-traditional players may drive demand in the gold market, which may have a significant impact on the price of the precious metal.

Spot prices of precious metals were firmly up for the week. Gold gained 2.55% over its close last week at $2,301.74 to end the week at $2,360.50 per troy ounce. Silver advanced by 6.10% from last week’s close at $26.56 to rest at this week’s closing price of $28.18 per troy ounce. Platinum registered a 4.20% gain to close this week at $997.63 per troy ounce from last week’s close at $957.44. Palladium ended the week higher by 3.76% from its close last week at $944.49 to its close this week at $980.03 per troy ounce. The three-month LME prices of industrial metals also did well in this week’s trading. Copper, which closed at $9,910.00 per metric ton this week, rose to $10,004.00 for a 0.95% gain. Aluminum, which ended at $2,551.50 last week, was last traded at $2,529.50 per metric ton this week, for a slight decline of 0.86%. Zinc, last priced at $2,903.00 a week ago, gained 0.95% this week to end at $2,930.50 per metric ton. Tin gained by 0.34% from its closing price last week at $31,983.00 to end this week at $32,093.00 per metric ton.

Energy and Oil

After several weeks of decline, oil prices are one more gaining upward traction. Some bullish sentiment is resulting from falling U.S. crude inventories and robust Chinese imports. China’s oil imports have climbed year-over-year to approximately 10.88 million barrels per day last month. This is a 5.5% increase compared to April 2023, with refinery activity boosted by improving manufacturing activity as well as high-flying activity during the Labour Day holiday. Since early April, Brent futures are poised to register their first weekly gain and are moving closer to $85 per barrel. This trend is further strengthened by Israel’s Rafah operation and the easing of the U.S. labor market where jobless claims were the highest in eight months.

Natural Gas

For the report week from Wednesday, May 1 to Wednesday, May 8, 2024, the Henry Hub spot price rose by $0.38 from $1.63 per million British thermal units (MMBtu) to $2.01/MMBtu. Regarding the Henry Hub futures, the price of the June 2024 NYMEX contract increased by $0.255, from $1.932/MMBtu at the start of the report week to $2.187/MMBtu by the week’s end. The price of the 12-month strip averaging June 2024 through May 2025 futures contracts rose by $0.087 to $2.967/MMBtu.

International natural gas futures prices rose during this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.16 to a weekly average of $10.46/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.70 to a weekly average of $9.77/MMBtu. In the week last year corresponding to this week (from May 3 to May 10, 2023), the prices were $11.28/MMBtu in East Asia and $11.61/MMBtu at the TTF.

World Markets

European equities gained positive territory over this trading week. The pan-European STOXX Europe 600 Index advanced by 3.01% higher in local currency terms, on better-than-expected corporate earnings. Also, a driving factor was increased optimism that major central banks would soon start cutting interest rates. Major stock indexes likewise surged. Italy’s FTSE MIB climbed by 3.06%, France’s CAC 40 Index added 3.29%, and Germany’s DAX advanced by 4.28%. The UK’s FTSE 100 Index gained 2.68% to a new record high. The UK economy expanded by 0.6%, much stronger than expected, in the first quarter of 2024. It technically exited the recession that began in the second half of 2023, according to a first estimate from the Office for National Statistics or ONS. The growth was supported by increases in production and an expansion in services. Furthermore, the Bank of England signaled that it is considering cutting interest rates in June. According to economists, a decision to lower borrowing costs in June is likely as long as the labor market and services inflation data in the next two months do not surprise significantly on the upside.

Japan’s equities suffered marginal losses, on the back of hints by Bank of Japan (BoJ) Governor Kazuo Ueda that the central bank could raise interest rates early. Japan’s Nikkei 225 Index and the broader TOPIX Index closed slightly lower this week over last week’s close. The BoJ may raise interest rates should there emerge upside risks to the price outlook, given that inflation may have become more susceptible to the effects of weakness in the yen. At present, U.S.-Japan interest rate differentials remain very high, prompting some observers to believe in the likelihood of another interest rate hike to support sustainable yen appreciation. Over the week, the yen fell to a high-JPY157 range versus the U.S. dollar, from a previous JPY 153. This was despite a common observation among market participants that authorities had recently intervened on two occasions in the foreign exchange markets to prop up the yen, as suggested by the accounts of the BoJ. The yield on the 10-year Japanese government bond closed the week broadly unchanged close to a six-month high at approximately 0.9%. Participants in BoJ’s April meeting were shown to be turning extremely hawkish. However, signs of weakness in economic data may delay these possible rate hikes. For instance, real (adjusted for inflation) wages fell 2.5% in March year-on-year, worse than the 1.8% drop in February.

China’s stock markets registered gains for the week, buoyed by hopes of economic recovery following holiday spending during the previous week’s Labor Day holiday. The Shanghai Composite Index advanced by 1.6% while the blue-chip CSI 300 rose by 1.72%. The Hong Kong benchmark Hang Seng Index shot up by 2.64%. Tourism revenue over the five-day holiday increased by 7.6% compared to the 2023 holiday and surpassed pre-pandemic levels, as shown by data from the Ministry of Culture and Tourism. Domestic revenue was also higher this year by 12.7%, and international trips picked up as well. Box-office sales were registered at RMB 1.53 billion which is approximately the same as last year. However, average spending per traveler declined by 11.5% from 2019, indicative of consumers remaining cautious about spending. Regarding trade, China’s exports rose by 1.5% in April from a year ago, higher than the 7.5% decline in March. While European shipments fell, exports to Southeast Asian nations improved, and sales to the U.S. remained roughly the same. Imports advanced by 8.4% in April which is better-than-expected, reversing the 1.9% decline in March. These importation changes were attributed by analysts to increased raw materials shipments rather than improved consumer demand. The overall trade surplus increased from $58.55 billion in March to $72.35 billion in April.

The Week Ahead

Included among the important economic reports scheduled for release this week are CPI and PPI inflation results, retail sales data, and business inventories for March.

Key Topics to Watch

- Fed Vice Chair Philip Jefferson and Cleveland Fed President Loretta Mester together on panel (May 13)

- Producer price index for April

- PPI year-over-year

- Core PPI for April

- Core PPI year-over-year

- Fed Gov. Lisa Cook speaks (May 14)

- Fed Chair Jerome Powell speaks (May 14)

- Consumer price index for April

- CPI year-over-year

- Core CPI for April

- Core CPI year-over-year

- U.S. retail sales for April

- Retail sales minus autos for April

- Empire State manufacturing survey for May

- Home builder confidence index for May

- Business inventories for March

- Minneapolis Fed President Neel Kashkari speaks (May 15)

- Fed Gov. Michelle Bowman speaks (May 15)

- Initial jobless claims for May 11

- Philadelphia Fed manufacturing survey for May

- Housing starts for April

- Building permits for April

- Import price index for April

- Import price index minus fuel for April

- Industrial production for April

- Capacity utilization for April

- New York Fed President Williams speaks (April 16)

- Fed Vice Chair for Supervision Michael Barr testifies (April 16)

- Cleveland Fed President Loretta Mester speaks (April 16)

- Atlanta Fed President Raphael Bostic speaks (April 16)

- U.S. leading economic indicators for April

- Fed Governor Christopher Waller speaks (April 17)

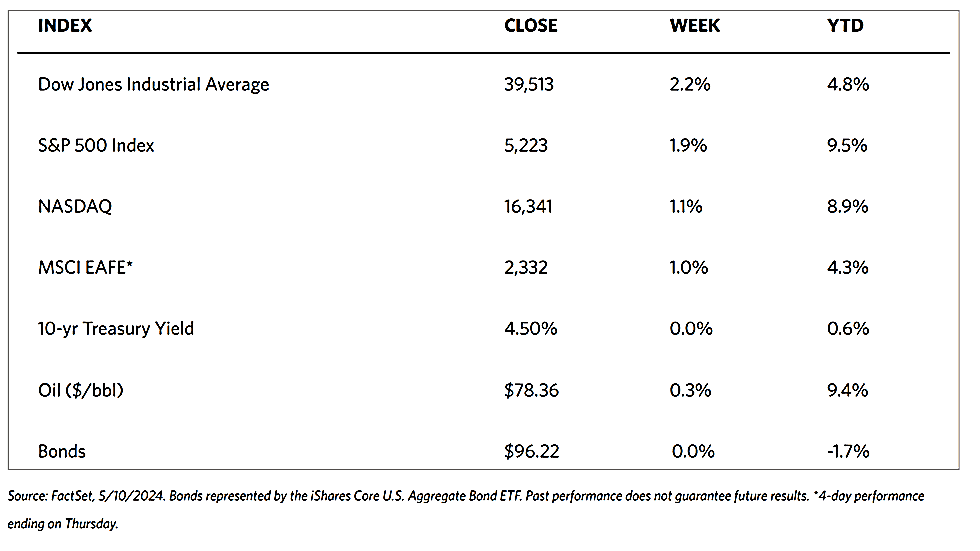

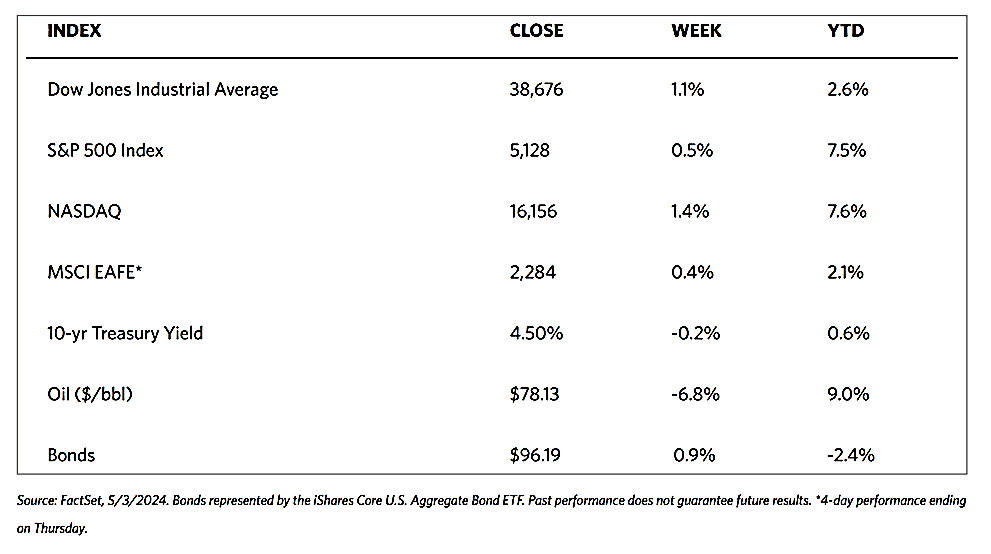

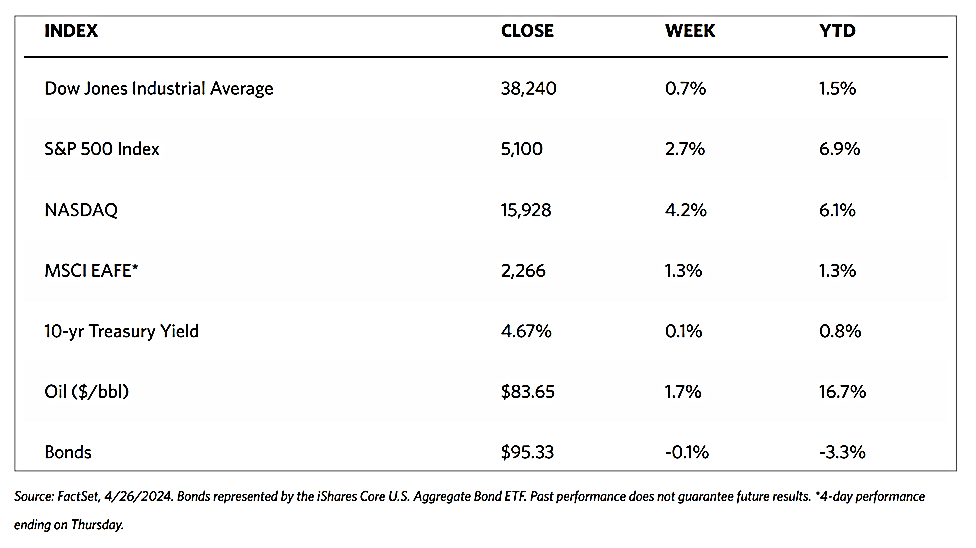

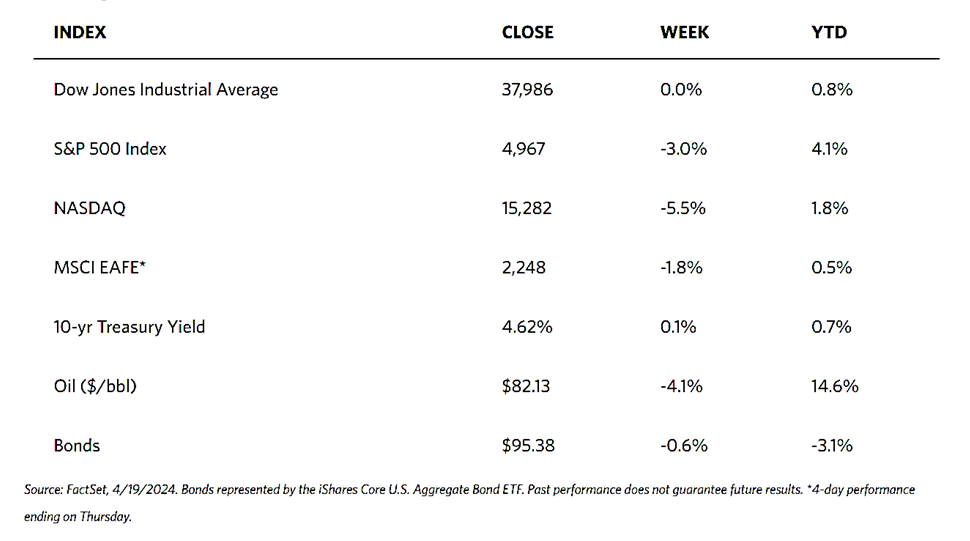

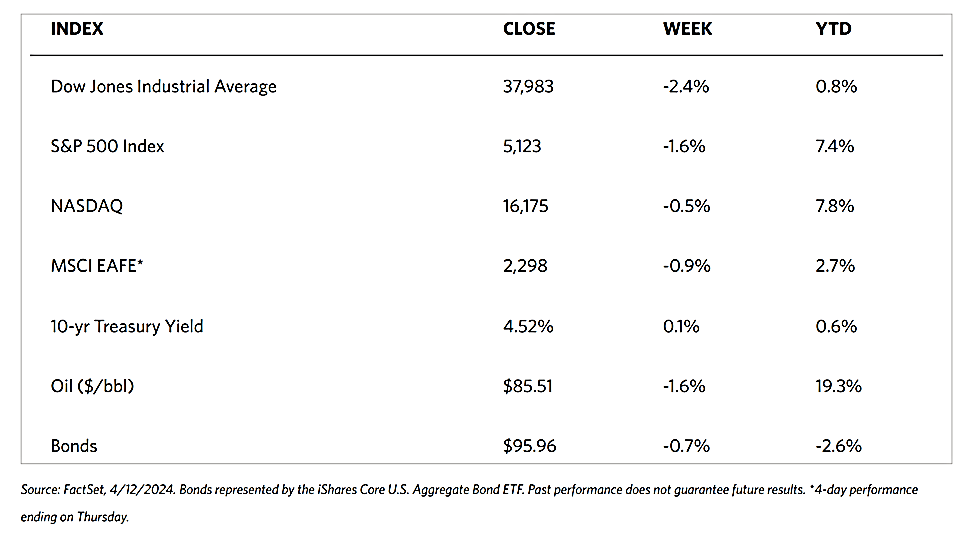

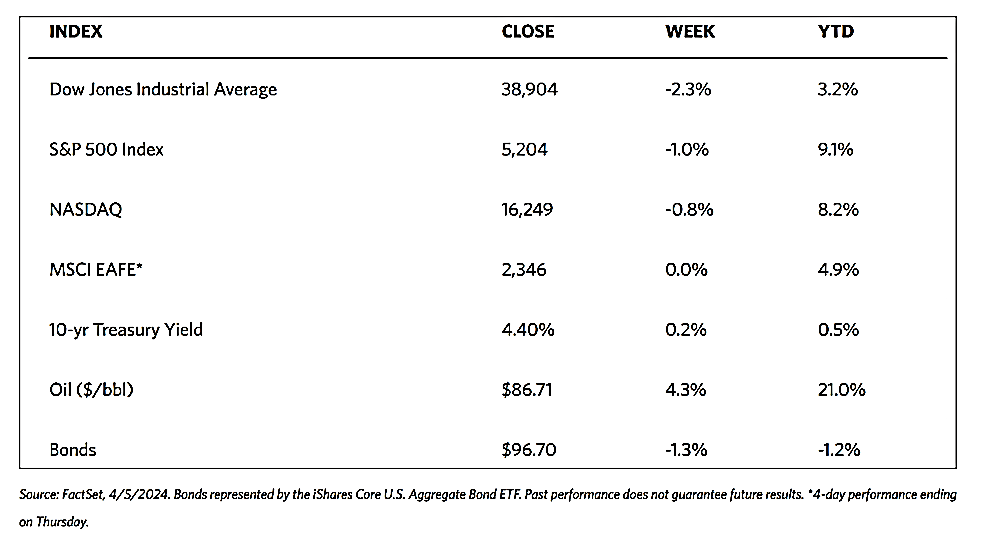

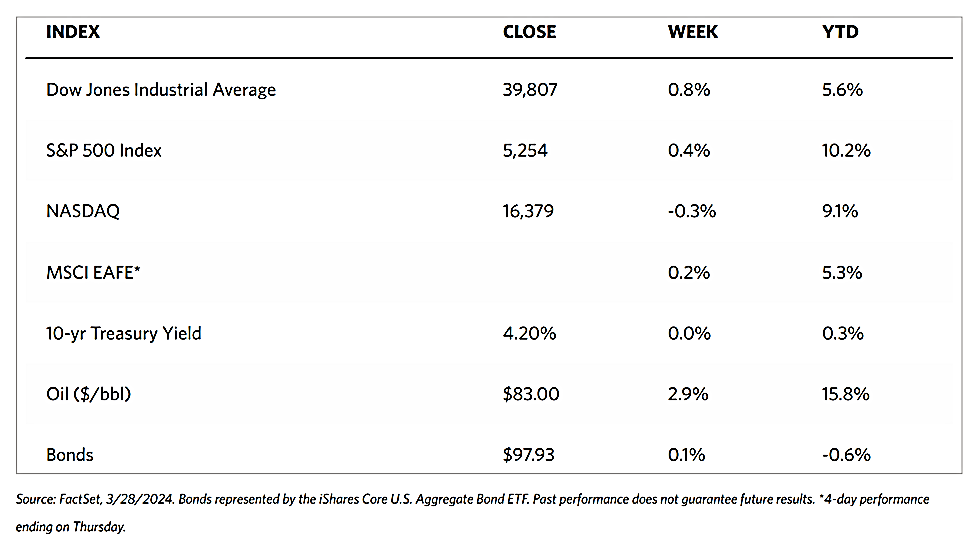

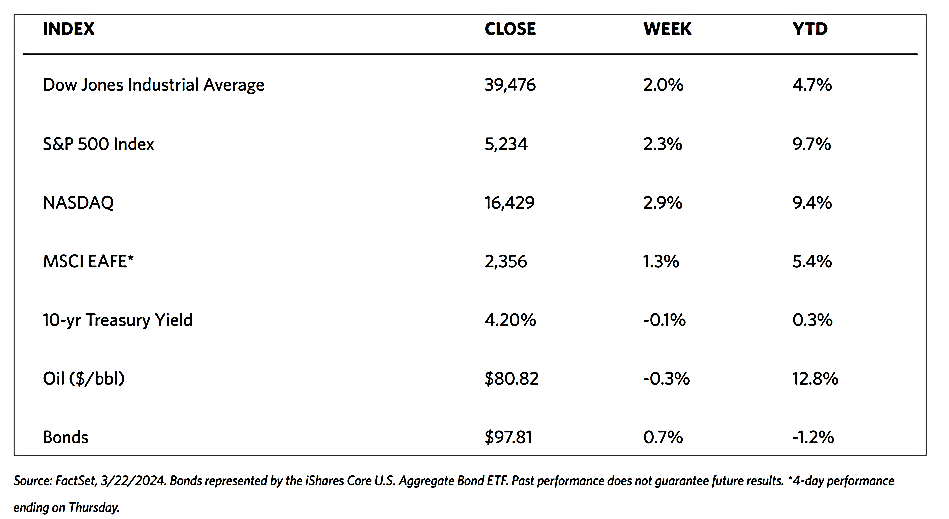

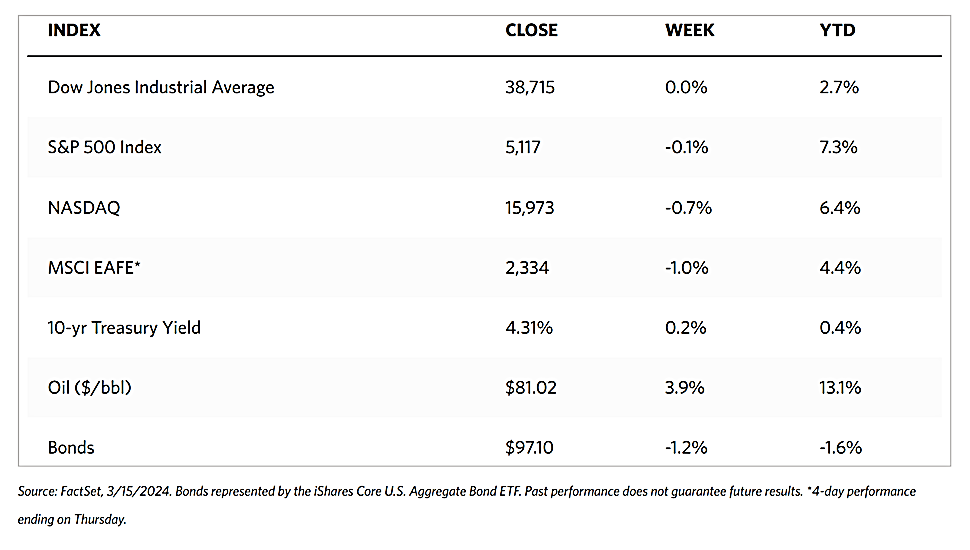

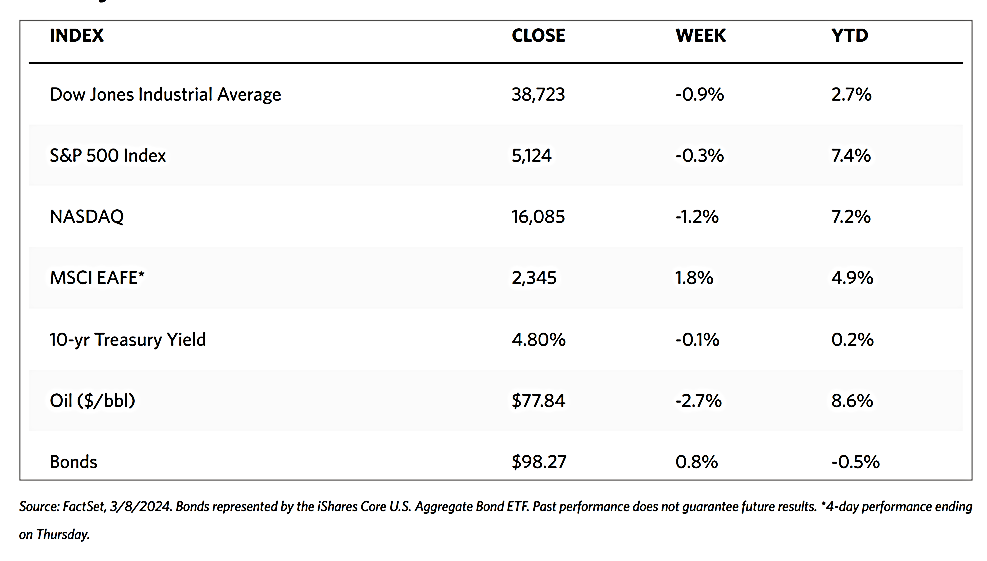

Markets Index Wrap-Up