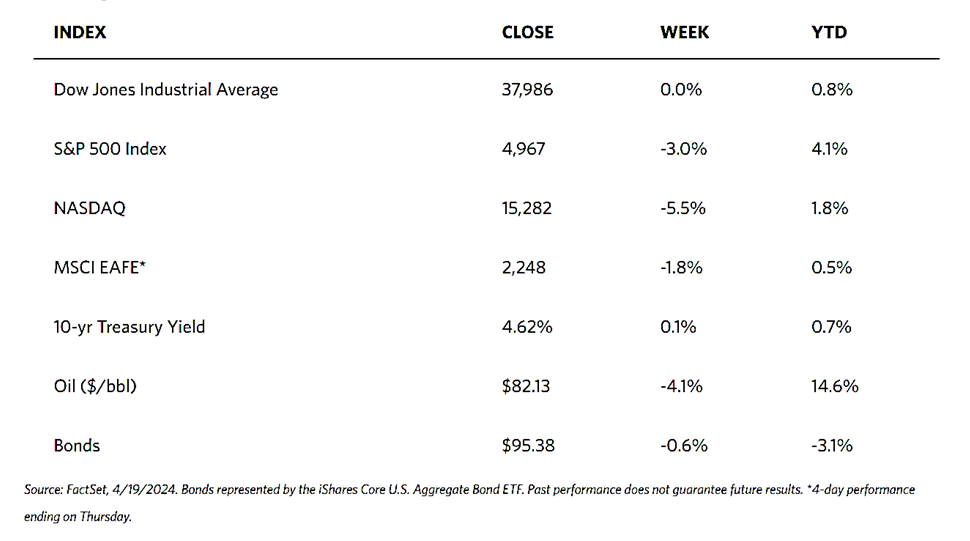

Weekly Market Review – April 20, 2024

Stock Markets

Most major stock indexes are down for the week, except for the 30-stock Dow Jones Industrial Index (DJIA) which gained a slim 0.01%. All broader indexes lost ground and incurred losses. The Dow Jones Total Stock Market plummeted by 3.07% while the broad S&P 500 Index lost 3.05%. The technology-heavy Nasdaq Stock Market Composite plunged even deeper by 5.52%, and the NYSE Composite slumped by 1.02%. The inventor risk-perception indicator CBOE Volatility Index (VIX) rose by 8.09% for the week, suggestive of the heightened volatility expected in the market.

This is the third consecutive week of broad losses as concerns continue to mount over tensions in the Middle East. Furthermore, fears that interest rates may remain “higher for longer” continue to weigh on investor sentiments. As rising rates placed a higher theoretical discount on future earnings, mega-cap technology shares lagged, as the plunge by the Nasdaq this week showed. Advanced chipmaker supplier ASML Holdings missed its first-quarter revenue target, and this fact appears to weigh on the sector and general optimism toward companies with artificial intelligence (AI)-related earnings.

Relief that Iran’s well-telegraphed retaliatory strike on Israel did not result in worst-case scenarios probably prompted more optimistic trading when the week began. However, when the Israeli war cabinet decided to retaliate “clearly and forcefully,” stock prices tumbled on Friday when Israel conducted strikes on air defense facilities in Iranian territory as well as on Iran-backed groups in Iran and Iraq.

U.S. Economy

Strong economic data that were released during the week seemed to increase concerns among investors that the Federal Reserve would push back interest rate cuts, previously hinted to take place in June, to instead take place in the fall, or worse, in 2025. The Commerce reported on Monday that retail sales rose by 0.7% in March, which is well above consensus expectation of about 0.3%. February’s gain was revised upward to 0.9%. Partly at work were rising gas prices (note, the data was not adjusted for inflation), but the robustness was broad-based and included healthy gains in discretionary categories like bars, restaurants, and online retailers. On the other hand, there were downward surprises in housing market data. These may have advanced fears of growing inflation by signaling further tightness in supply. These include housing starts and permits in March which came in well below expected volumes and declined from February, with housing starts falling to the lowest level in seven months. The level of existing home sales also declined, although it did so mostly in line with expectations, as the average 30-year mortgage rate climbed above 7% for the first time since December.

Metals and Mining

Despite the stellar performance of gold and silver, the spot prices of precious metals ended mixed. Gold ascended by 2.03% from its closing price last week at $2,344.37 to its closing price this week at $2,391.93 per troy ounce. Silver ended trading this week at $28.69 per troy ounce, 2.91% above last week’s close of $27.88. Platinum, which ended last week at $976.74, closed this week at $935.54 per troy ounce for a decline of 4.22%. Likewise, palladium fell by 2.00% from its week-ago closing price of $1,052.45 to this week’s close at $1,031.38 per troy ounce. The three-month LME prices of industrial metals ended mostly on the upside. Copper came from last week’s price of $9,457.50 to end this week at $9,876.00 per metric ton, chalking up a 4.43% increase. Aluminum climbed by 7.02% this week from last week’s close at $2,494.00 to end week at $2,669.00 per metric ton. Zinc ended this week at $2,852.00 per metric ton, 0.83% higher than last week’s close of $2,828.50. Tin, which last traded at $32,353.00 one week ago, ended this week at $35,582.00 per metric ton, for a gain of 9.98%.

Energy and Oil

Oil prices exhibited increased volatility in recent trading sessions, which was largely attributable to the heightened risks surrounding the Israel-Iran conflict. Brent prices ratcheted above $90 per barrel on initial reports of Israeli strikes on Iranian soil. They plunged back to $86 per barrel after Tehran dismissed any serious impacts that the strikes were alleged to have caused. Due to these most recent and pressing concerns, the reimposition of oil sanctions on Venezuela was foregone for the meantime by the market as the U.S. Department of State let its 6-month waiver to allow Venezuela to freely trade its crude expire. The Department of State claimed that President Maduro failed to fulfill his pre-election commitments and provided oil companies a 45-day grace period to wind down operations in the country.

Natural Gas

For the report week beginning Wednesday, April 10, to Wednesday, April 17, 2024, the Henry Hub spot price fell by $0.38 from $1.88 per million British thermal units (MMBtu) to $1.50/MMBtu. Regarding the Henry Hub futures, the price of the May 2024 NYMEX contract decreased by $0.173, from $1.885/MMBtu at the start of the report week to $1.712/MMBtu at the week’s end. The price of the 12-month strip averaging 2024 through April 2025 futures contracts declined by $0.059 to $2.769/MMBtu.

International natural gas futures prices rose this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.62 to a weekly average of $10.19/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $1.15/MMBtu to a weekly average of $9.73/MMBtu. For comparison, in the week last year corresponding to this report week (week beginning April 12 and ending April 19, 2023), the prices were $12.56/MMBtu in East Asia and $13.35/MMBtu at the TTF.

World Markets

European stocks traded lower this week as the pan-European STOXX Europe 600 Index closed lower by 1.18% than last week, due to rising tensions in the Middle East. The major indexes in the region were mixed. While France’s CAC 40 Index was little changed, Italy’s FTSE MIB rose by 0.47% and Germany’s DAX dipped by 1.08%. The UK’s FTSE 100 declined by 1.25%. The lackluster performance of UK stocks may be partly accounted for by the annual consumer price growth rate reported at 3.2%. This should have been cause for celebration since the inflation rate fell to its lowest level in two and a half years, but the reported slowdown fell short of expectations forecasted by analysts and the Bank of England (BoE). In the broader Europe, several European Central Bank (ECB) policymakers at the IMF meeting reiterated that the likely target date for lowering borrowing costs is in June, provided there were no further unexpected economic shocks. ECB leadership emphasized, however, that the policy should correspond to incoming economic data, such as oil prices which the ECB is monitoring “very closely.”

Japanese equities suffered a deep sell-down last week amid the rise in geopolitical tensions in the Middle East and the uncertainties attendant to them. The Nikkei 225 Index plunged by 6.2% while the broader TOPIX Index declined by 4.8%. Another contributor to the stock sell-off is concern that AI-related demand is waning sooner than expected. In fixed-income investing, the yield on the Japanese government bond closed the week broadly unchanged from the week before, at around 0.84%. The Bank of Japan (BoJ) Governor Kazuo Ueda reprised comments he has made before that a rate hike may be warranted should weakness in the yen exert significant upward pressure on inflation. Although speculation continues regarding potential intervention by Japanese authorities in the currency markets to prop up the yen, no such move was taken. The U.S., South Korean, and Japanese leaders nevertheless met to discuss current conditions in the foreign exchange markets, with a sharp focus addressing the sharp depreciation of the Japanese yen and the South Korean won.

After the economy expanded by more than expected during the last quarter, the Chinese stock market rallied. The Shanghai Composite Index climbed by 1.52% while the blue-chip CSI 300 added 1.89% for the week. The Hong Kong benchmark Hang Seng Index declined by 2.89% as investor sentiment was dampened by the escalating geopolitical tensions in the Middle East. China’s GDP grew by an above-consensus 5.3% year-on-year for the first quarter of this year, accelerating modestly from the 5.2% growth in last year’s fourth quarter. The economy grew by 1.6% on a quarterly basis, rising from the fourth quarter’s 1.4% expansion. Other data, though, provided a mixed picture of the economy. In March, industrial production grew by 4.5% from a year earlier, which is lower than expected. This is down from the 7% growth achieved in the January to February period. The retail sales for March expanded by a lower-than-expected rate of 3.1% from a year ago, due to seasonal factors such as the slowdown of catering and auto revenue after the Lunar New Year Holiday. Although property investment fell by 9.5% year-on-year, fixed asset investment rose by more than forecasted in the first quarter from a year ago.

The Week Ahead

The first-quarter GDP report and the PCE inflation data are among the important economic releases to look forward to this week.

Key Topics to Watch

- S&P flash U.S. services PMI for April

- S&P flash U.S. manufacturing PMI for April

- New home sales for March

- Durable-goods orders for March

- Durable-goods minus transportation for March

- Gross Domestic Product (GDP) for the first quarter

- Initial jobless claims for April 20

- Advanced U.S. trade balance in goods for March

- Advanced retail inventories in March

- Advanced wholesale inventories in March

- Pending home sales in March

- Personal income (nominal) in March

- Personal spending (nominal)

- PCE index

- PCE (year-over-year)

- Core PCE index

- Core PCE (year-over-year)

- Consumer sentiment (final) for April

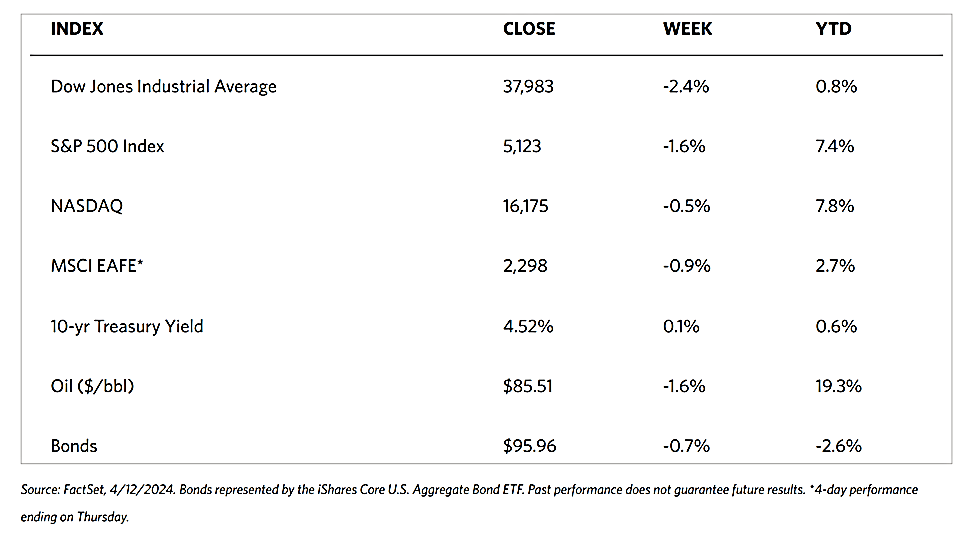

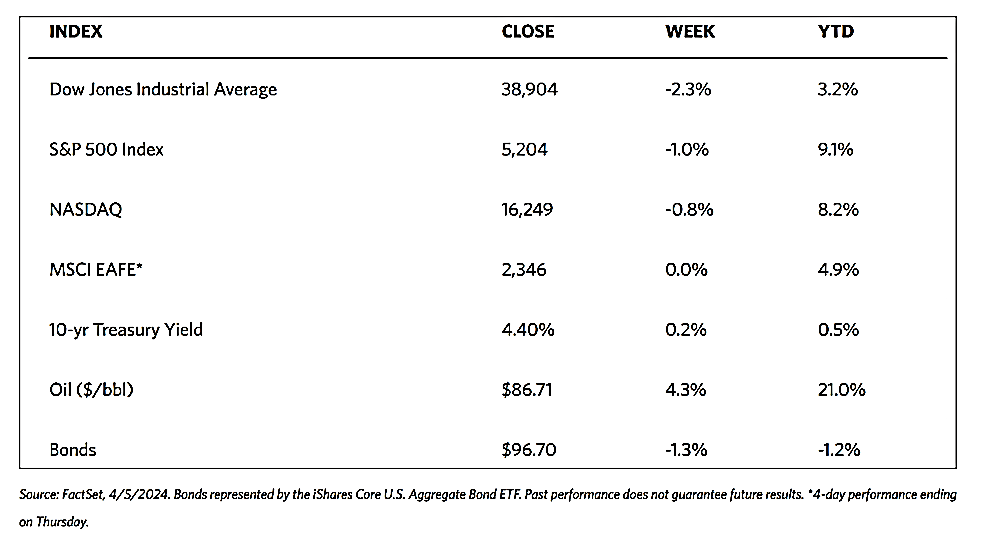

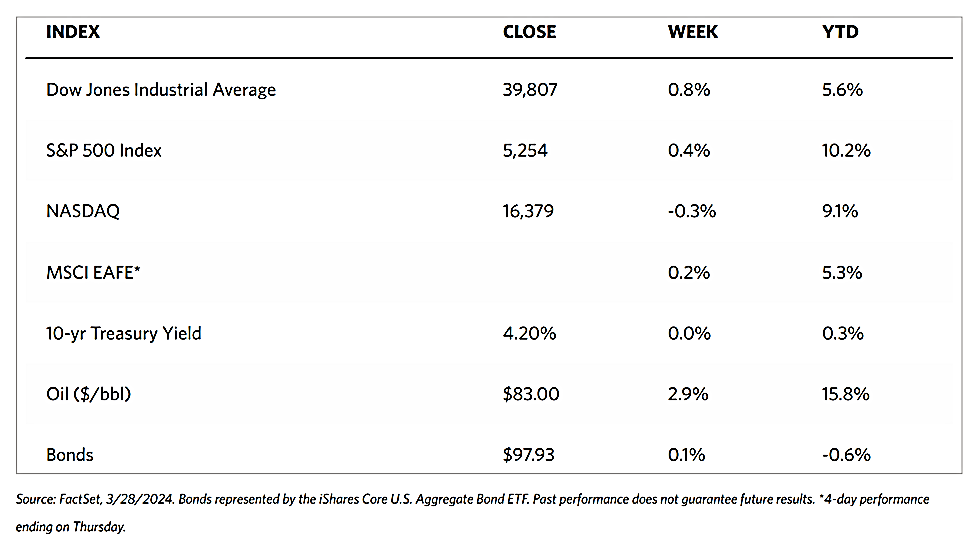

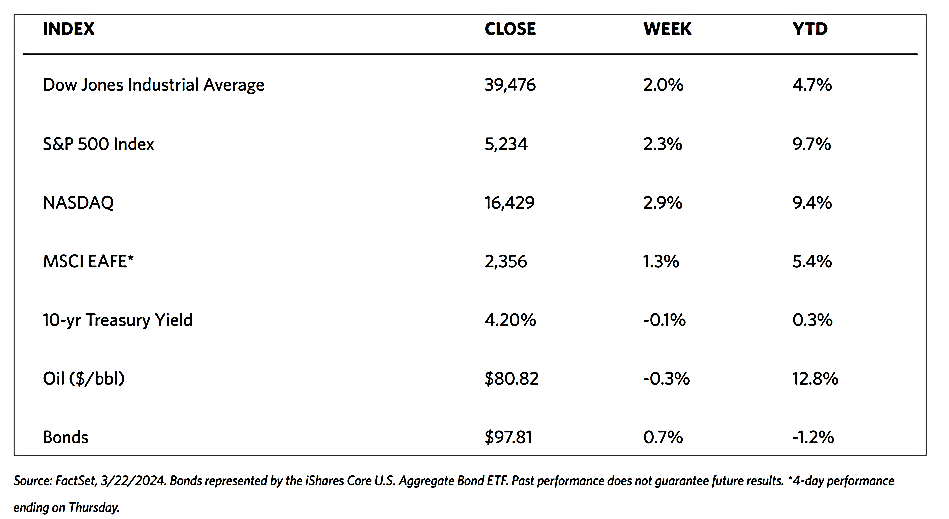

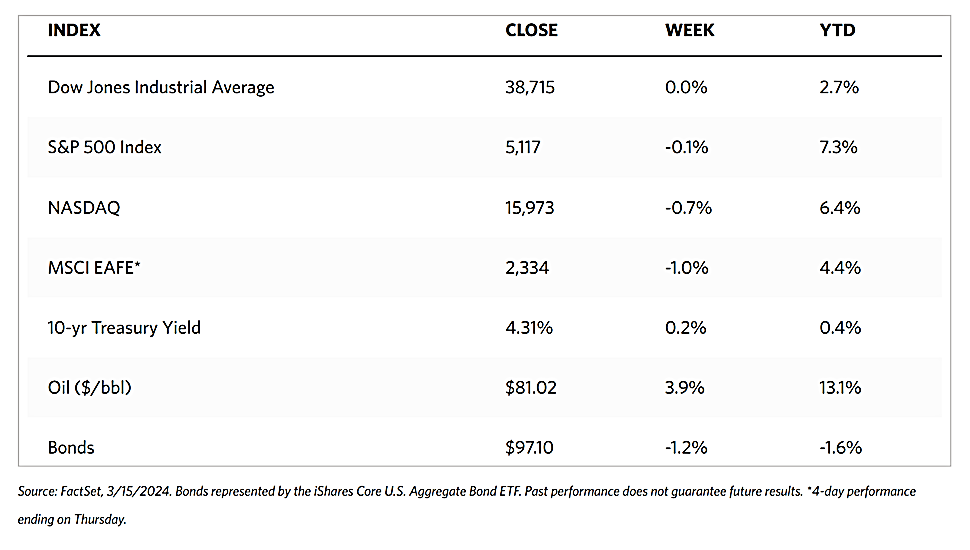

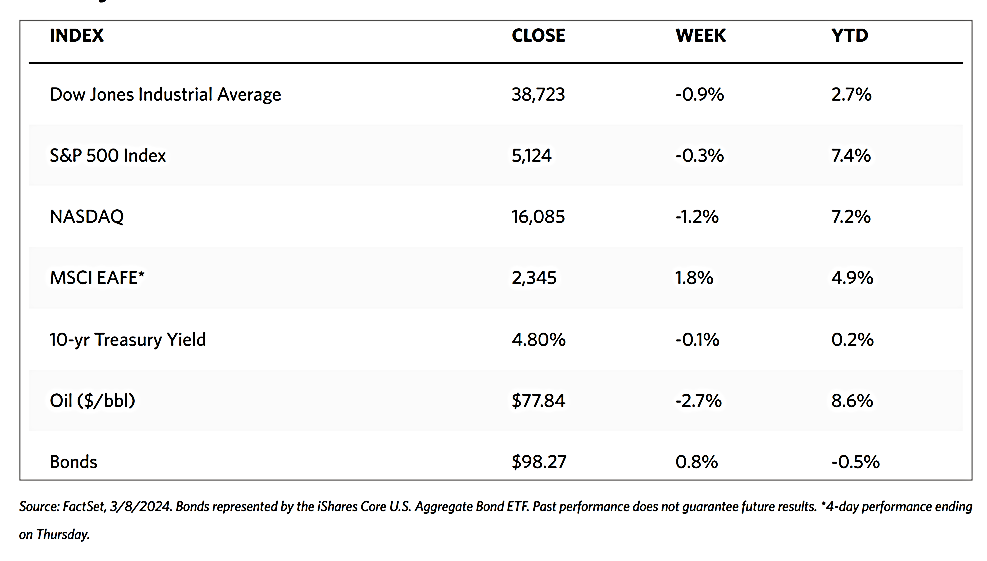

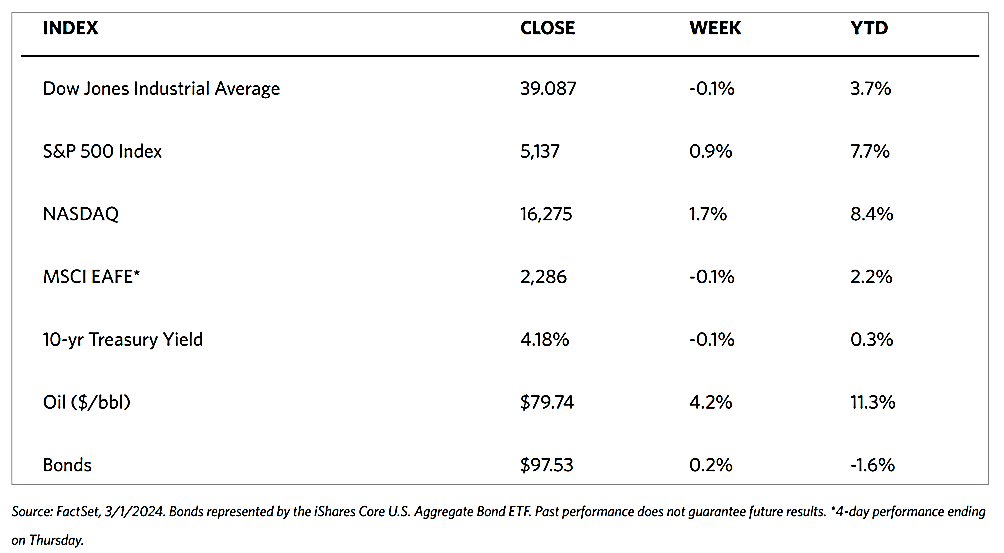

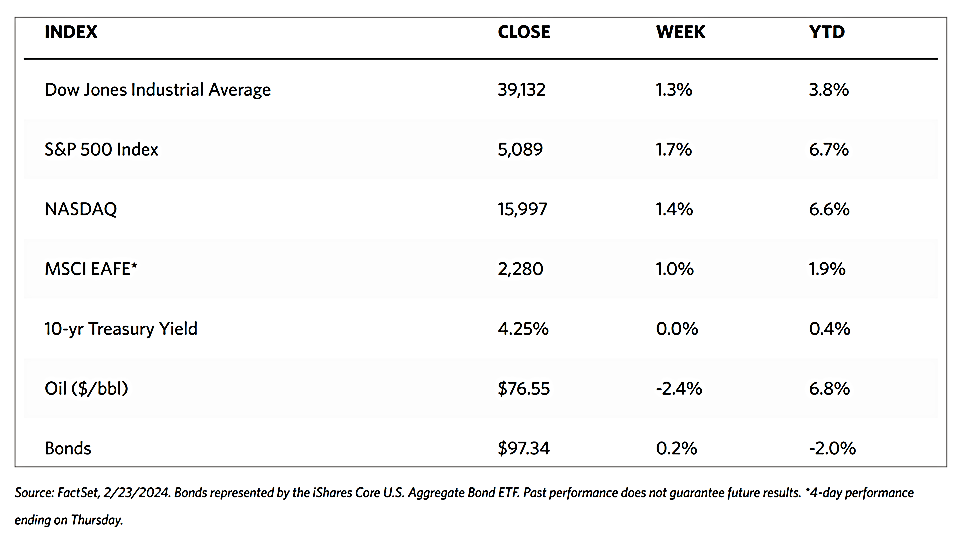

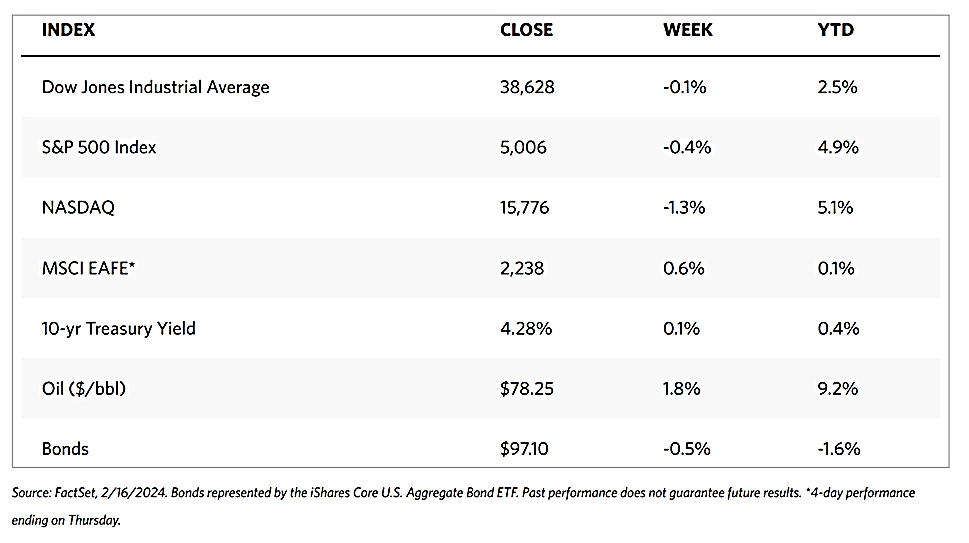

Markets Index Wrap-Up